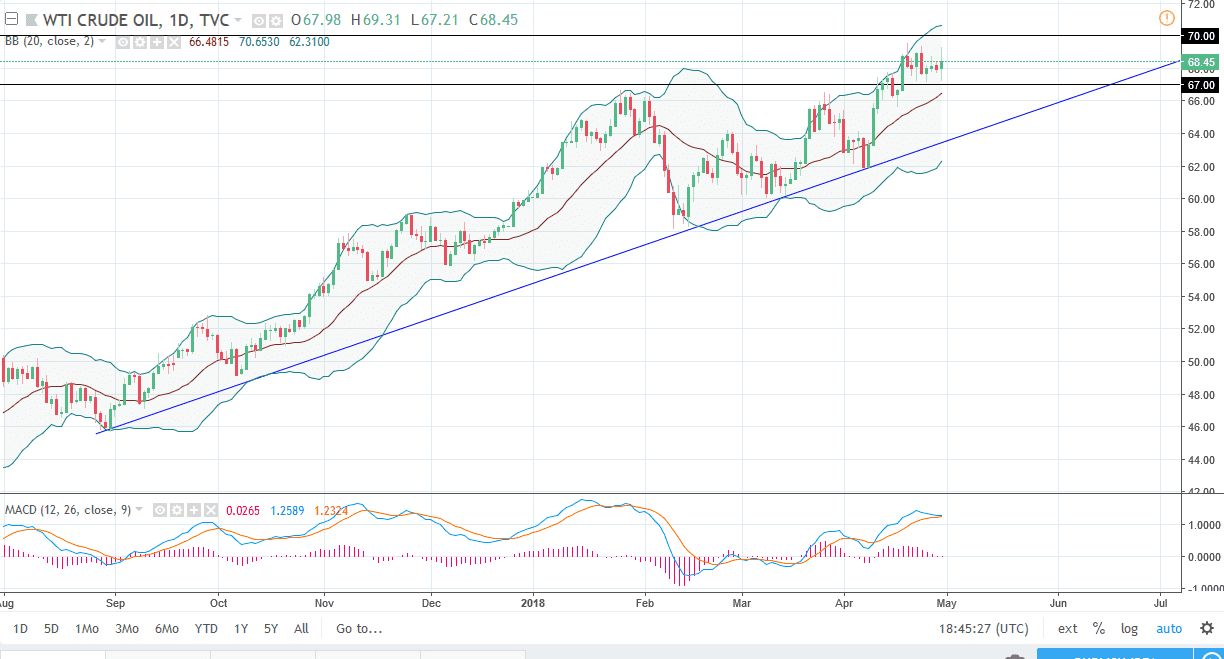

WTI Crude Oil

The WTI Crude Oil market was very noisy during the day on Monday, as we continue to go back and forth in a consolidation area that is now well defined. The $67 level underneath is supportive, not only because we have seen that area offer resistance in the past, but also because the 20 SMA of the Bollinger Band indicator is just below there. Currently, it appears that the $70 level is resistance, so if we were to break above that level I think that WTI Crude Oil markets would go much higher, as it has been so reliable. Alternately, if we break down below the $67 level we will more than likely go looking towards $65 after that. There is still a strong daily uptrend line underneath that continues to keep the market in a bullish attitude overall.

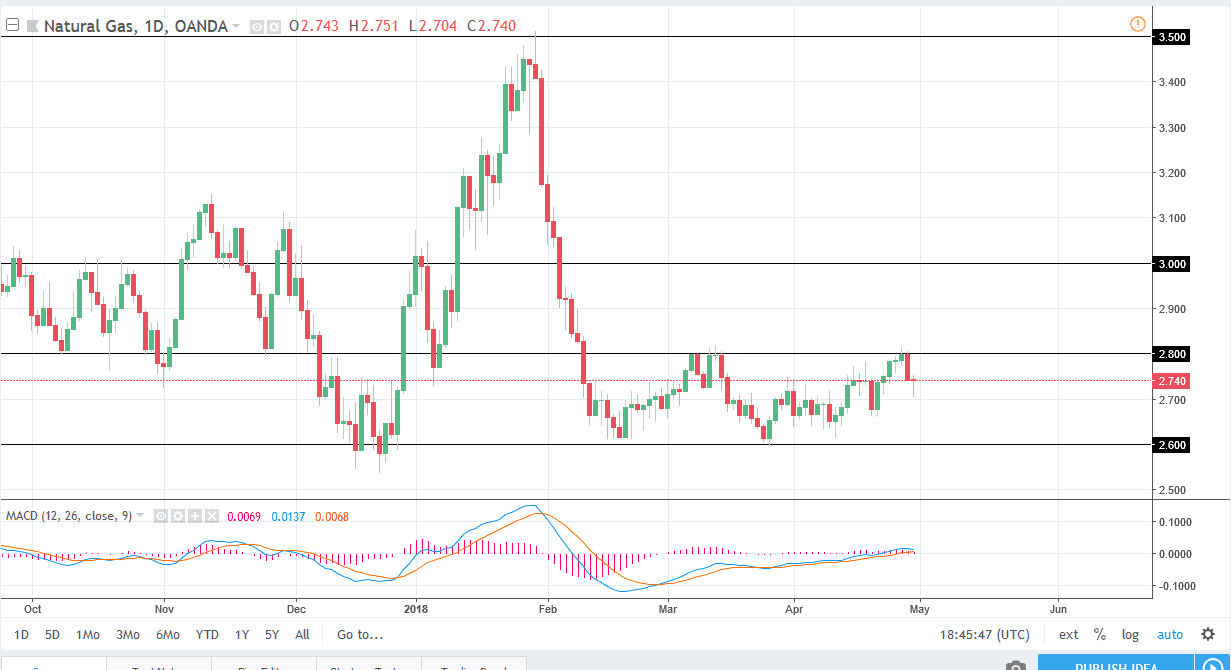

Natural Gas

The natural gas markets fell initially during the trading session on Monday, reaching towards the $2.71 level. We’ve had a nice rally since we reach those lower levels and ended up forming a bit of a hammer. The hammer is a very bullish sign and could send this market back towards the $2.80 level, which has been resistive several times recently, as well as supportive in 2017. While I do think that we can break above that level, it’s likely that we could climb to the $2.90 level next, followed by the $3.00 level after that. Alternately, if we broke down below the bottom of the hammer, I would be a seller as we should continue to go towards the $2.60 level. This is a market that is negative overall longer-term, but it looks as if we may get short-term bullish pressure, followed by much more stringent selling.