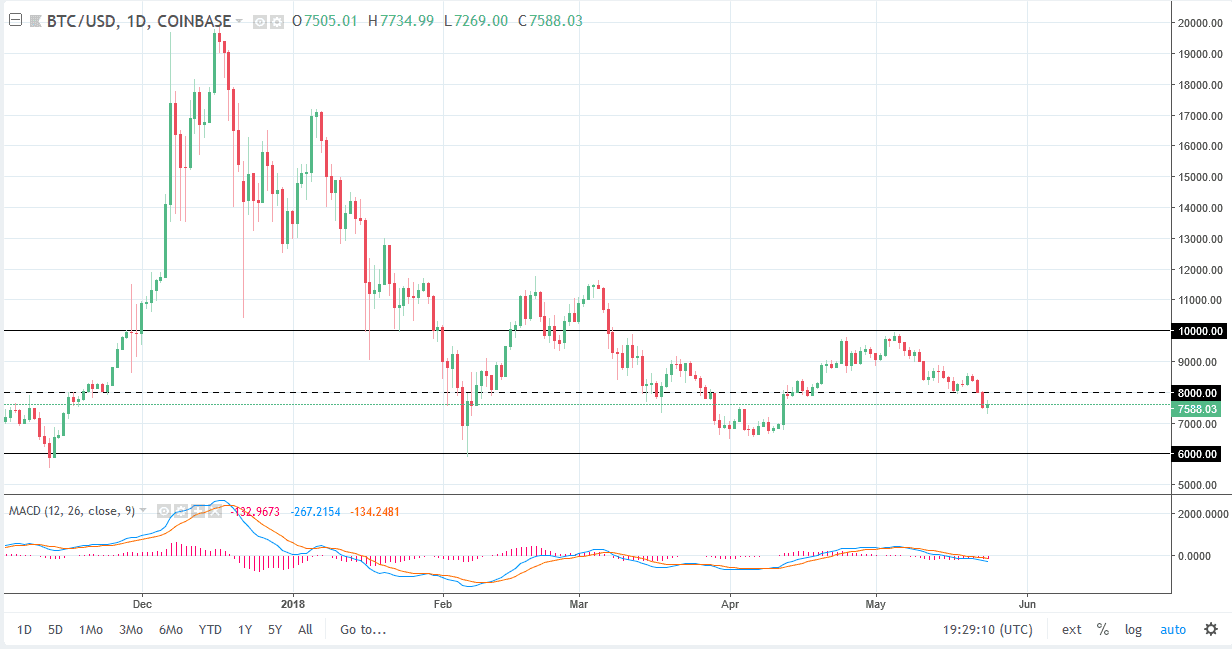

BTC/USD

Bitcoin bounced around during the trading session on Thursday, as we are below the $8000 level rather solidly. It looks as if we will continue to go lower, and I suspect that rallies at this point will continue to respect the resistance at the $8000 level. I think eventually we will go to the $7000 and then possibly even $6000 after that. If we break down below the $6000, things get ugly rather quick. We have seen a bit of the range for some time, but I would point out that the highs are getting lower, almost certainly assigned of increasing bearish pressure, or perhaps in this case simple apathy. I think a lot of the hype around bitcoin has finally died, and a lot of the “hot money” has vacated. We are now seeing this market mature a bit, which means pricing is going to be much more realistic. I suspect the sellers return repeatedly.

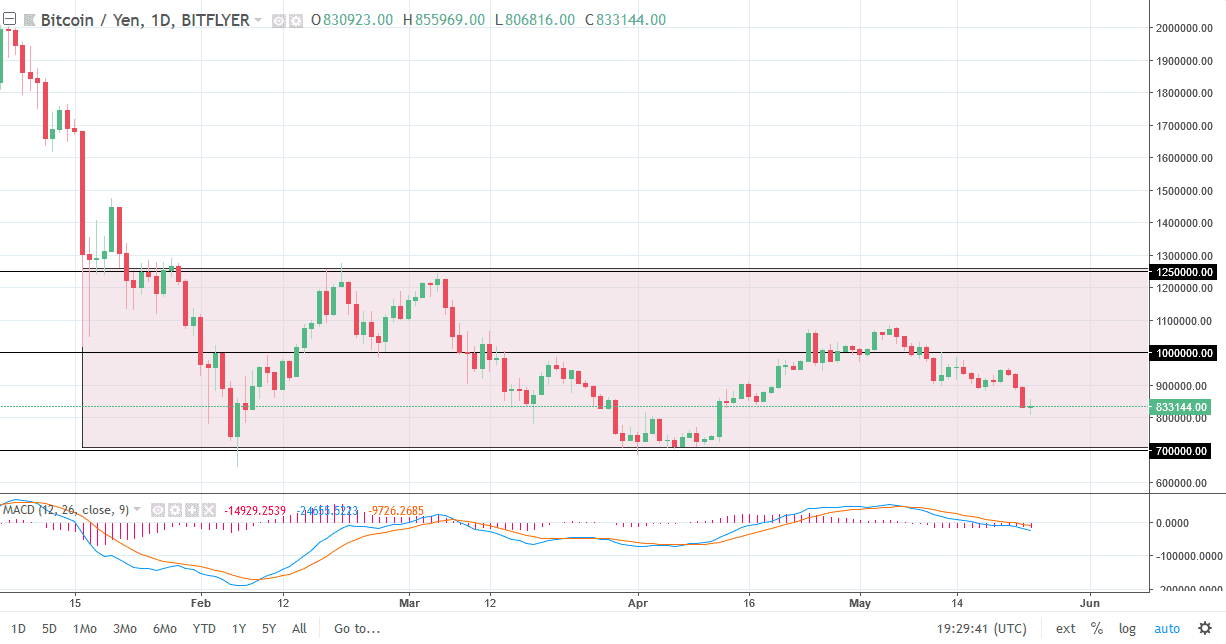

BTC/JPY

Bitcoin went back and forth against the Japanese yen during trading on Thursday, forming a relatively neutral candle. It looks as if we are trying to form some type of support in the general vicinity, but I think at this point rallies are to be sold. Unlike the BTC/USD pair, this market did not reach the highest of the overall consolidation which was much more well-defined. Because of this, I suspect that this market may struggle, and we could very well break down below the vital ¥700,000 level. I believe that ultimately this market will continue to be one that you can sell rallies, because quite frankly Bitcoin can’t get out of its own way. It’s not necessarily that we are melding down, I think very few people care.