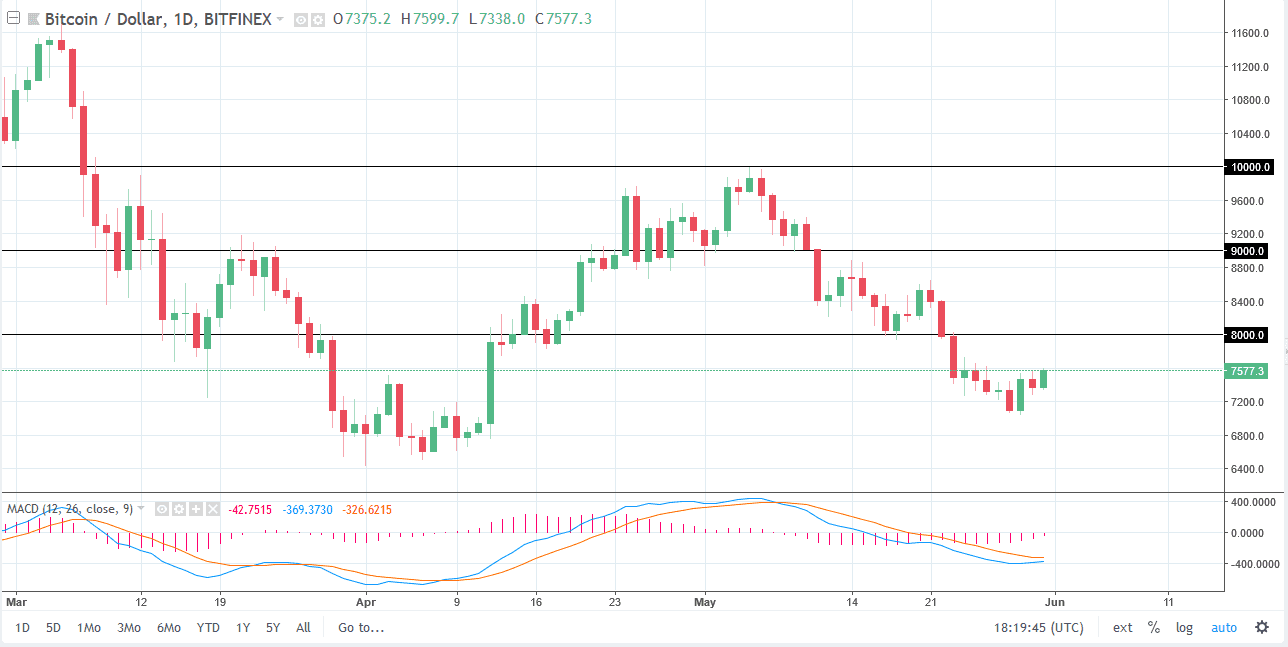

BTC/USD

Bitcoin rallied again during the day on Friday, after initially pulling back on Thursday. The market looks as if it is trying to test the 7600 level, but quite frankly I think a lot of this is confusion based around the tariffs and the potential troubles that we are starting to see in global trade. People may be trying to use bitcoin as a bit of a safety trade, but quite frankly in the end I don’t think that’s going to work. I see significant resistance at the $8000 level, and it’s not until we break above there that I am overly impressed. That being said, the market did gain 2.7% during the day, which is one of the stronger moves that we have seen recently. Ultimately, if we did break above the $8000 level then I would be convinced to start buying. Until then, I’m looking for exhaustive candle to start selling.

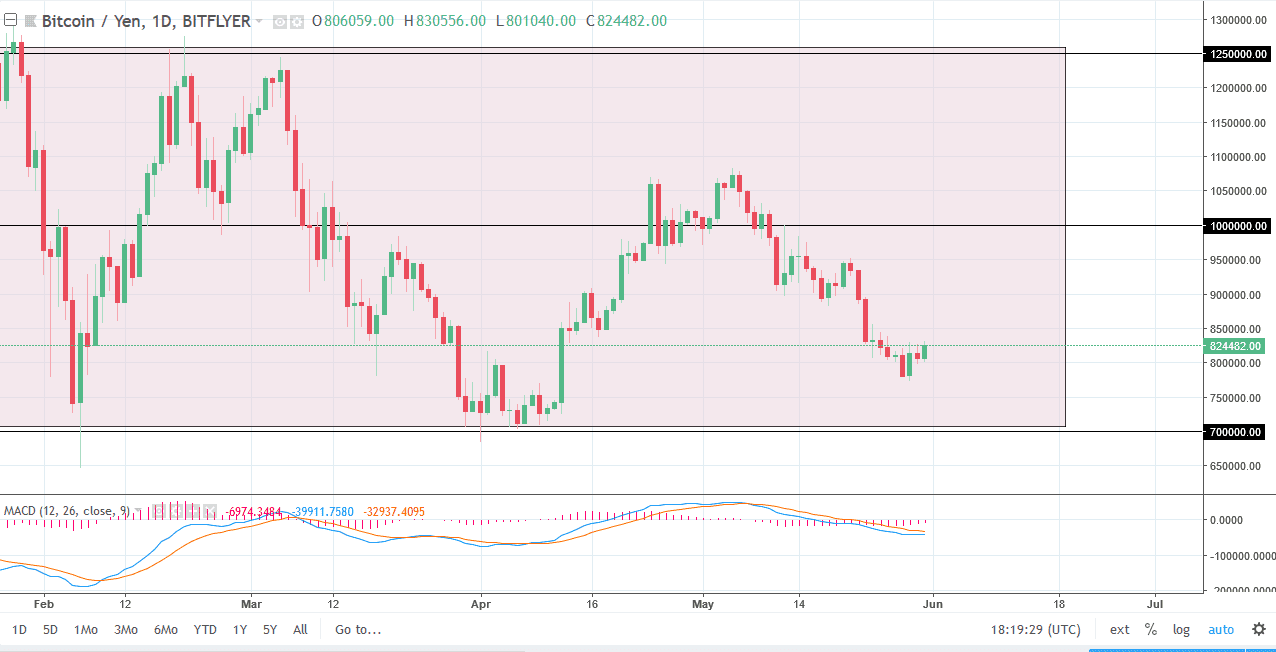

BTC/JPY

Bitcoin rallied against the Japanese yen as well, reaching towards the ¥825,000 level. The market still sees a significant amount of resistance near the ¥850,000 level, and most certainly at the ¥900,000 level. I think that the market will eventually find sellers, especially if the whole situation with global trade can calm down, or if we get some type of melt down in the USD/JPY pair, as it would send many looking for the Japanese Yen overall. The market would then go looking towards the ¥700,000 level underneath which is the bottom of the longer-term consolidation. I don’t have any interest in buying this pair, at least not right now while things are so skittish. If I was going to buying Bitcoin, it would probably be against either the US dollar or the Euro.