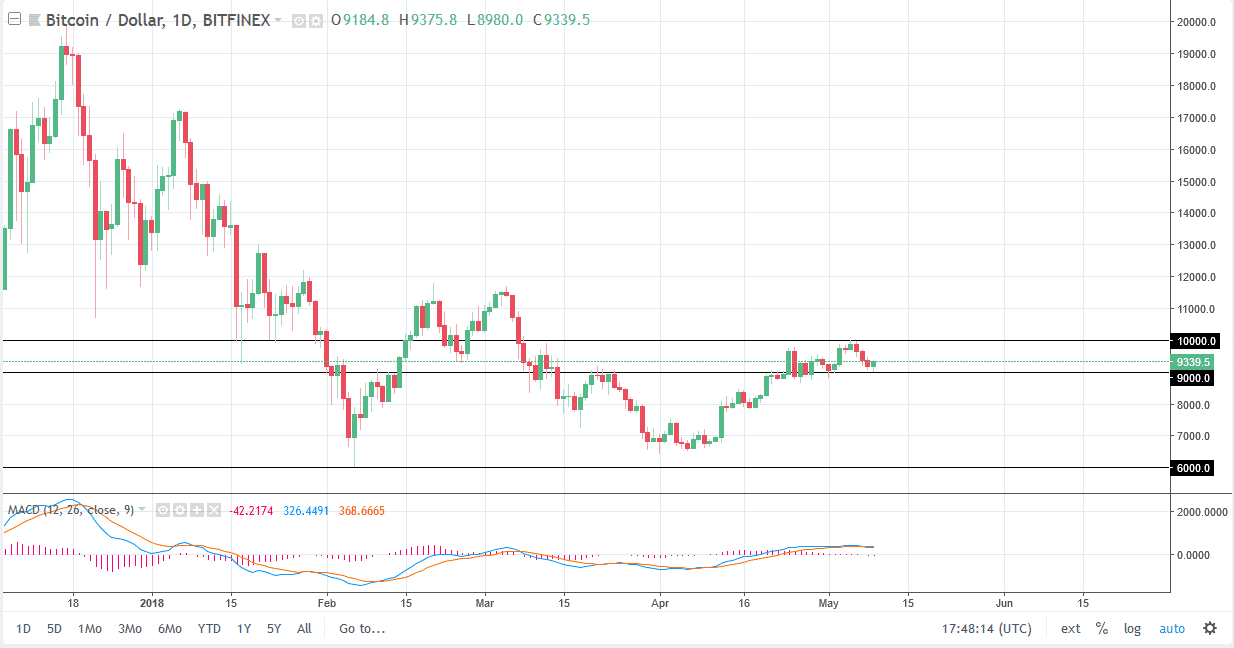

BTC/USD

The Bitcoin market initially fell against the US dollar on Wednesday but found enough support near the $9000 level to turn around and form a positive candle. The positive candle of course suggests that we could rally again, reaching towards the $10,000 level. We have been consolidating between the $9000 level on the bottom and the $10,000 level above, and the action on Wednesday only reinforced this situation. The market breaking above the $10,000 level could release Bitcoin to go looking towards the $12,000 level, which has been resistance previously. Ultimately, if we were to break down below the $9000 level, it could release this market down to the $8000 level. I anticipate that there are a lot of back-and-forth moves left in this market, so I think that short-term range bound trading is probably going to be what we continue to see. However, we have a couple of obvious levels that could throw more money into the market, such as a break above the previously mentioned resistance barrier, or of course a breakdown below the $9000 level that allows this market to drop to $8000 next.

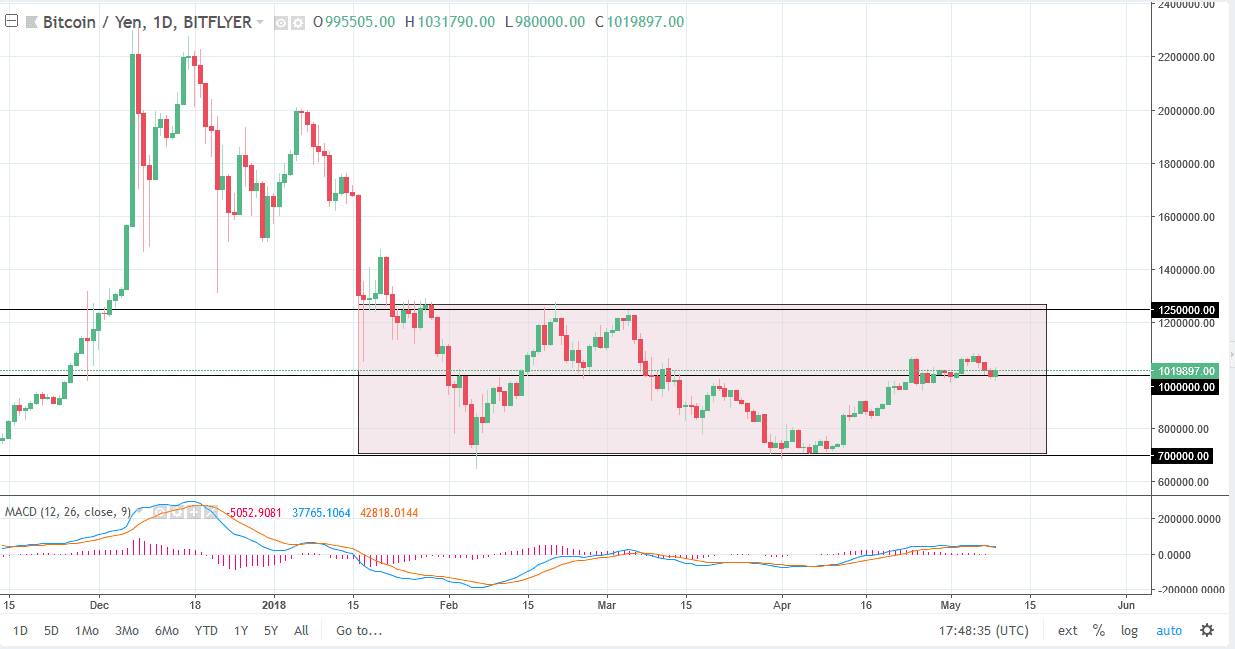

BTC/JPY

Bitcoin also rallied against the Japanese yen during the day on Wednesday, using the ¥1 million level as support, and of course an attraction level. I think that the market is probably going to try to break towards the ¥1.1 million level, which clearing that level opens the door to the top of the major consolidation level at the ¥1.25 million level. If we were to break down below the ¥900,000 level, then I think the market drops down to the ¥700,000 level. This is essentially the middle of the overall consolidation area, but that means that we could go in either direction.