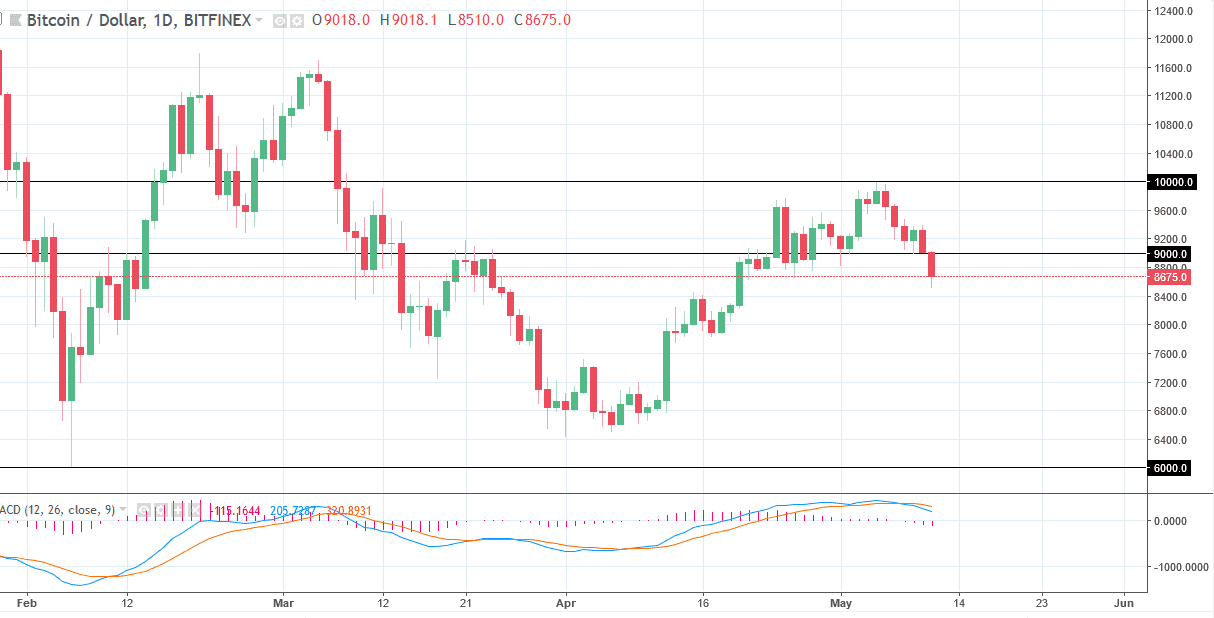

BTC/USD

The Bitcoin markets fell against the US dollar during trading on Friday, leaving the $9000 level behind. By breaking down through there and the $8800 level, it’s likely that we will continue to see bearish pressure, and a break below the lows of the Friday session has me targeting $8000 at that point. If we were to turn around and break above the $9200 level, then we will make another attempt at the $10,000 level. Bitcoin appears to be rolling over, and perhaps reaching towards the bottom of the overall consolidation for the long term, down to the $6000 level. I find it ironic that this market continues to fall even though the US dollar fell as well during the day in the Forex markets. You cannot blame this on dollar strength anymore.

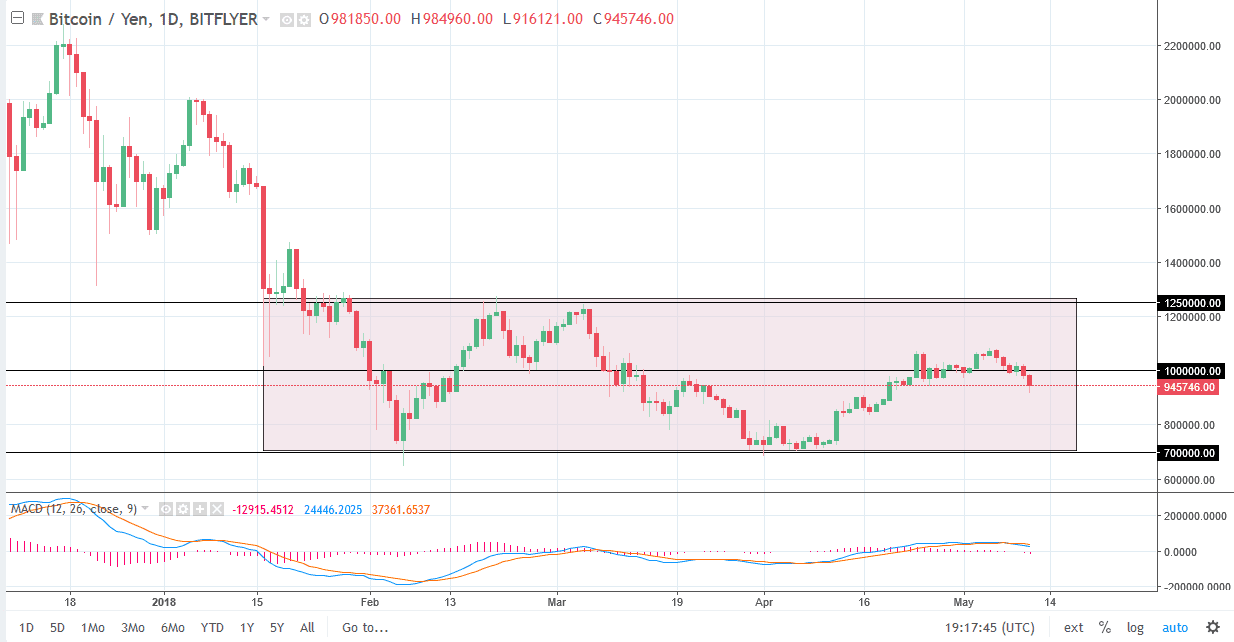

BTC/JPY

Bitcoin also fell against the Japanese yen, breaking significantly below the ¥1 million level and even below the ¥950,000 level. I think if it’s ready to go below the ¥900,000 level, we will then go down to the ¥800,000 level, and then possibly the ¥700,000 level. I would not be a buyer until we turn around and break above the ¥1,020,000 level, which could send this market to the ¥1.1 million level and then eventually the ¥1.25 million level. However, it looks as if Bitcoin is rolling over in general, so it makes sense that we are more apt to find selling pressure. A breakdown below the bottom of the daily candle would have me shorting a small position as we continue to bounce around in the overall consolidation region that we have seen marked on the chart and a pink rectangle.