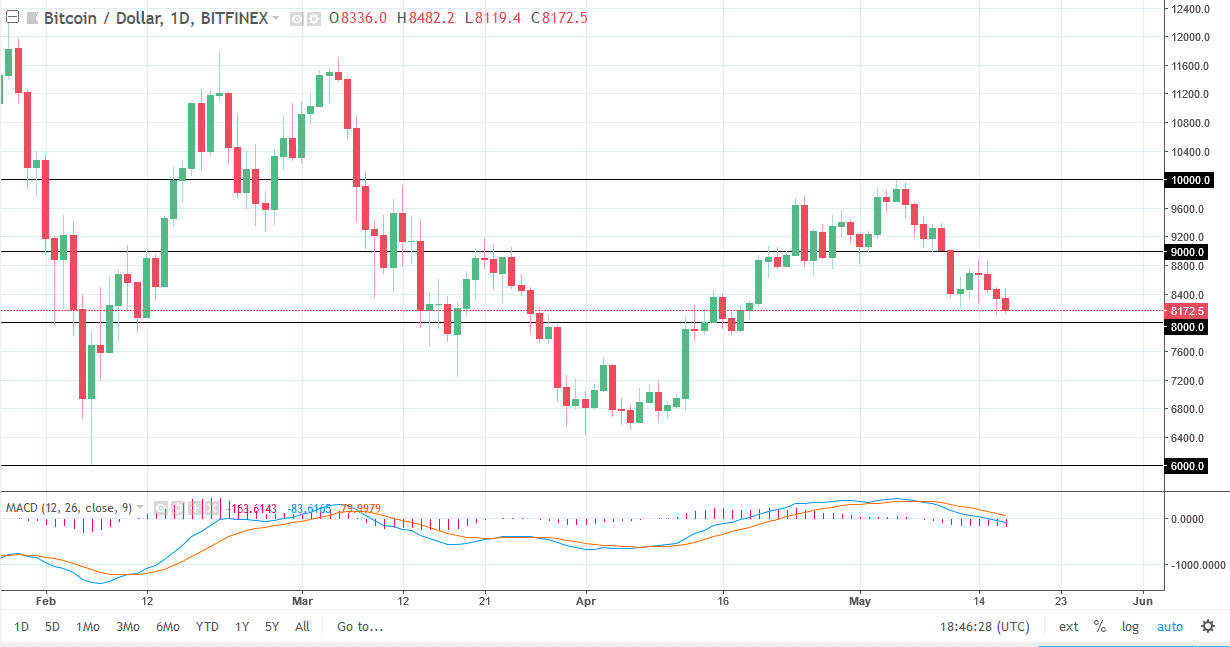

BTC/USD

Bitcoin fell against the US dollar during the session on Thursday, reaching down to the bottom of the hammer from the previous session. This suggests to me that we are going to reach towards the $8000 level just below. That’s an area that has been very important in the past, and I think that market participants could get involved at that area. However, if we are to break down below the $7900 level, the market will more than likely unravel rather significantly. I believe that we are starting to see even more bearish pressure, as bitcoin can’t seem to get out of its own way. If we break out to the upside, I think there is plenty of resistance near the $9000 level. It looks to me like the market is starting to rollover rather significantly. This will be exacerbated by a strengthening US dollar overall.

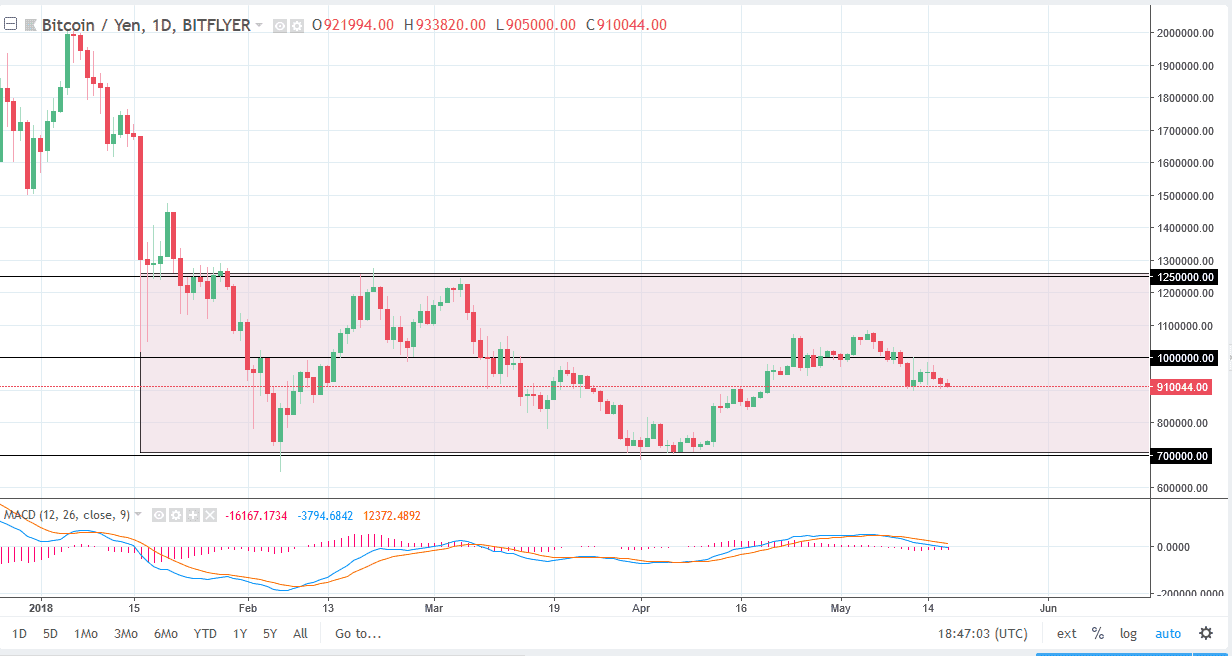

BTC/JPY

Bitcoin also fell against the Japanese yen, reaching down towards the ¥900,000 level, an area that has been support and resistance in the past. If we can break down below the ¥900,000 level, it’s likely that we will try to reach down towards the ¥800,000 level. Below there, I think it’s only a matter time before we test ¥700,000, mainly because it is the bottom of the overall consolidation area that the market has been in, going back to the beginning to the you. I believe that we are essentially in the “fair value” range of the overall consolidation, so I think that the volatility in this area could continue, but ultimately I think we will continue the downward pressure as we have made a “lower high” recently. If we break down below the ¥700,000 level, this market unwinds rather drastically.