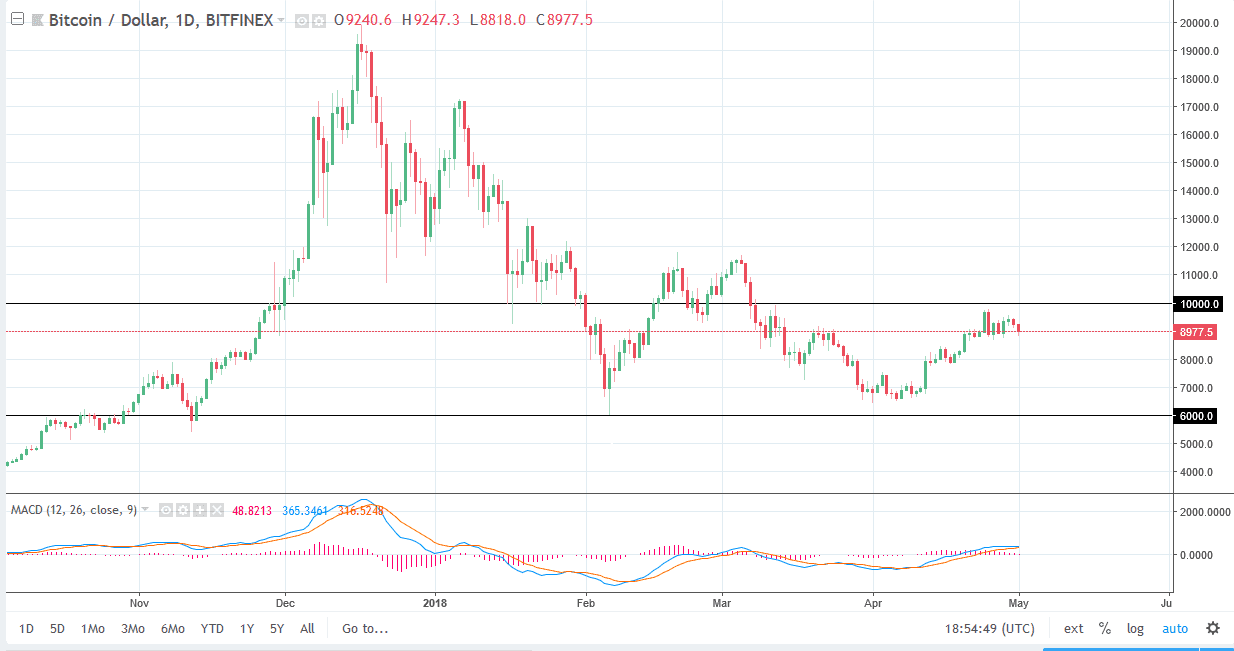

BTC/USD

Bitcoin didn’t do much during training on Tuesday, as we continue to hang around the $9000 level. This is a market that simply hasn’t gone anywhere, and it looks like we are trying to reach towards the $10,000 level above, which of course is a large, round, psychologically significant figure and of course the previous resistance and support. I think that if we can break above the $10,000 level, that we can go to the $12,000 level after that. Ultimately, I think in the short term we are looking at a lot of consolidation, but if we break down from here, I think the market goes to the $8000 level. Bitcoin continues to be very sideways in general, and I think that should continue to be the case. Short-term back and forth traders might love this market, but if you are looking for some type of big move, you need to keep looking as you won’t find it here.

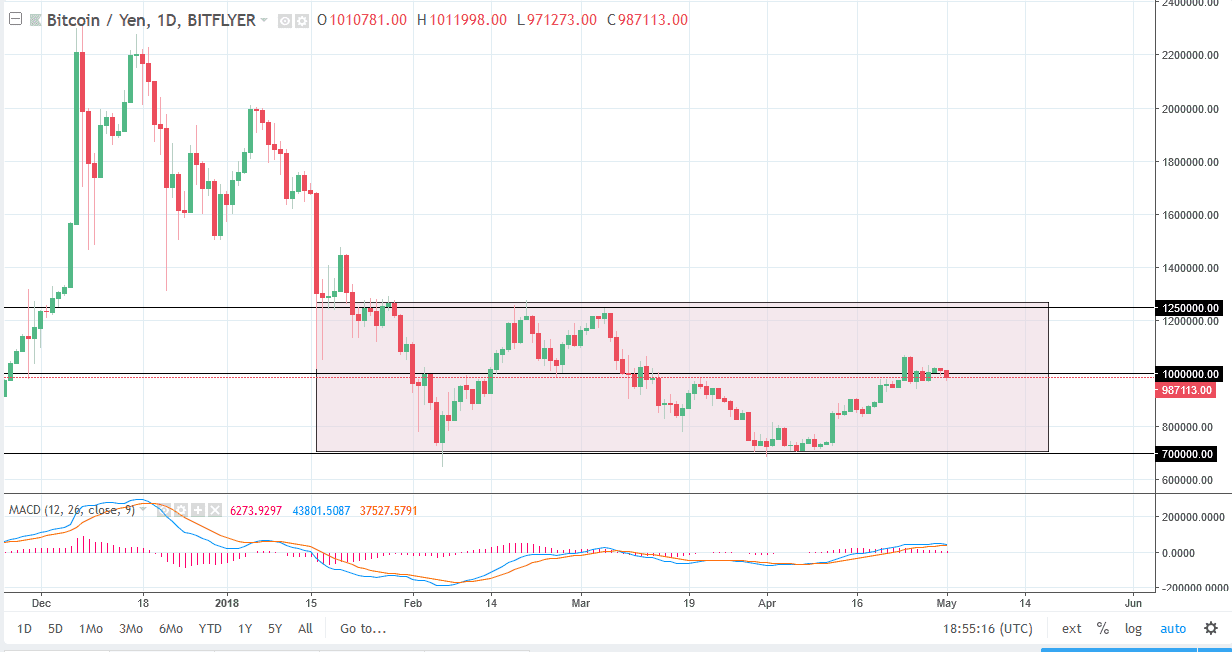

BTC/JPY

Bitcoin continues to dance around the ¥1 million level, an area that has a certain amount of psychological significance obviously, but I think that it also functions as essentially “fair value” in the market. As volatility dries up, this becomes the domain of a “wait-and-see” type of attitude. Even as the Japanese yen has gotten crushed by the US dollar, Bitcoin can’t make any headway. This tells me that either there is a lack of strength, or a simple lack of interest. If we can break above the ¥1,020,000 level, the market probably goes to the ¥1.25 million level. Otherwise, if we break down below the ¥950,000 level, we probably unwind to the ¥800,000 level, and perhaps even the ¥700,000 level after that.