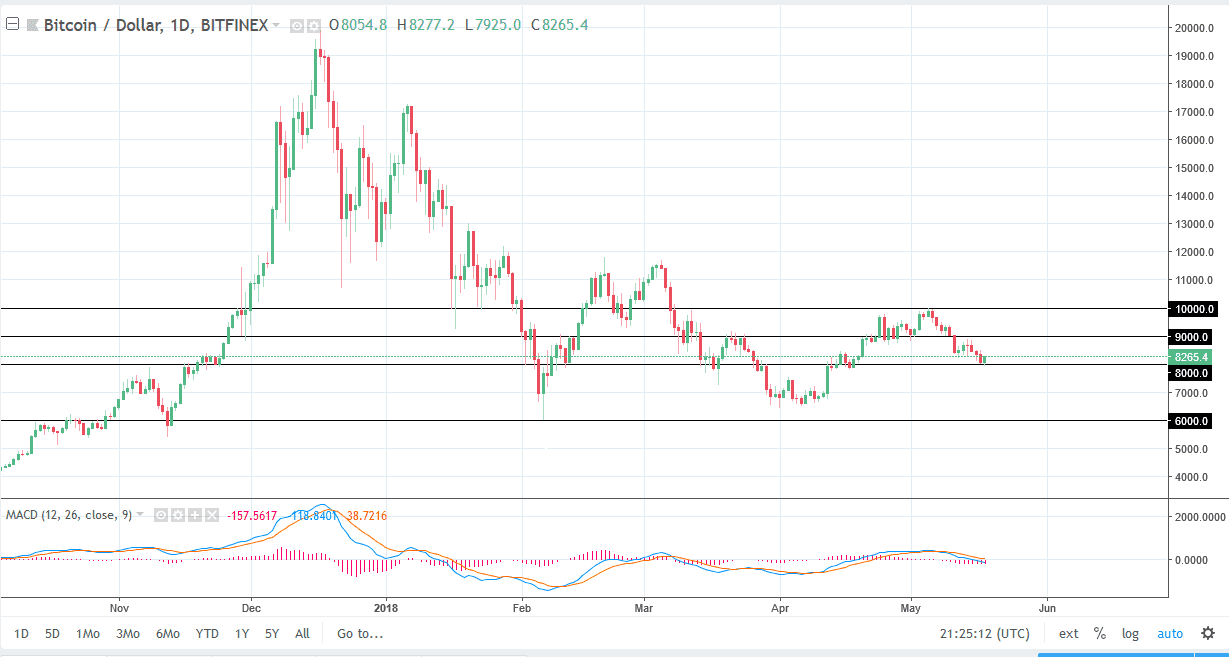

BTC/USD

Bitcoin markets rallied slightly during the Friday session, bouncing from the $8000 level, which of course has been an area that has been supportive. The market looks likely to recognize this area at short-term support, but quite frankly if we rollover and break below the $8000 level, we could unwind to the $7000 level rather quickly. If we bounce from here will probably go looking towards the $9000 level above, which has been resistance more than once. Bitcoin continues to struggle overall, and I suspect that given enough time we will go looking towards the $7000 level underneath, an area that has been very important more than once. Adding more pressure to this market is that the US dollar has strengthened as of late, and of course crypto currencies have been less than impressive. I think there is too much resistance above to see a significant break out in the short term.

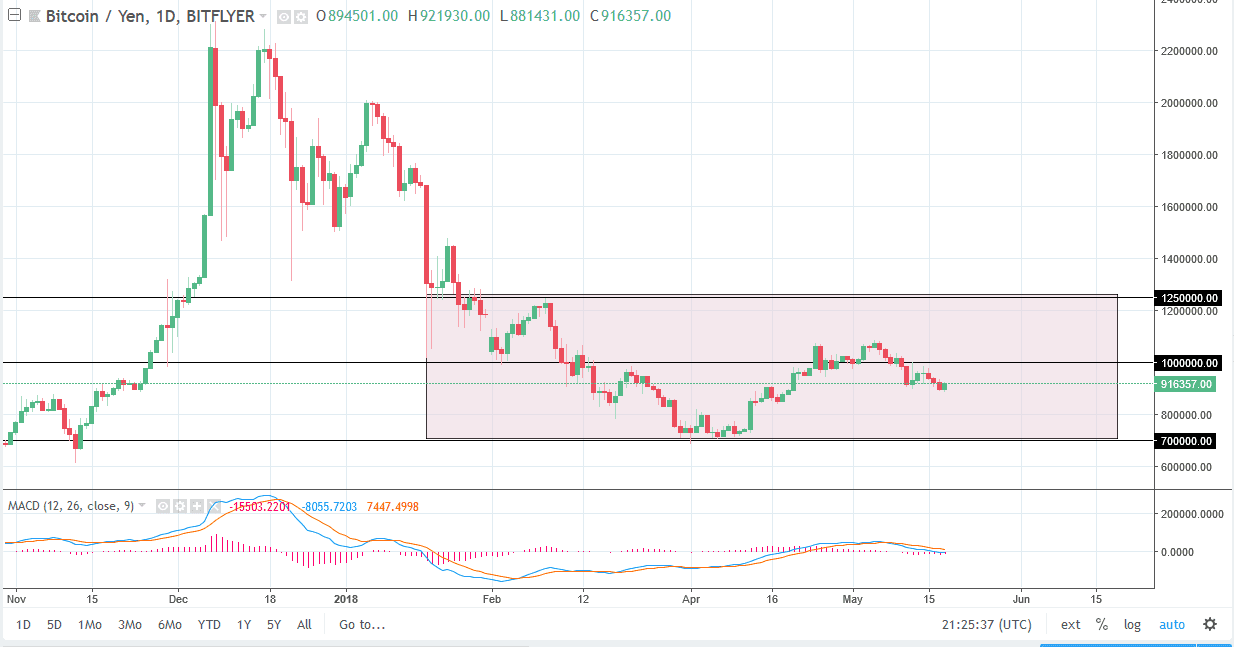

BTC/JPY

Bitcoin rallied slightly against the Japanese yen as well but continues to look very suspicious to say the least. If we can break down below the ¥900,000 level, it’s likely that we will continue to go lower, aiming for the ¥800,000 level, and then the ¥700,000 level which is the bottom of the overall consolidation. If we do rally from here, I anticipate that the ¥1 million level could be a bit of trouble as well, extending to the ¥1.1 million level. Break above there should send the market towards the ¥1.25 million level. This is a market that is very volatile, so if you are planning on buying bitcoin against the Japanese yen, perhaps you need to see some type of pullback to offer a bit more value to get involved as you will almost certainly have to ride the move through a lot of noise.