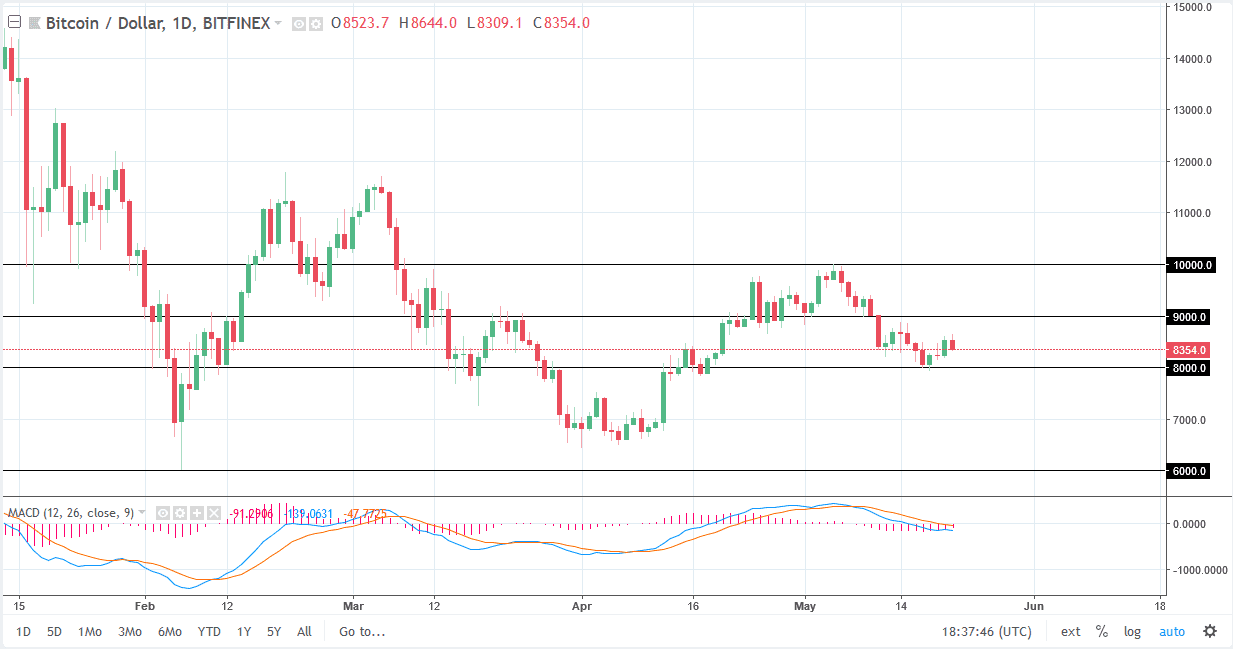

BTC/USD

Bitcoin tried to rally on Monday against the US dollar but then fell towards the $8350 level. I think that the market shows that it is not ready to go higher quite yet, and that it’s likely to reach towards the $8000 level next. That’s an area that has been massive support recently, so I think that we will continue to see a bit of buying pressure there. If we were to break down below the $8000 level, at that point I anticipate that the $7500 level would be targeted. In the short term, I believe that it is going to be difficult to break above the $9000 level. That level being broken to the upside would be very bullish, but I doubt we are going to see that in the short term. I think that the market certainly has a lot of negativity attached to it, but I’m not looking for a major move in either direction anytime soon.

BTC/JPY

Bitcoin fell against the Japanese yen during the day, but unlike the US dollar, we did get a bit of a bounce to form a hammer. The hammer is of course a bullish sign, so I think we may get a bit of a divergence between these pairs today. If we can break above the top of the hammer for the session on Monday, then I think that the market could go higher, perhaps to the ¥950,000 level. Otherwise, if we break down below the bottom of the hammer, then the market will probably unwind a bit to reach down towards the ¥925,000 level initially, perhaps even down to the ¥900,000 level over the longer-term. I anticipate that this market will continue to be very noisy, and perhaps without any sense of clarity.