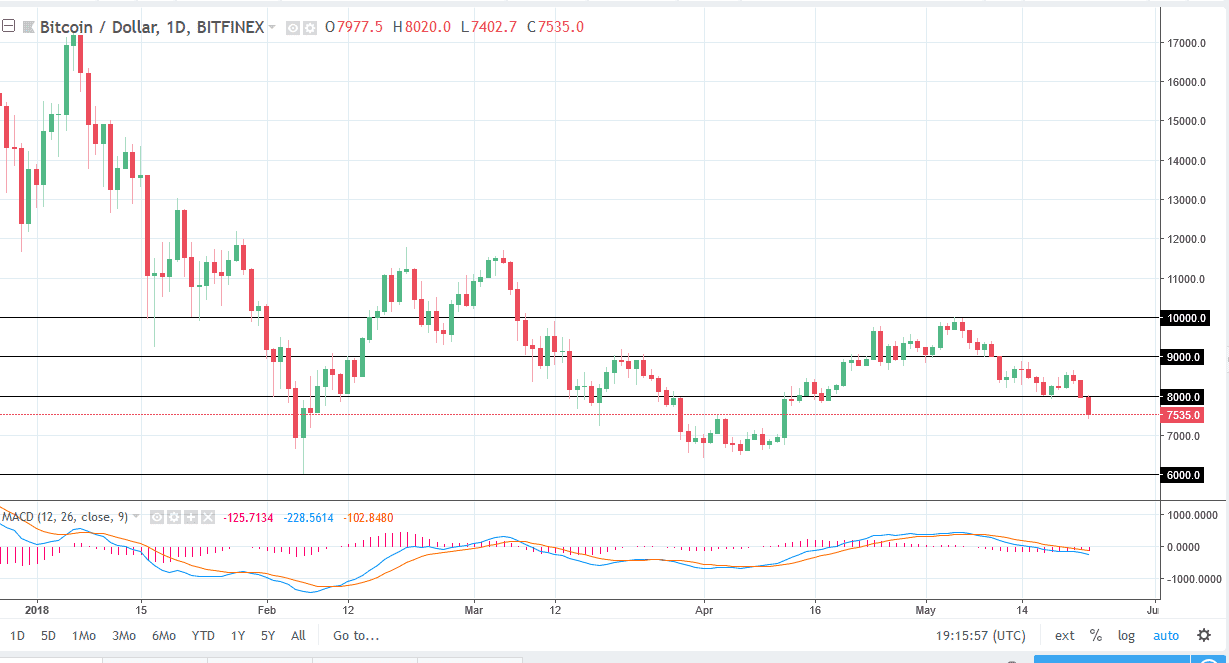

BTC/USD

Bitcoin markets fell again on Wednesday, crashing through the $8000 support level. Because of this, I think we will go looking towards the bottom of the overall consolidation, which is closer to the $6500 level. I think rallies are more than likely going to be sold at this point, as crypto currencies continue to struggle. When you look at this chart, it’s not hard to see that the latest high was lower, and I think we may eventually go low enough to test the $6000 level. A break down below there unwinds this market to the $5000 level. I don’t have any interest in buying this market, at least not right now. I will evaluate each daily candle for signs of a bottom, but right now we don’t have it. The US dollar is the strongest fiat currency that I follow right now, so it makes sense that we are struggling.

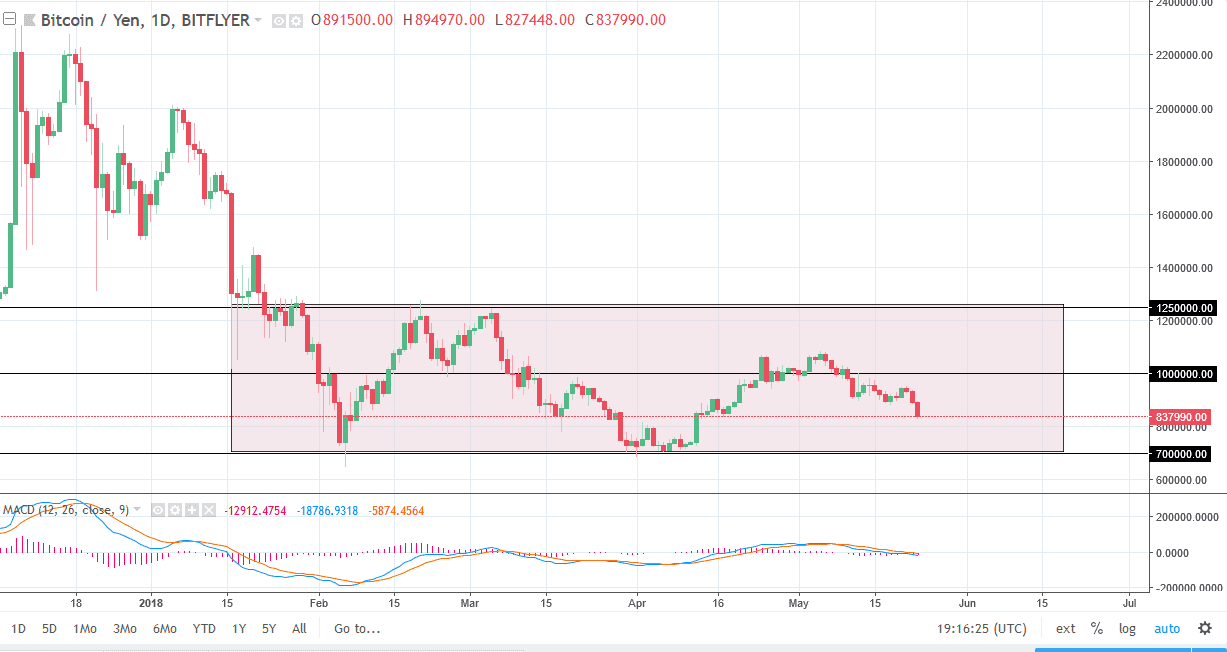

BTC/JPY

Bitcoin also sold off against the Japanese yen, breaking through the ¥900,000 level during the day on Wednesday. We are now approaching the ¥800,000 level and look very likely the test the bottom of the overall consolidation area that extends down to the ¥700,000 level. From the bounce in April, we did not reach the top of the consolidation area which is at the ¥1.25 million level, a very ominous and bad sign indeed. We break down below the ¥700,000 level, the next leg lower in this market will start. Otherwise, we could see a bit of a bounce from there and perhaps an attempt to reach the ¥1 million level again. In the next few days though, I would anticipate sellers on short-term rallies and of course sellers adding to positions on breakdowns. All things being equal, Bitcoin does not look healthy right now. We are not in panic mode, but we are most certainly negative.