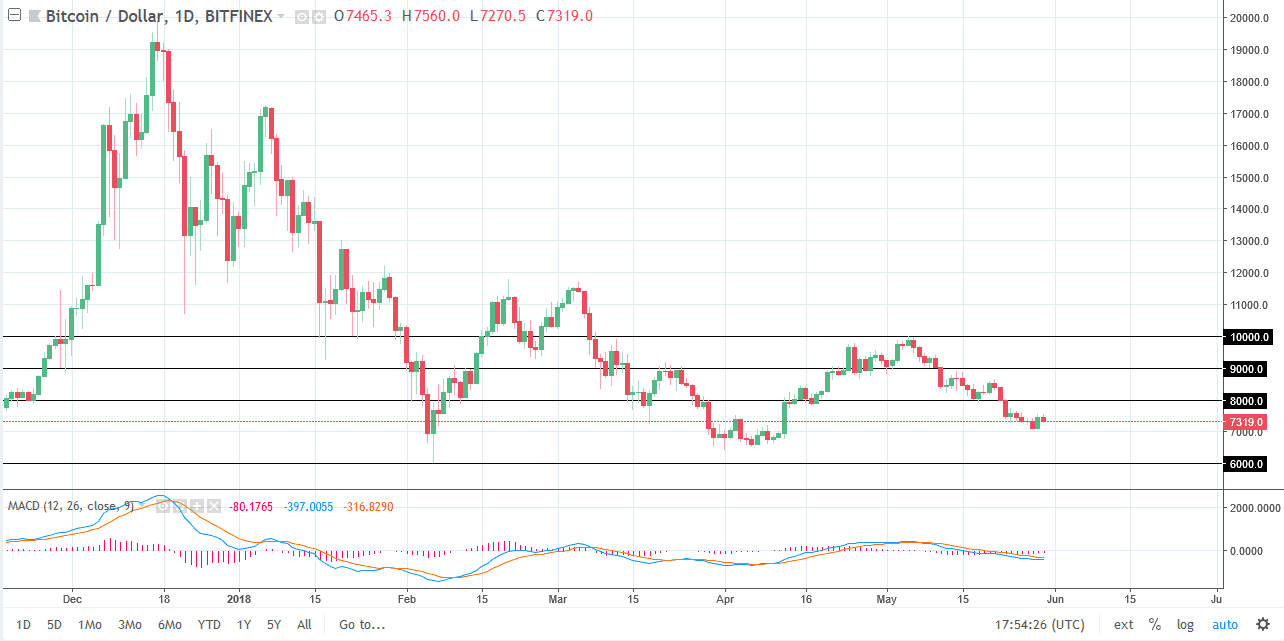

BTC/USD

Bitcoin markets fell again during the trading session on Wednesday, as we continue to see more of the same downward pressure that we have seen for some time. The market looks as if it is reaching towards the $7000 level next, and then perhaps even below there to reach towards the $6000 level. I think short-term rallies continue to show selling opportunities, and that the first signs of exhaustion I think the sellers continue to jump in and punish Bitcoin as it can’t seem to keep its head up. Overall, I believe that the US dollar continues to be one of the strongest currencies in the world, and therefore Bitcoin is going to continue to struggle to gain against the greenback for any significant amount of time. I believe that $8000 will offer a significant amount of resistance and therefore I would be surprised if we break above there in the short term.

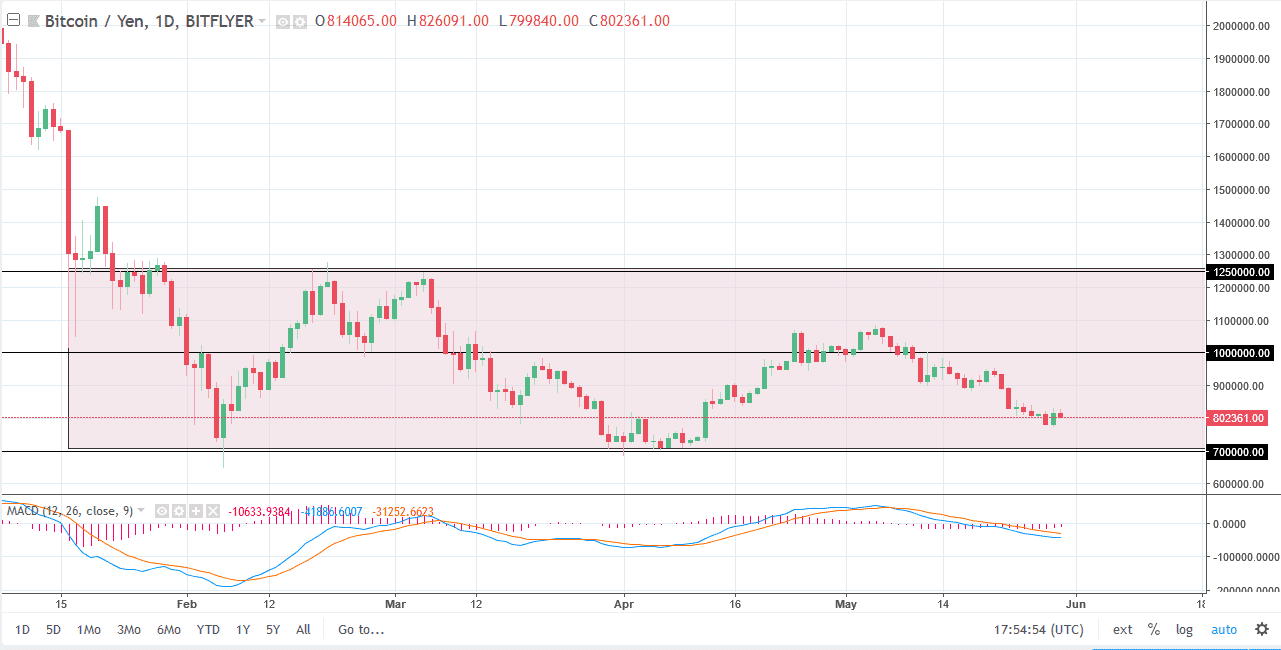

BTC/JPY

Bitcoin fell during the trading session against the Japanese yen as well, reaching towards the ¥800,000 level. I believe that the market will break down and go looking towards the bottom of the overall consolidation, which is at the ¥700,000 level. I have no interest in buying this market, and I think that every time we rally us an opportunity to pick up the Japanese yen “on the cheap.” If we can break down below the ¥700,000 level, and I think we will, this market will unwind to the ¥600,000 level rather quickly. I believe that the ¥1 million level above is the “ceiling” in this currency pair, and it makes sense that we will continue to see this pair fall as we have seen so much in the way of negativity when it comes to the entire crypto currency markets.