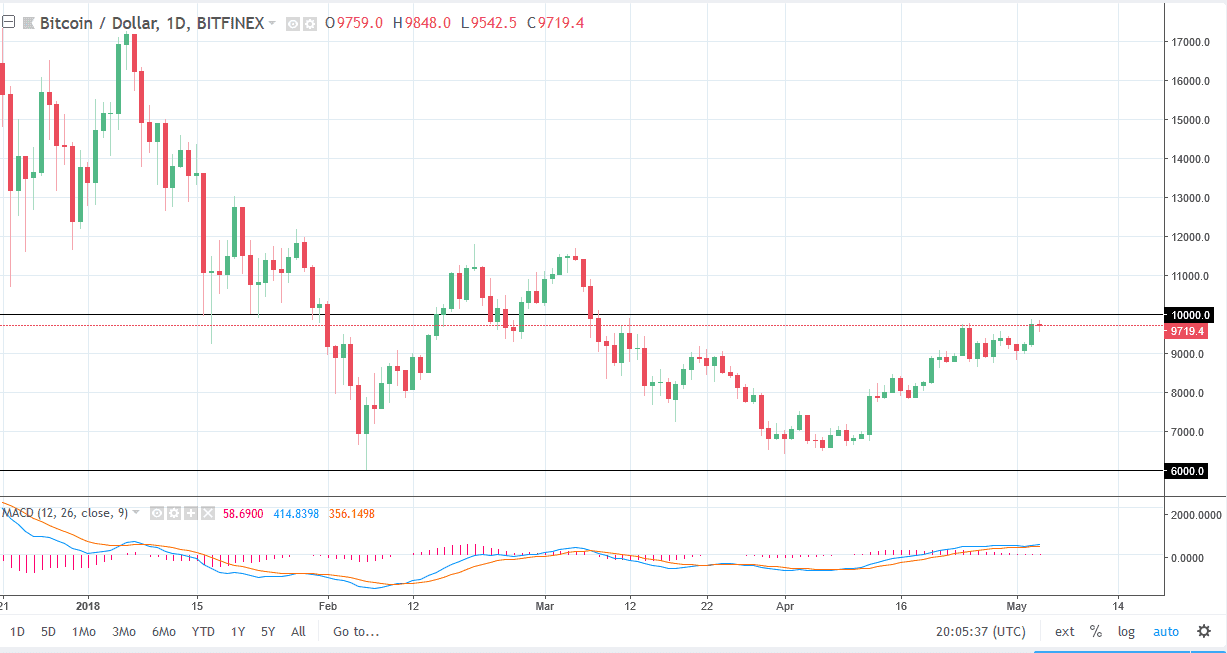

BTC/USD

Bitcoin did very little against the US dollar during the trading session on Friday, as the world focused on the jobs number in America. The $10,000 level continues to be a major barrier above, and if we can break above there, and it certainly looks as if we are trying to build up the necessary momentum, I think the market can go higher, perhaps targeting the $12,000 level. If we don’t, I think we will probably pull back to the $9000 level, which has been supportive for several weeks. A breakdown below there would of course be negative, perhaps unwinding this market to the $8000 level. I think that a lot of the days of 10% gains are all but done in this market, as the institutional money flowing into Bitcoin has done something that people didn’t think about, calmed down the volatility, as institutional traders introduced algorithms.

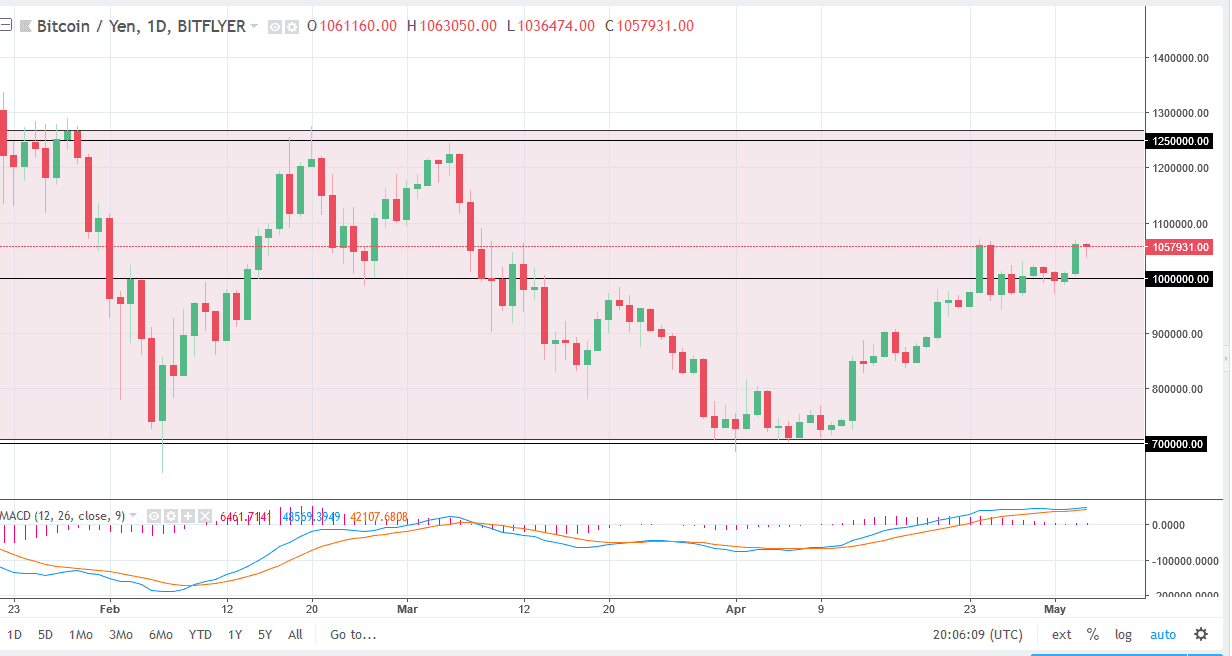

BTC/JPY

The Bitcoin markets fell initially during the day on Friday, but then turned around to form a hammer. It looks as if we are trying to get to the ¥1.1 million level, an area that has been resistance in the past. If we can clear that level, then I think we go to the ¥1.25 million level above. A break above there could send this market much higher, perhaps to the ¥2 million level. Obviously, this is a market that is very choppy, but I think that the ¥950,000 level underneath should continue to be support. If we were to break down below there, then I think we go to the ¥850,000 level. Pay attention to the Japanese yen, if it continues to fall in value, that should push this market much higher. I believe that ultimately we can continue to find buyers on dips as they represent value.