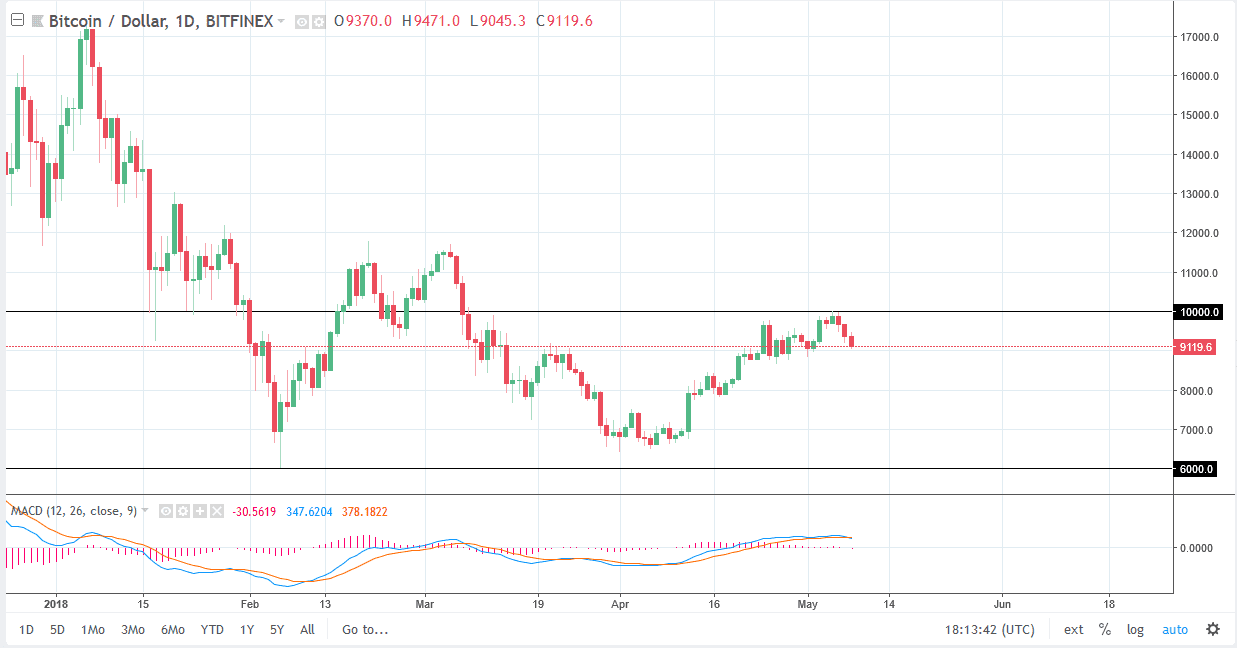

BTC/USD

The Bitcoin markets fell against the US dollar at the open on Tuesday, as it looks like we are testing the $9000 level underneath for support again. I think that the market will probably bounce from here, but I also recognize that there is a massive amount of resistance at the $10,000 level above. If we can finally get a daily close above that level, then I think the market is free to go to the $12,000 level. I think that the overall outlook for this market is one that is consolidation, and therefore I think that if we break down below the $9000 level, it could negate that consolidation. I think that the market probably goes down to the $8000 level underneath, which is also support. I think that the market will eventually try to find buyers, but currently the US dollar has been strengthening, and that of course is working against the value of this market.

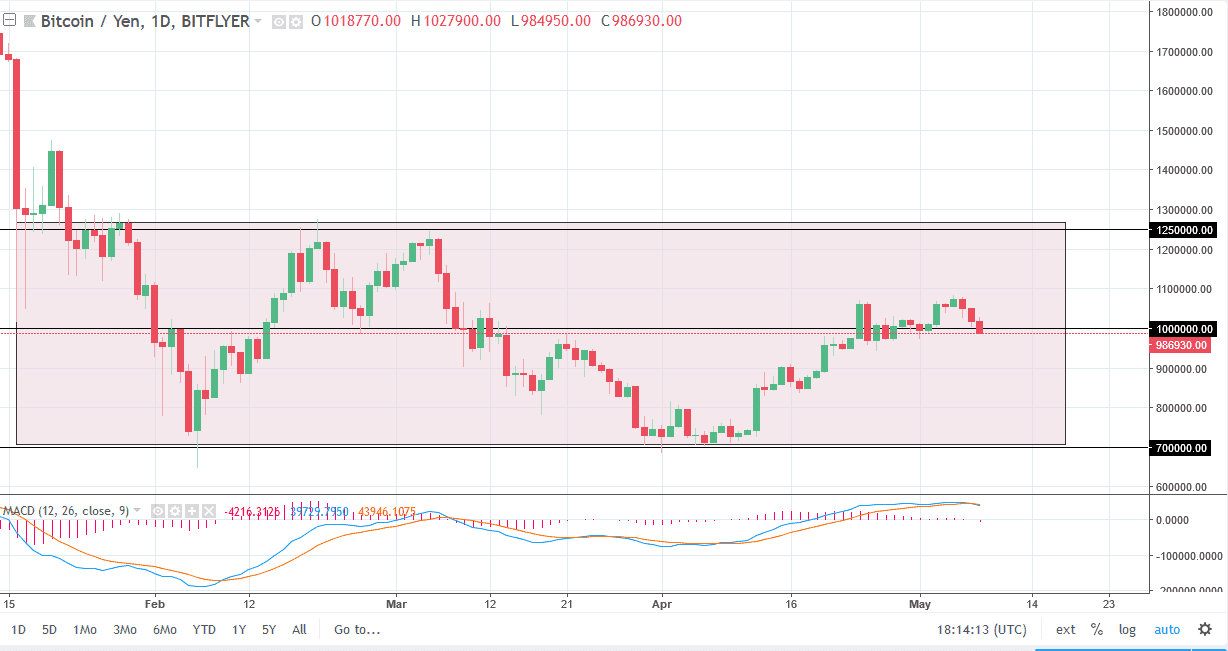

BTC/JPY

Bitcoin fell against the Japanese yen, breaking through the ¥1 million level on Tuesday. The market looks likely to go down to the ¥950,000 level to look for support, and a bounce from there would make a significant amount of sense. However, if we break down below that level I think the market will probably continue to drift towards the 800,000 level. Otherwise, if we bounced from this area, I think the market probably goes looking towards the ¥1.1 million level again, which I see as a barrier. A break above there allows the market to go to the top of the longer consolidation area which is the ¥1.25 million level. That being said, if we break down we could go as low as ¥700,000 level underneath, which has been the bottom of the larger consolidation range.