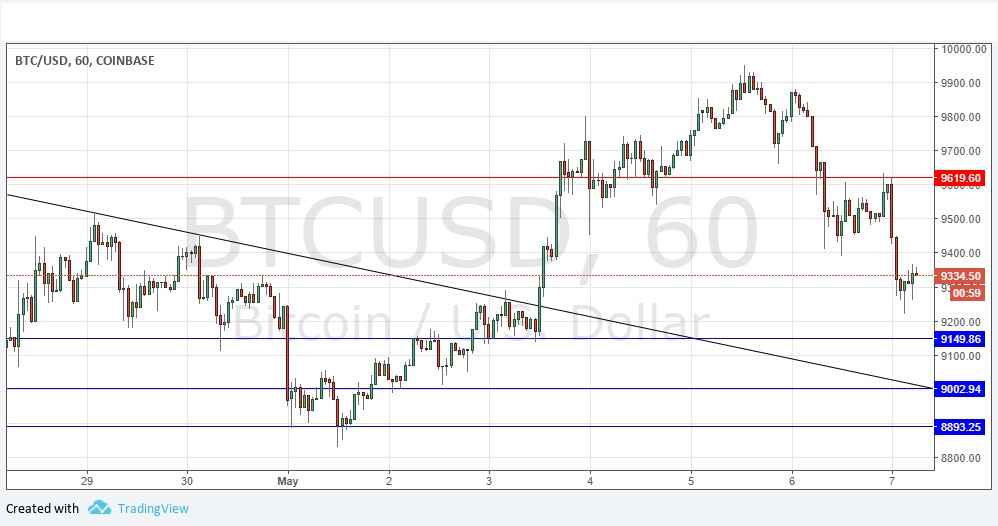

Last Thursday’s signals produced a good, profitable long trade from the engulfing candlestick which rejected the nearest support level at $9,150 from above, giving a good maximum reward to risk ratio for profit taking.

Today’s BTC/USD Signals

Risk 0.75% per trade.

Trades must be taken before 5pm Tokyo time, during the next 24-hour period only.

Long Trades

Go long after a bullish price action reversal on the H1 time frame following the next touch of $9,150, $9,003 or $8,893.

Place the stop loss 1 pip below the local swing low.

Move the stop loss to break even once the trade is $200 in profit by price.

Remove 50% of the position as profit when the trade is $200 in profit by price and leave the remainder of the position to run.

Short Trade

Go short after a bullish price action reversal on the H1 time frame following the next touch of $9,620.

Place the stop loss 1 pip above the local swing high.

Move the stop loss to break even once the trade is $200 in profit by price.

Remove 50% of the position as profit when the trade is $200 in profit by price and leave the remainder of the position to run.

The best method to identify a classic “price action reversal” is for an hourly candle to close, such as a pin bar, a doji, an outside or even just an engulfing candle with a higher close. You can exploit these levels or zones by watching the price action that occurs at the given levels.

BTC/USD Analysis

I wrote last Thursday that momentum seemed relatively bullish, but this would have to be confirmed by a decisive break above the trend line. If the price did get established above there, it has space to rise higher as there are no obvious strong resistance levels until the big round number at $10,000 is reached. This worked out very well, with the nearest support living giving a nicely profitable long trade entry.

However, the price has fallen back by a long way over the past few days after getting close to the psychologically important $10,000 area, printing a new clear resistance level below there on its journey at $9,600. Due to the inconclusive medium-term movement I have no directional bias, I would look only to trade convincing rejections of key levels. The short-term action suggests a flattening out or even a bullish turn. The support levels below look attractive, especially $9,000 which is not only a round number but currently very confluent with the trend line.

There is nothing due today concerning the USD.