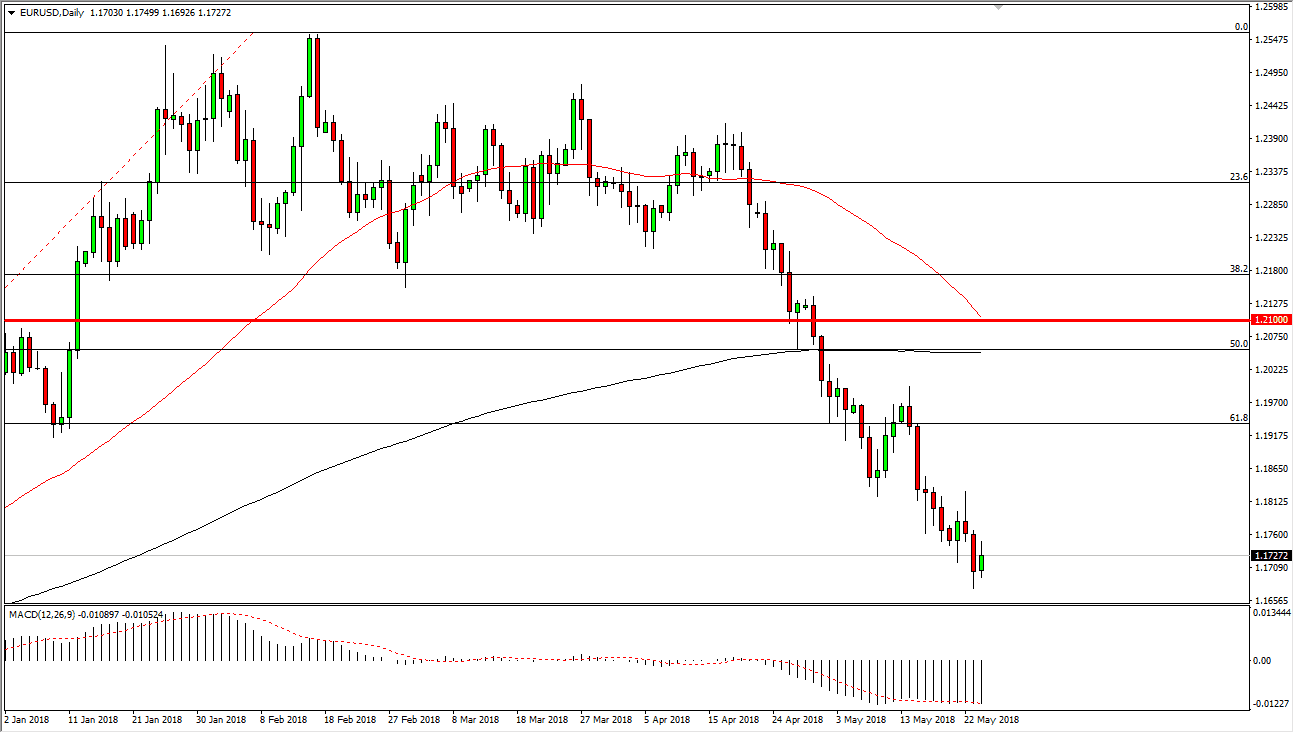

EUR/USD

The Euro rallied a bit during the trading session on Thursday but gave back about half of the gains in a sign of just how soft this pair is. The 1.1750 level was previous support, and it now looks as if it will be resistance. It looks like we will continue to go lower, but at this point I would feel much better about selling rallies as they occur. I think at this point, the market could break down to the 1.1550 level underneath, and possibly even lower than that. I would expect a lot of support at the 1.1550 level, so I would anticipate a short-term bounce. If we do rally from here, I think some of the major barriers to overcome will be the 1.18 handle, followed very closely by the 1.1850 level as well. Interest rates in America continue to push this pair lower.

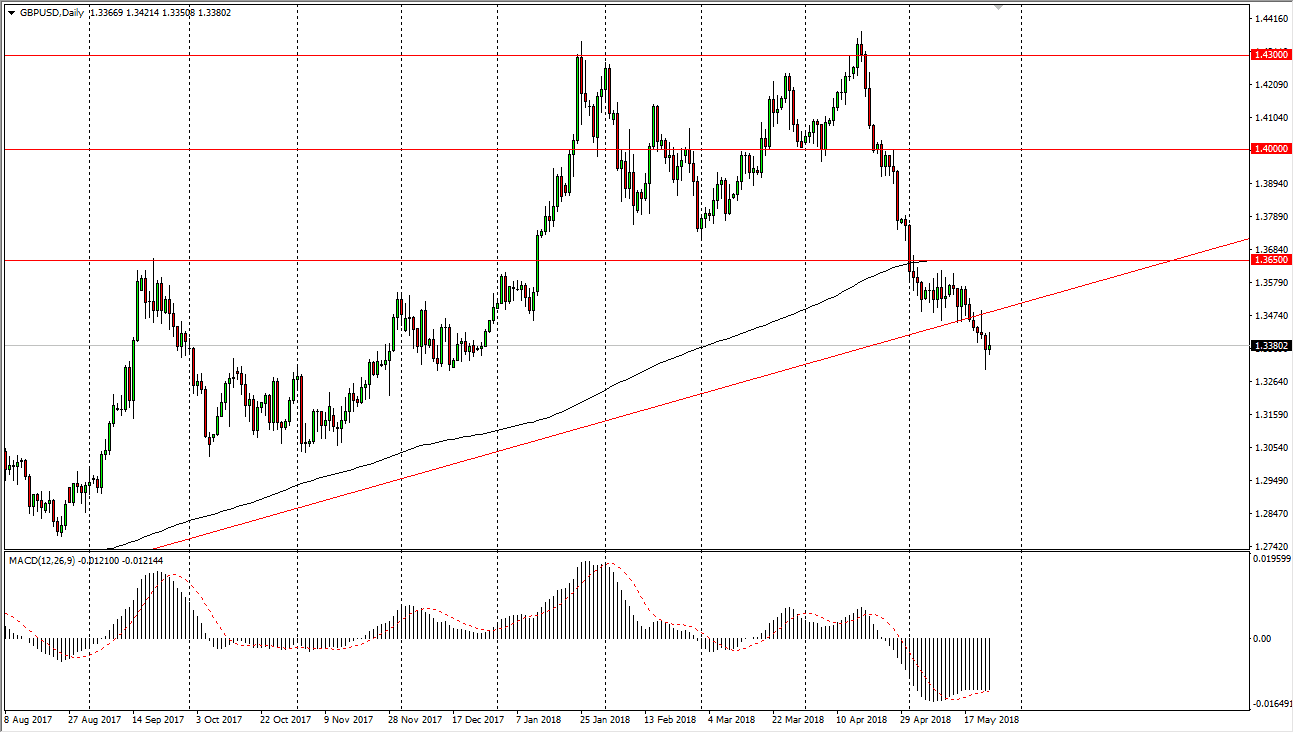

GBP/USD

The British pound initially try to rally during the day but as you can see rolled over to form a shooting star. The shooting star of course is a negative sign, as it was an attempt to gain some strength, but we could not hang onto the little bit that we had. The market was very noisy during the day, but right now it looks as if every time the buyers step in, the sellers come right back to punish them. The previous uptrend line should continue to offer a lot of resistance, just as the shooting star will from the Tuesday session. I think it’s only a matter time before we break through the 1.33 handle and extend down to the 1.30 level underneath. I have no interest in buying this pair until we break above the 1.3650 level, something that looks very unlikely to happen.