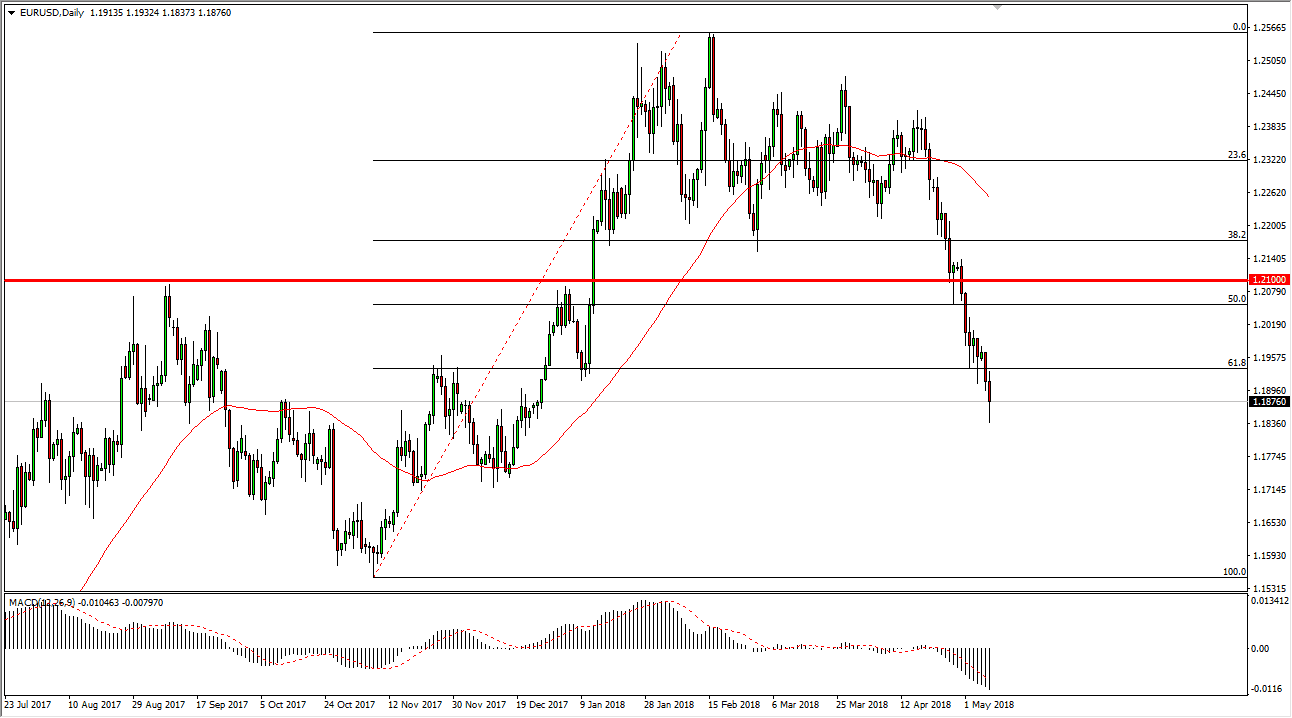

EUR/USD

The EUR/USD pair broke down significantly on Tuesday again, breaking down below the 1.19 handle, and reaching below the 1.1850 level at one point during the session. We have cleared the 61.8% Fibonacci retracement level, and now I think it’s only a matter of time before we go to the beginning of the move, putting this market much closer to the 1.15 handle. I think the 1.21 level above is significant resistance, as it was previous support. I like the idea of shorting rallies as they occur, as the US dollar continues to show a significant amount of strength in general. That by default will push this market lower as it is the benchmark for US dollar strength or weakness. It’s not until we break above the 1.21 handle that I would be interested in buying. I think that if the markets formed a supportive candle on the daily chart near the 1.15 level, then I could be convinced to buy. I think we are going to see a summer of dollar strength based upon interest rate expectations.

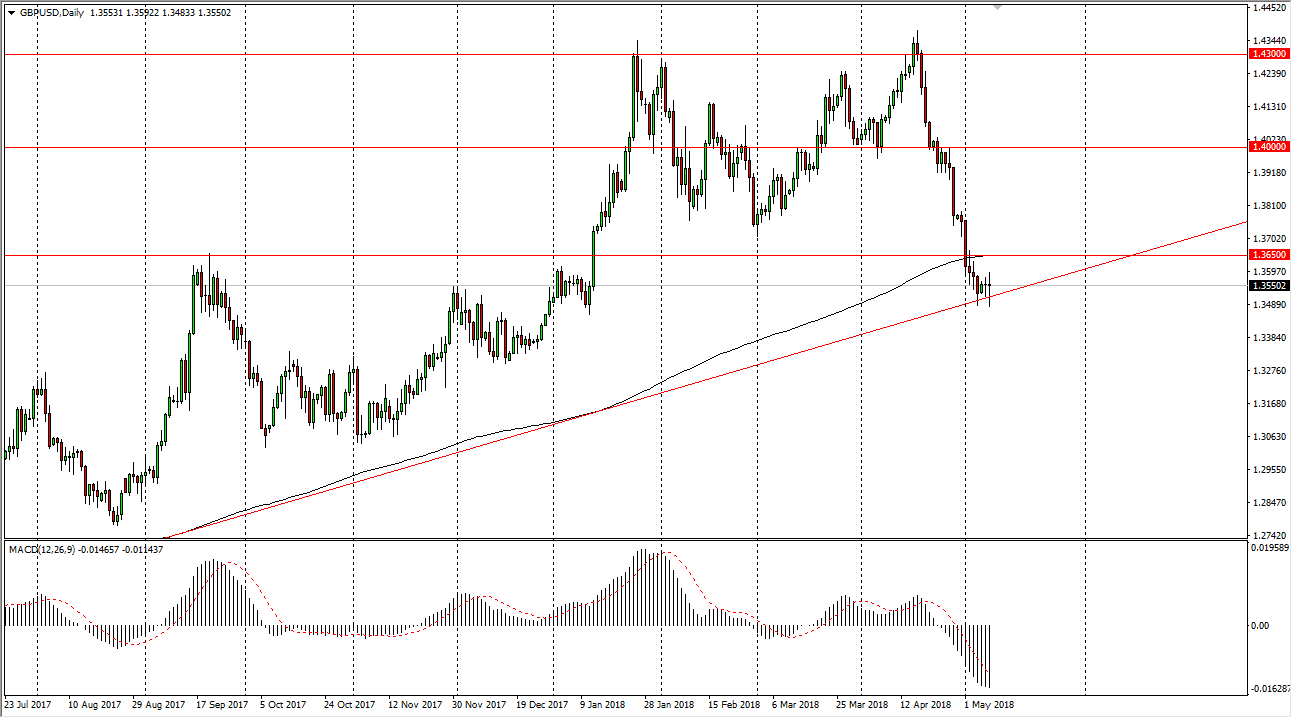

GBP/USD

The British pound has been very noisy during the trading session on Tuesday, testing the uptrend line that defines the uptrend overall. I believe that the 1.3650 level is offering resistance, as well as the 200-day SMA. Market participants will continue to pay attention to this area, because it will determine where we go next. I suspect that we are probably going to see more bearish pressure as the US dollar is going to strengthen during most of the summer. That being said, I think that any rally at this point will be suspicious, and the first signs of exhaustion will probably be sold into. If we get a daily close above the 1.37 handle, then I think some type of recovery is in the cards.