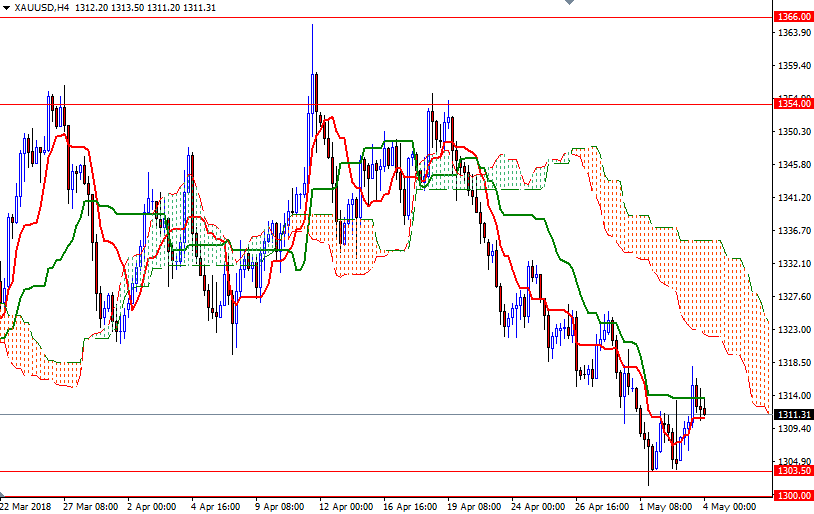

Gold prices rose $6.93 an ounce on Thursday, helped by a drop in the U.S. dollar. XAU/USD initially drifted higher as expected and challenged the resistance in the $1315-1314 zone but it was unable to sustain gains. In economic news, weekly jobless claims data beat expectations but ISM's service sector index came in below estimates. Attention now turns to the week's final big event, the U.S. employment report from the Labor Department.

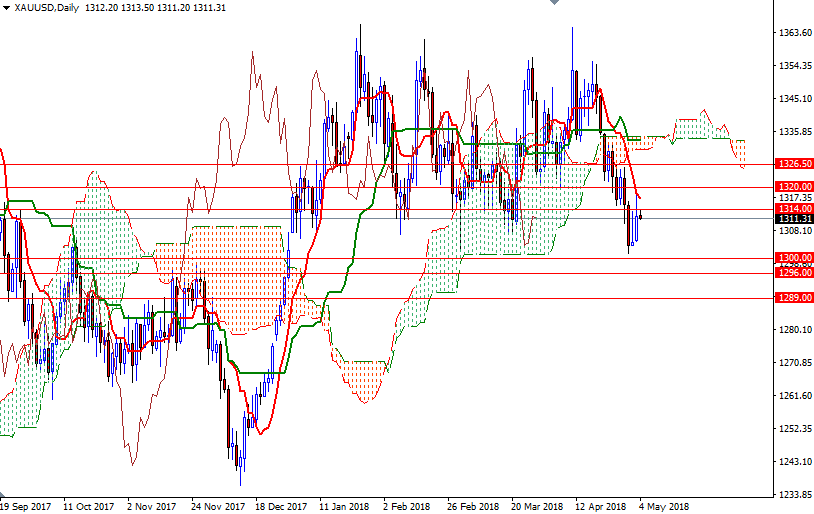

The shorter-term charts are slightly bullish at the moment, with the market trading above the Ichimoku clouds on the H1 and the M30 time frames. If the bulls defend their camp in the 1311-1309 are and lift prices back above 1315/4, they may have a chance to test 1317-1316.30 (the daily Kijun-Sen) and 1322/0. A break through there would foreshadow a move up to 1326.50-1325.60.

However, if the bears take the reins and drag prices below 1311-1309, then 1307/6 may be the next stop. A break below 1306 implies that we are heading back to 1303.50. The bears have to produce a daily close below the strategic support in the 1300-1296 zone to gain momentum for 1292-1289.