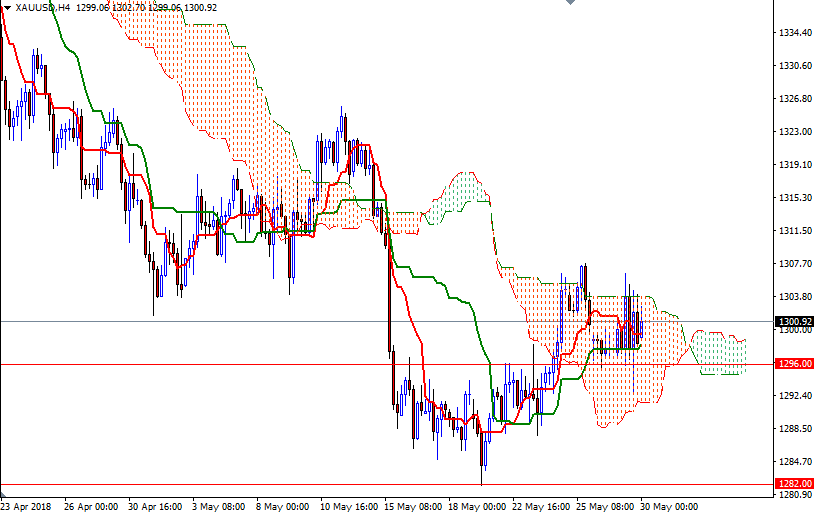

Gold prices ended the day with slight gains, but remained locked within a sideways trading range. XAU/USD tested the support at $1292.50 before climbing back above the $1297-$1296 area. Worries about Italy and Spain dragged down stock markets around the world. The euro tumbled to fresh 10-month lows against the dollar.

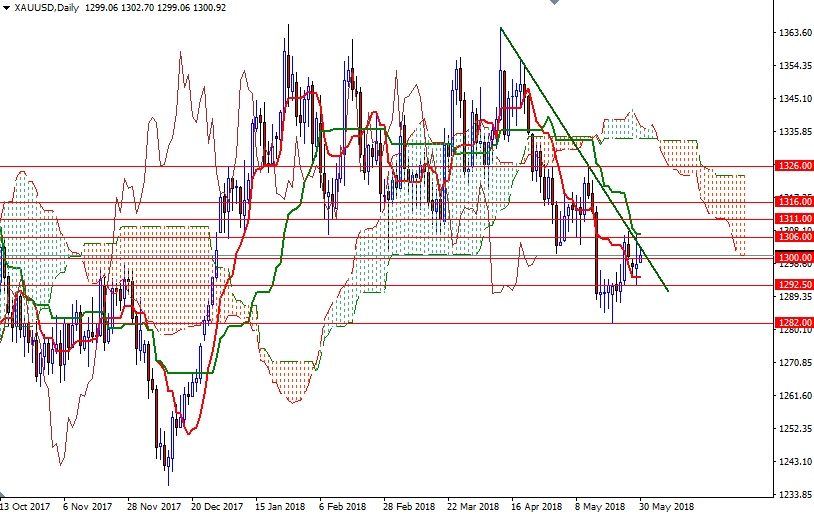

The market is trying to hold above the 1297/6 zone; however, we are still trading within the borders of the 4-hourly Ichimoku cloud. The Tenkan-Sen (nine-period moving average, red line) and the Kijun-Sen (twenty six-day moving average, green line) are nearly flat on both charts, indicating that there is no strong momentum. Also keep in mind that XAU/USD is in a seven-week-old downtrend on the daily chart, and the descending trend line continues to limit the upside.

If the market can get above the resistance in the 1307.50-1306 area, where the daily Kijun-Sen and 200-day moving average converge, it has the potential to rise to 1311. A break through there brings in 1318/6. The bulls have to produce a daily close above 1318 to make a move to 1326/3, the bottom of the daily cloud. On the other hand, if XAU/USD drops below 1296, we may pay another visit to 1292.50-1290. The bears have to capture this strategic camp to tackle 1287.40-1286. Once below there, the market will be targeting 1282/1.