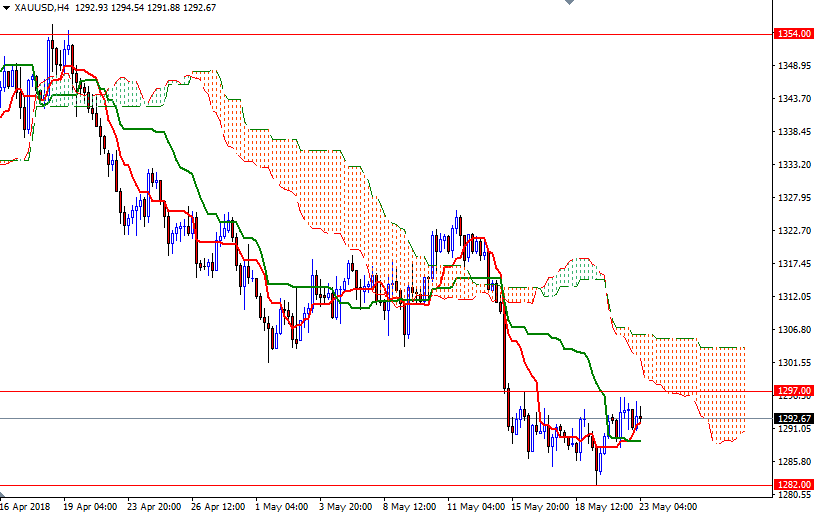

Gold prices ended Tuesday slightly lower after a quiet session. XAU/USD found support at around $1277.40 and reached the $1297-$1296 area as expected but it was unable to break through. The market revisited this barrier in early Asia trading and failed again. Focus of the marketplace today is on the release of minutes of the Federal Reserve’s latest policy meeting.

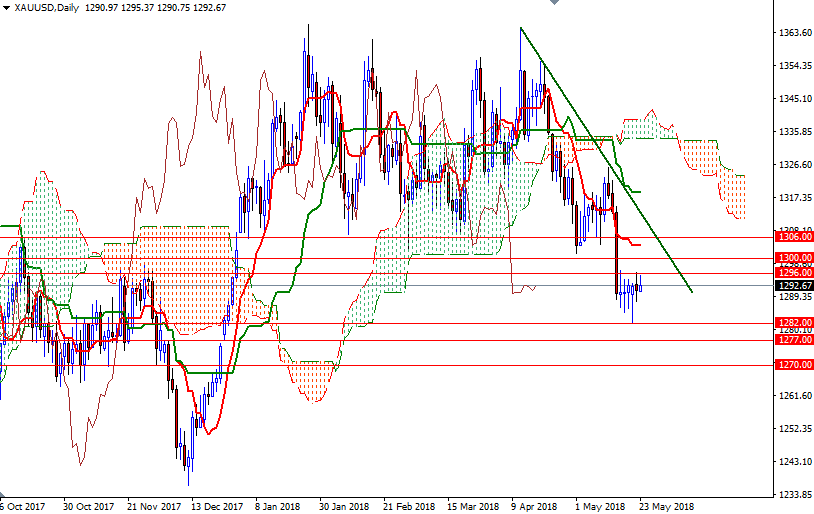

The key levels remains unchanged, as the market continues consolidating roughly between the 1296 and the 1282 levels. XAU/USD is trading above the weekly Ichimoku cloud but the daily and the 4-hourly charts indicate that the bears have the overall near-term technical advantage. The bulls have to penetrate 1297/6 to gain momentum for 1300. A break through there could trigger a push up to 1303.50 or even 1306. Beyond there the 1313/0 area, the confluence of a horizontal resistance and a six-week old bearish trend line, stands out a strategic key resistance that the bulls have to overcome.

To the downside, keep an eye on the aforementioned support at 1277.40. If this support is broken, the bears will have another chance to challenge 1286 and 1284. Just below there, we have an important support in 1282/1 and the market has to penetrate this barrier to tackle 1277/4. Closing below the 1274 level on a daily basis implies that the next stop will be 1270.