Gold prices ended Monday’s session up $2.12 an ounce but remained within a relatively narrow trading range. XAU/USD initially tested the support in the $1282-$1281 area as expected after priced fell below $1285. The metal recovered losses seen earlier as a pullback in the U.S. dollar lent some support, though upbeat investor risk appetite in the world marketplace limited the upside. World stock markets were higher yesterday. U.S. economic data due for release Tuesday is light and includes the Richmond Fed’s manufacturing index.

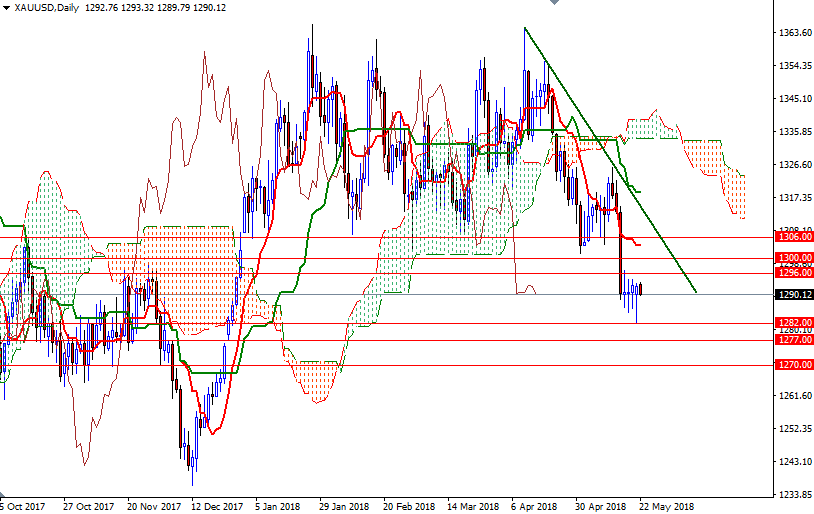

The market continues to trade below the daily and the 4-hourly charts. However, note that the recovery in gold yesterday resulted in the formation of a hammer. The tall lower shadow of yesterday’s candle implies that the beards may be getting exhausted after recent strong selling pressure. To confirm that a short-term bottom is in place, XAU/USD has to successfully climb above the 1297/6 area. If this resistance is broken, look for further upside with 1300 and 1303.50 as targets. A daily close above 1303.50 is essential for a move to 1306.

To the downside, the initial support sits at 1287.40, followed by 1285.80-1285. If prices get back below 1285, the support in the 1282/1 area will be in danger. The bears have to drag prices below 1281 to challenge 1277/4. Breaking below 1274 suggests that the market will be targeting 1270 next.