Gold prices ended Tuesday’s session nearly unchanged after a volatile day that saw prices swing between gains and losses. XAU/USD initially edged lower to the $1308-$1306 zone before finding enough support to reverse its course. The market marched towards the technical resistance at $1320 after President Donald Trump said the U.S. was exiting the Iranian nuclear accord, but the bulls surrendered as buying dried up. Fed Chairman Jerome Powell said the central bank will continue to help build resilience in the financial system and “will communicate our policy strategy as clearly and transparently as possible to help align expectations and avoid market disruptions.”

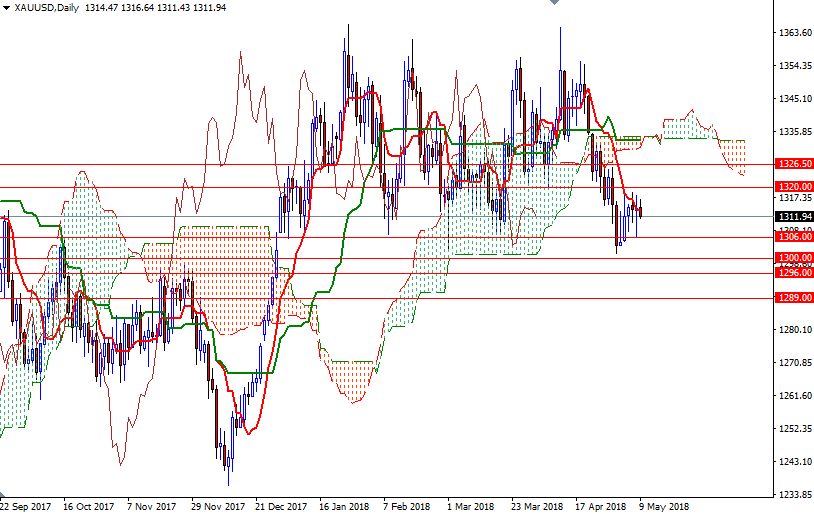

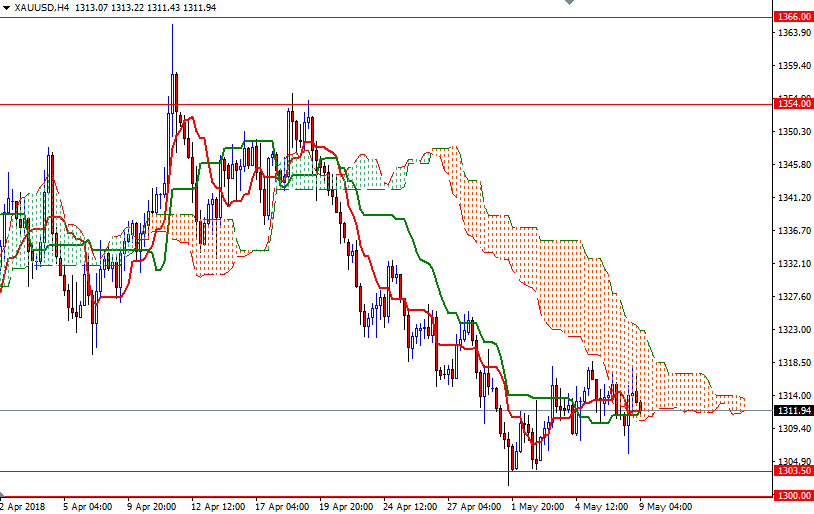

Prices remain below the daily Ichimoku cloud, and the Tenkan-Sen (nine-period moving average, red line) and the Kijun-Sen (twenty six-period moving average, green line) are negatively aligned. The long lower shadow of yesterday’s candle suggests lower prices continue to entice buyers but we are still within the trading range of the past five days. XAU/USD is moving inside the 4-hourly cloud, and the market is looking for a direction. If prices penetrate the 4-hourly cloud, keep an eye on the resistance in the 1326.50-1325.60 zone. The bulls will have to overcome this barrier to set sail for the daily cloud.

To the downside, the initial support sits at 1310, followed by 1308/6. If this support gives way, then 1303.50 will be the next target. A break below there could send prices back to the solid support in the 1300-1296 area. Closing below 1296 on a daily basis could prelude a stronger drop.