Gold prices rose $2.28 an ounce on Wednesday after minutes from the Federal Open Market Committee’s May meeting suggested the central bank would not increase the pace of its interest rate hikes. U.S. President Trump comments on NAFTA, new setbacks in U.S.-China trade talks and political uncertainty in Italy were also supportive daily elements for gold. While the minutes show that FOMC members are about evenly split between those who anticipate two more rate hikes this year and those who expect three, the markets believe that policymakers likely to move again in June.

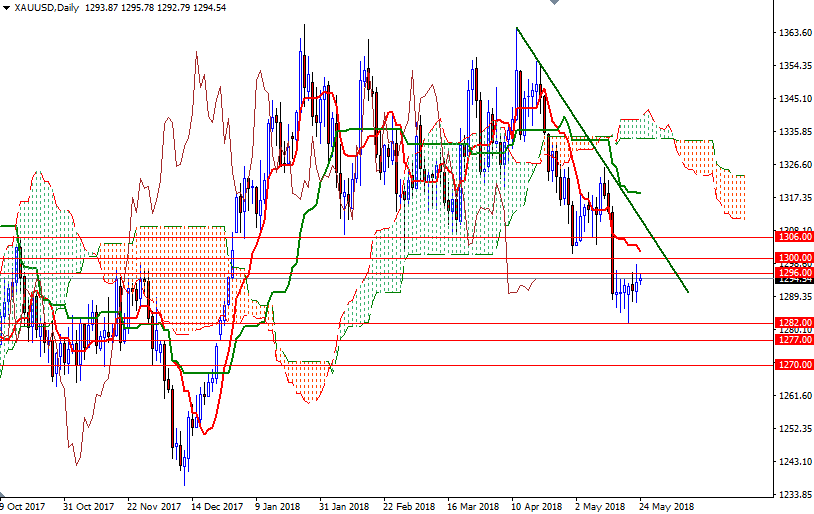

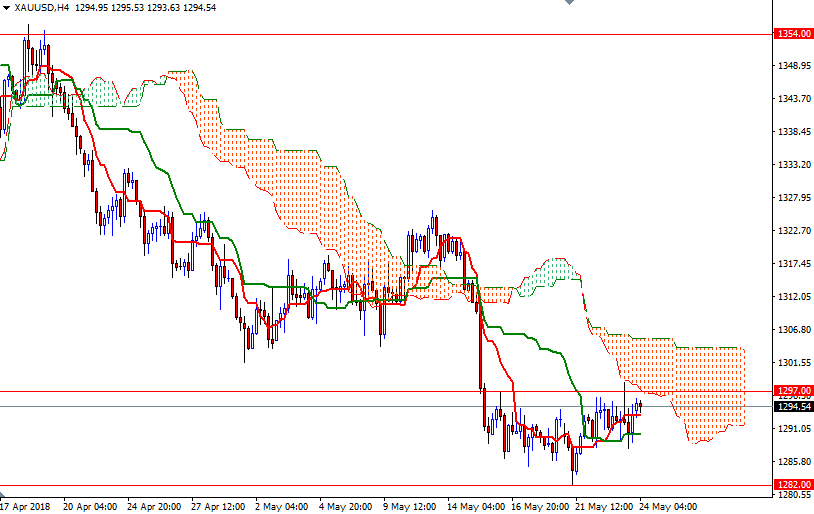

The short-term charts are slightly bullish at the moment, with the market trading above the Ichimoku clouds on the H1 and the M30 time frames. In addition to that, the Tenkan-Sen (nine-period moving average, red line) and the Kijun-Sen (twenty six-period moving average, green line) are positively aligned on the 4-hourly chart. The market is currently in the process of testing the resistance in the 1297/6 zone, where the bottom of the 4-hourly cloud resides. If XAU/USD breaks through and holds above 1297, then the 1300 level will be the next stop. The bulls have to overcome this solid technical resistance to set sail for 1303.50 and 1306. A daily close beyond 1306 is essential for a bullish continuation towards 1313/0.

However, if the 4-hourly cloud continues to block the bulls’ way, the market will probably pull back to test 1287.40-1286. Below there, we have a strategic support in the 1282/1 zone. The bears have to produce a daily close below 1281 to increase the downward pressure. In that case, the 1277/4 will be the next stop.