Gold prices declined for a second session on Monday as easing geopolitical tensions lessened the appeal of the yellow metal. XAU/USD traded in a narrow range as the New York and London markets were closed for public holidays. The strong US dollar continued to put price pressure on gold but declines across global equity markets were supportive.

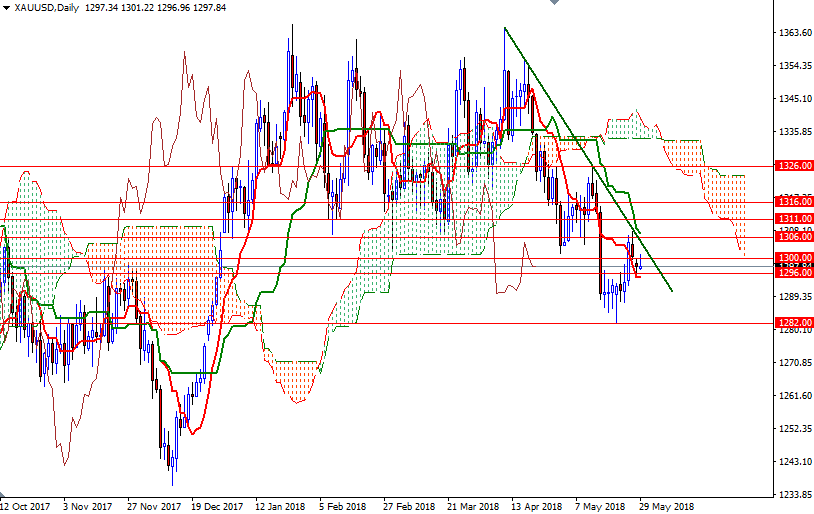

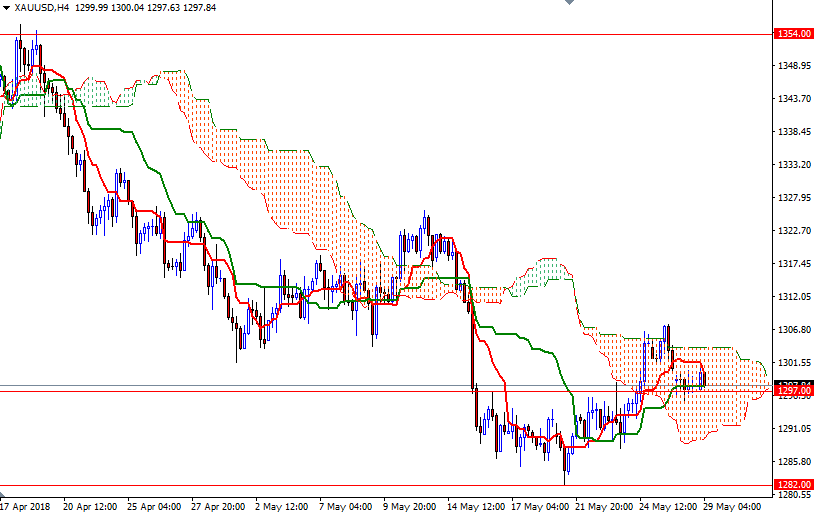

Trading below the daily Ichimoku cloud suggests bears currently remain in control on the daily charts. However, the market is trading within the borders of the Ichimoku clouds on the 4-hourly and the hourly charts, indicating sideways trading in the near term. To the upside, the initial resistance stands at 1303.50, followed by 1307.50-1306. If the market breaks through 1307.50-1306, the confluence of the daily Kijun-Sen (twenty six-day moving average, green line) and 200-day moving average, look for further upside with 1311 and 1318/6 as target.

The bears, on the other hand, will need to drag prices below 1297/6 and take out yesterday’s low to challenge 1292.50-1290 (the bottom of the cloud on the H4 chart). If this support is broken, the market will be targeting 1287.40-1286 next. Closing below 1286 on a daily basis would encourage sellers and open a path to 1282/1.