By: DailyForex

The difference between success and failure in Forex trading is very likely to depend upon which currency pairs you choose to trade each week, and not on the exact trading methods you might use to determine trade entries and exits. Each week I am going to analyze fundamentals, sentiment and technical positions in order to determine which currency pairs are most likely to produce the easiest and most profitable trading opportunities over the next week. In some cases it will be trading the trend. In other cases it will be trading support and resistance levels during more ranging markets.

Big Picture 27th May 2018

In my previous piece two weeks ago, I forecasted that the best trades would be short SEK/JPY and long Crude Oil and the S&P 500 Index. That week, SEK/JPY fell by 0.66%, Crude Oil rose by 1.13%, and the S&P 500 Index fell by 0.62%, giving an average win of 0.39%.

Last week saw a rise in the relative values of the U.S. Dollar and the Japanese Yen, while the Euro and the British Pound were the notable losers. The U.S. stock market continues to refuse to make any further significant advance. Crude Oil fell quite heavily after reaching new long-term high prices.

The major events of last week were a Euro-related crisis as it becomes clear that a new populist Italian government will be formed, which was rumored to be demanding a major write-off of Italian sovereign debt. The British Pound also weakened on slightly poor inflation data and continuing political woes for the British Government over Brexit. The somewhat dovish FOMC Meeting Minutes may have limited the advance in the U.S. Dollar, although strong Durable Goods Orders data later fueled a further rise.

Fundamental Analysis & Market Sentiment

Fundamental analysis tends to support the U.S. Dollar, as American economic fundamentals continue to look strong. The Japanese Yen also got a boost this week upon fears that upcoming negotiations over North Korea may not take place. There is very negative sentiment on the Euro. There is a serious crisis in the Turkish Lira, as a rapid slide to all-time lows was only halted by a rate hike by 3% to 16.5%. However, calls by the Turkish President this week for Turkish citizens to buy Lira with their foreign currency holdings smacks of desperation and might rattle markets further.

Technical Analysis

U.S. Dollar Index

The weekly price chart below shows a bearish pin bar / candlestick move was made over the week, with the Index making a new 4-month high price and closing between its price levels from 3 months and 6 months ago, invalidating the long-term bearish trend, but rejecting the resistance levels of 11896 and 11913. This is a continuation of a major bullish technical change. The long-term bearish trend line has been decisively broken, but the price has now reached a zone of resistance which may contain it for a while at least.

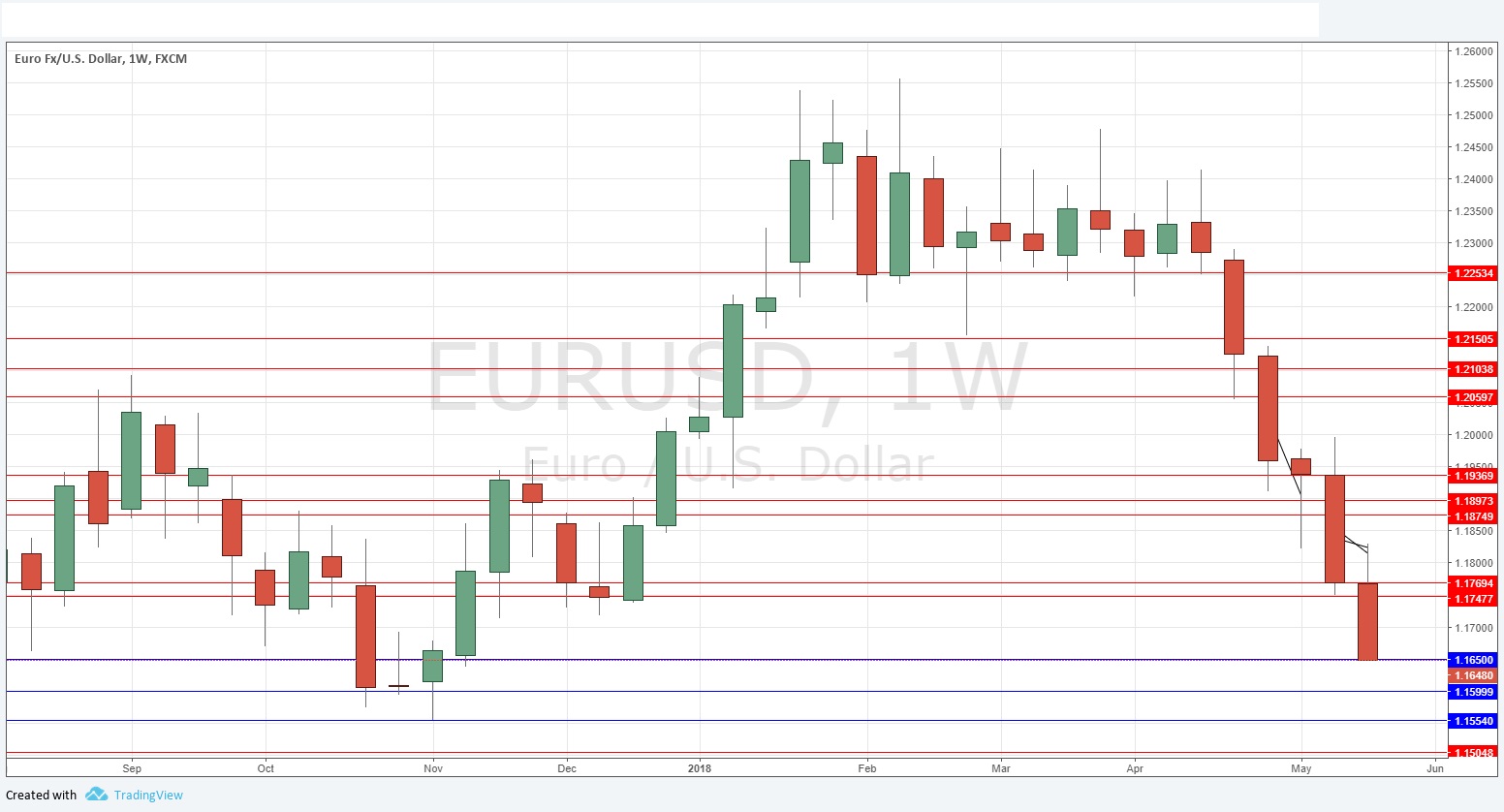

EUR/USD

The weekly chart below shows the price made another strong downwards move, printing a very bearish continuation candlestick which closed hard on its low. This is suggestive of strong downwards momentum, even though the price is arriving at an area which had previously produced a strong bullish inflection. The price is now below its levels from both 3 and 6 months ago, which is another bearish sign.

EUR/JPY

The weekly chart below shows the price made a strong downwards move, printing a very bearish candlestick which closed not far from its low, which is a 1-year low price. This is suggestive of strong downwards momentum, even though the price is arriving at an area which had previously produced a bullish inflection. The price is now below its levels from both 3 and 6 months ago, which is another bearish sign, and it is falling into “blue sky”.

GBP/USD

The weekly chart below shows the price made another strong downwards move, printing a very bearish continuation candlestick which closed hard on its low. This is suggestive of strong downwards momentum, even though the price is arriving at an area which had previously produced a bullish inflection. The price is now below its levels from both 3 and 6 months ago, which is another bearish sign.

Conclusion

Bearish on EUR/USD, GBP/USD, and EUR/JPY.