By: DailyForex.com

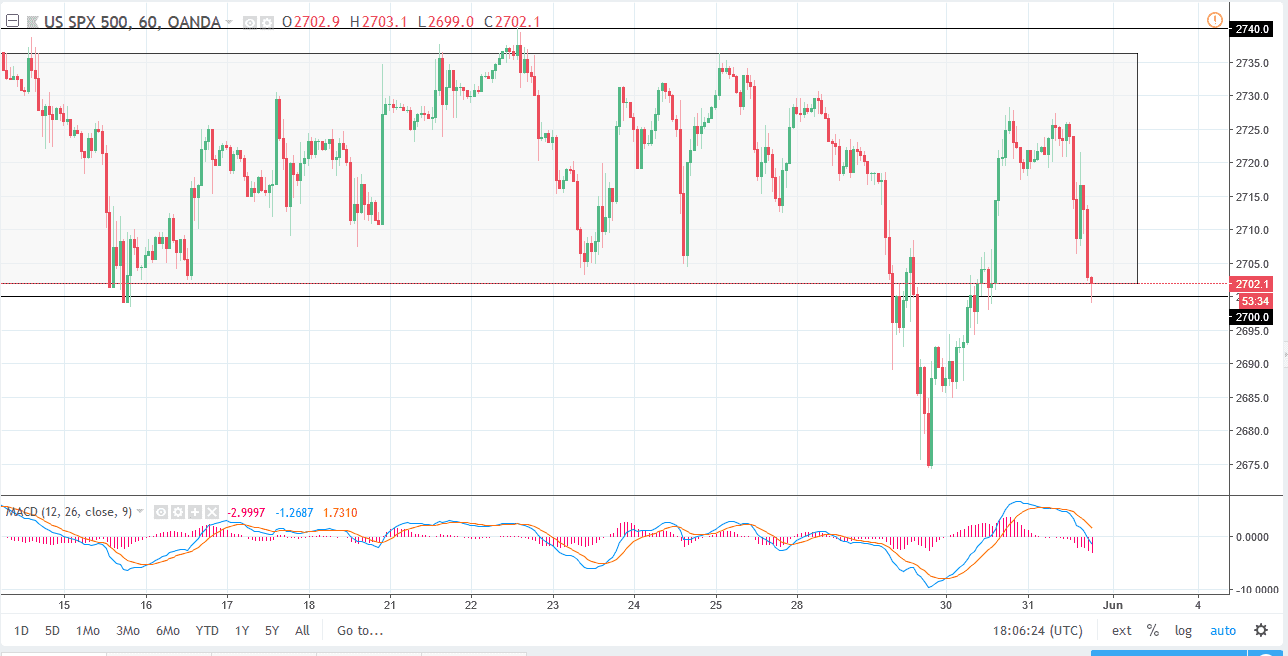

S&P 500

The S&P 500 broke down significantly during trading on Thursday as it was announced that the Americans would be slapping tariffs on the Canadians, the Mexicans, and the Europeans. This has people worried about a bit of a trade war, so it makes sense that we would go lower and looking for support at the 2700 level. As I record this, so far we are trying to find it, but I wouldn’t count on it lasting. Even if it does, we are probably looking at a bounce at best, as we try to stay within the 40 point trading range that we had been in. Otherwise, I think we will go looking towards the 2675 level as well. One thing I think you can count on is a lot of noise and a lot of danger when it comes to trading the stock markets over the next several sessions, as the EU is primed to retaliate.

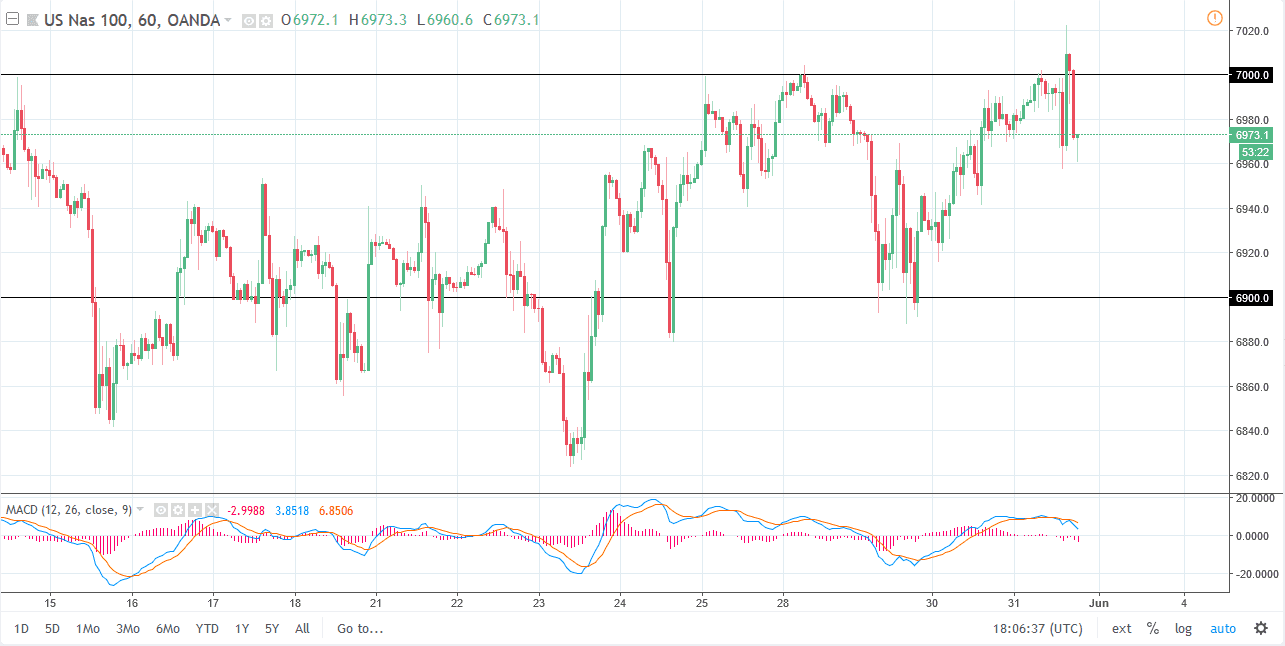

NASDAQ 100

In a non-move for the session, the NASDAQ 100 broke higher, reaching towards the 7020 level before selling off. We have found support at 6960 or so, and it looks like there’s plenty of support down to the 6900 level. So there is a market that can lead the rest of them higher, I believe it will be the NASDAQ 100. However, keep in mind that it’s only going to take a tweet or some type of random comment to have people start worrying again as there are major concerns when it comes to the possibility of the trade war. While I think the trade war is very unlikely, the machines will read the headlines and start selling right away. You can by on the dips, but just make sure you do it in small bits and pieces so that you don’t blow out your count on some random headline.