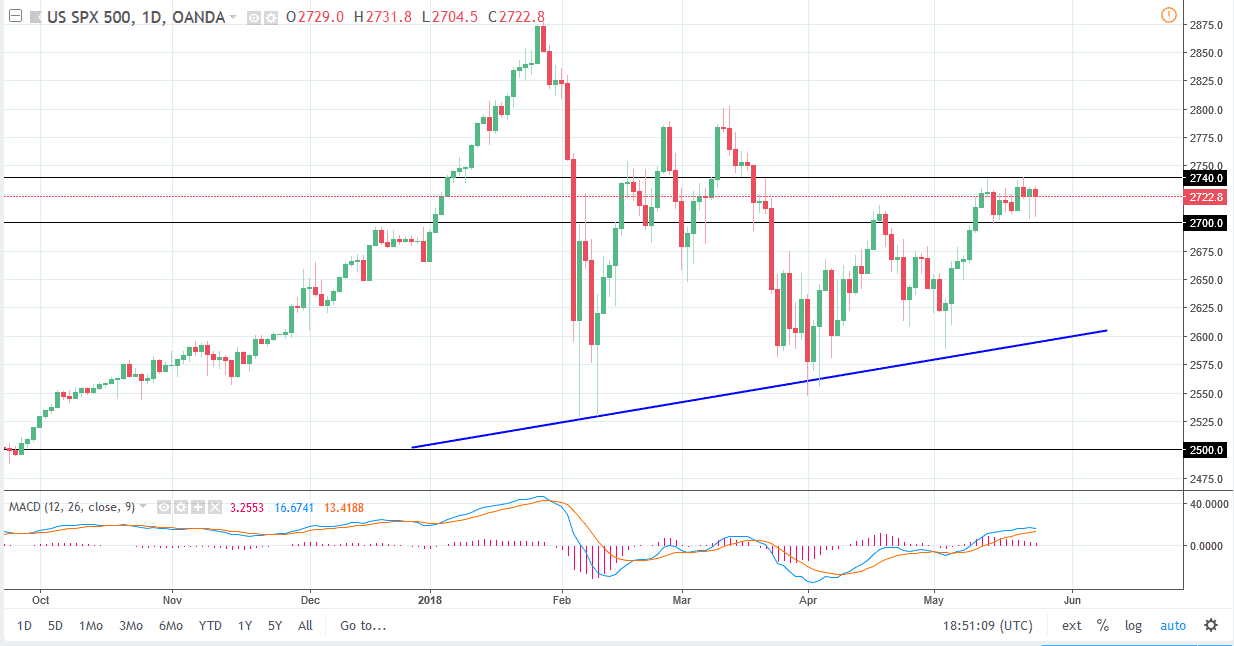

S&P 500

The S&P 500 initially fell rather hard during the day on Thursday, reaching towards the 2700 level as it was revealed that the United States and North Korea were not going to meet after all. That of course has a lot of the panic traders selling, but those who have a bit cooler heads of course found this as value in the marketplace that has been strong. Because of this, it’s likely that longer term we will see moves to the upside as it shows so much in the way of support and resiliency. I think 2700 continues to be an area that we will pay a lot of attention to, and I think that the 2740 level being broken to the upside would allow this market to go to the 2800 level. I believe that it’s only a matter of time before the break out thus, considering that we can’t shake the bullish pressure.

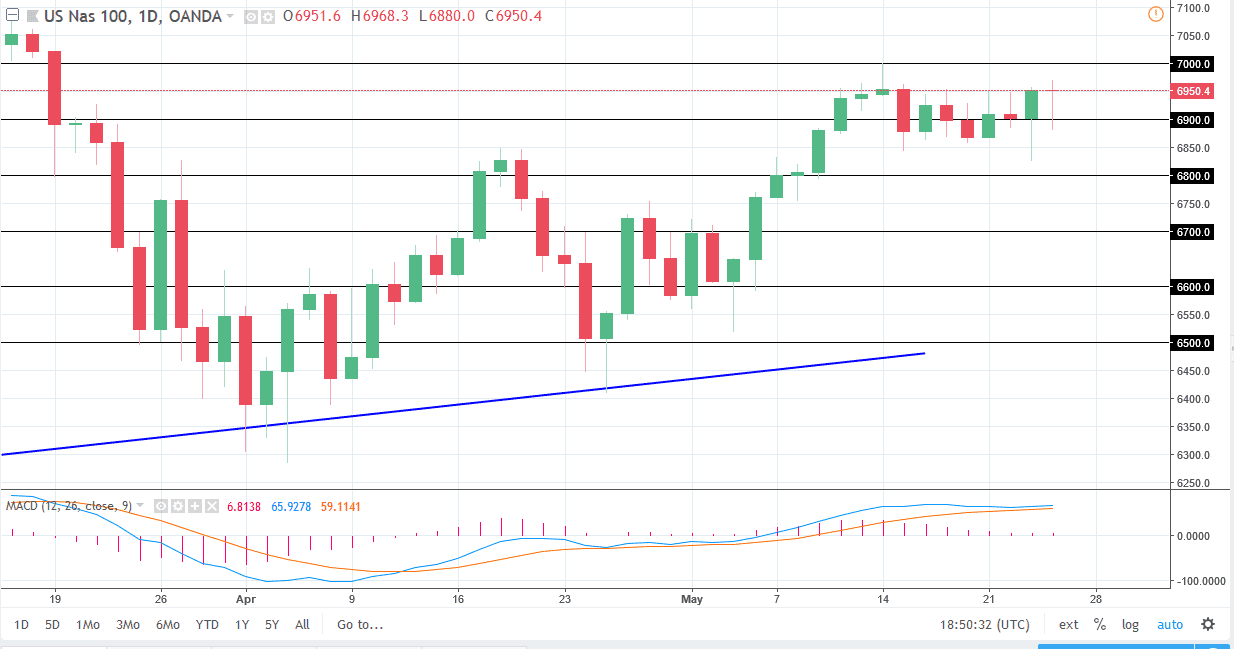

NASDAQ 100

The NASDAQ 100 also fell after the same announcement, but we can also see that we have the same reaction as the market turned around to reach towards the upside. In fact, it looks like we are going to break towards the 7000 handle above, which is of course a major barrier. Once we get above there, the market should be free to go much higher, perhaps giving us an opportunity to “buy-and-hold” over the longer-term. However, I think in the meantime we may get the occasional pullback, and that should offer enough value the people will take advantage of. I think there is a massive amount of support not only at the 6900 handle but extending down to the 6800 level after that. Ultimately, this is a market that continues to look likely to break out.