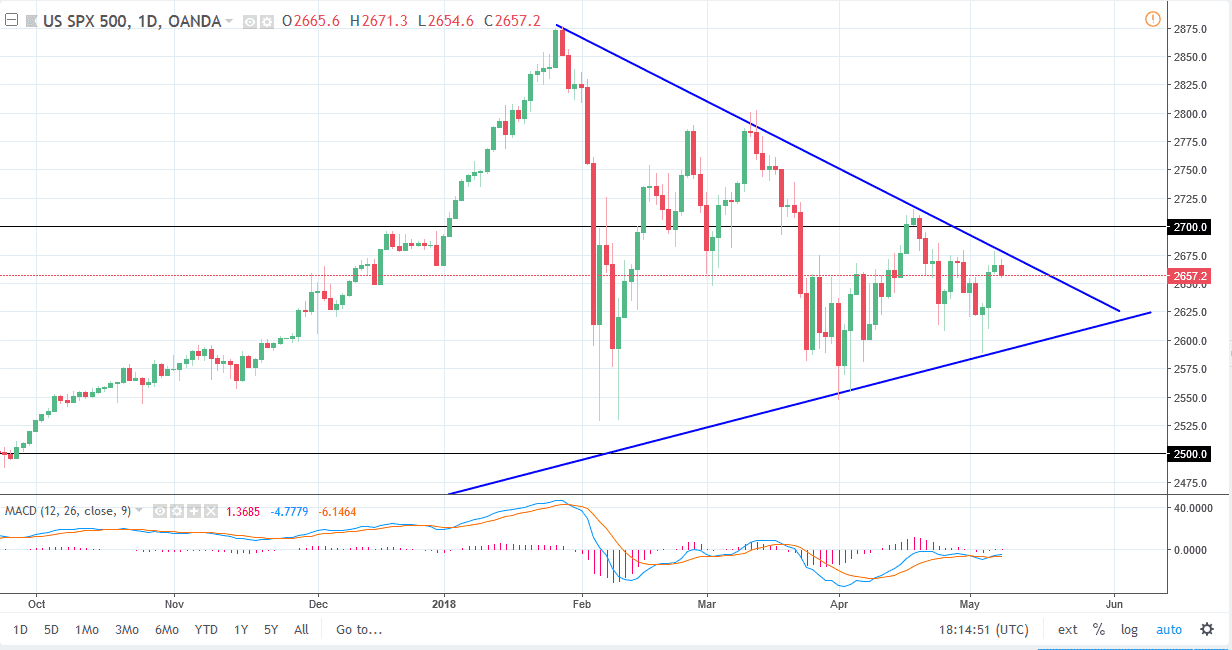

S&P 500

The S&P 500 as you can see on the daily chart has pulled back slightly during the trading session on Tuesday, as the market was a bit concerned about Donald Trump pulling out of the Iranian deal, but technically speaking, we are still within consolidation. If we can break above the downtrend line, I believe that we will continue to go higher. The market has been in a bit of a wedge as of late, so if we can break above the 2675 handle, the market then goes to the 2700 level. In the meantime, I think that short-term pullbacks are buying opportunities, if we can stay above the uptrend line. I believe that the 2600 level is essentially the “floor” in the market at this point. If we break down below that level, I think the market unwinds rather rapidly. Otherwise, I think that eventually the buyers could return.

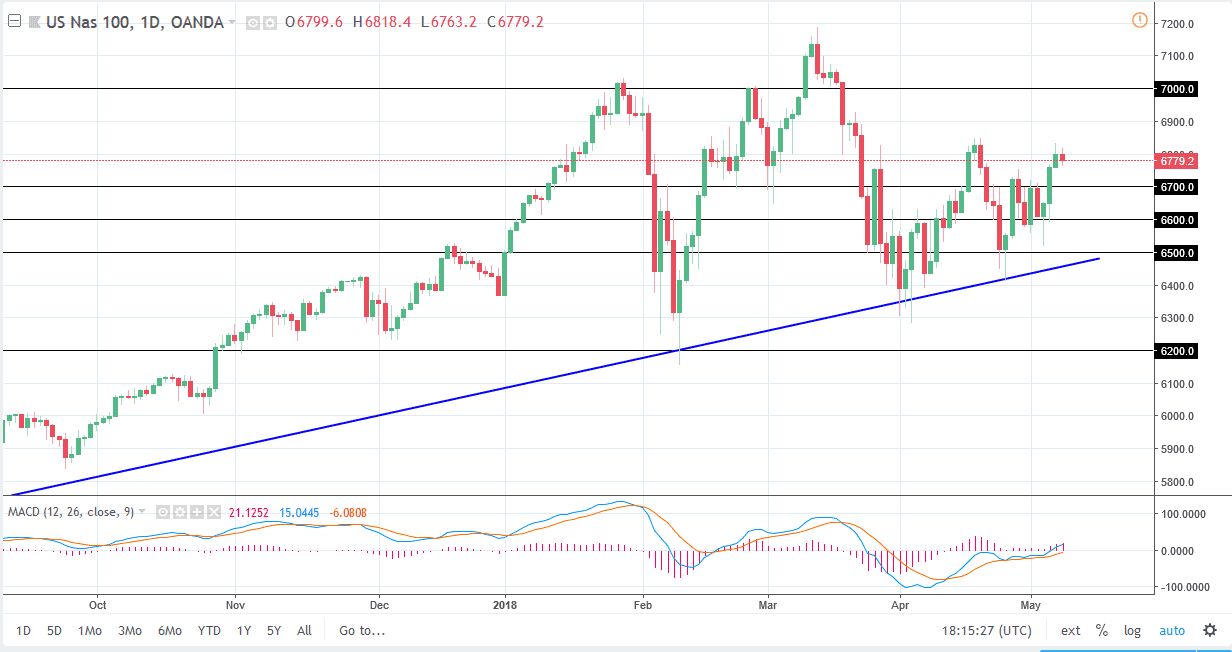

NASDAQ 100

The NASDAQ 100 pulled back a bit during the session on Tuesday, as we may have gotten a bit overextended. The 6700 level was previous resistance and should now be support. If we can break above the 6850 level, the market could go to the 7000 handle. I think that the market will continue to find buyers on dips, if we can stay above the $6500 level underneath. The uptrend line that goes underneath that level should continue to offer support, but if it doesn’t offer support on a test, then I think this market unwinds rather drastically. I have a target of 7000 in the short term, and perhaps even the 7200 level after that. I believe that we are going to grind higher, not necessarily explode to the upside.