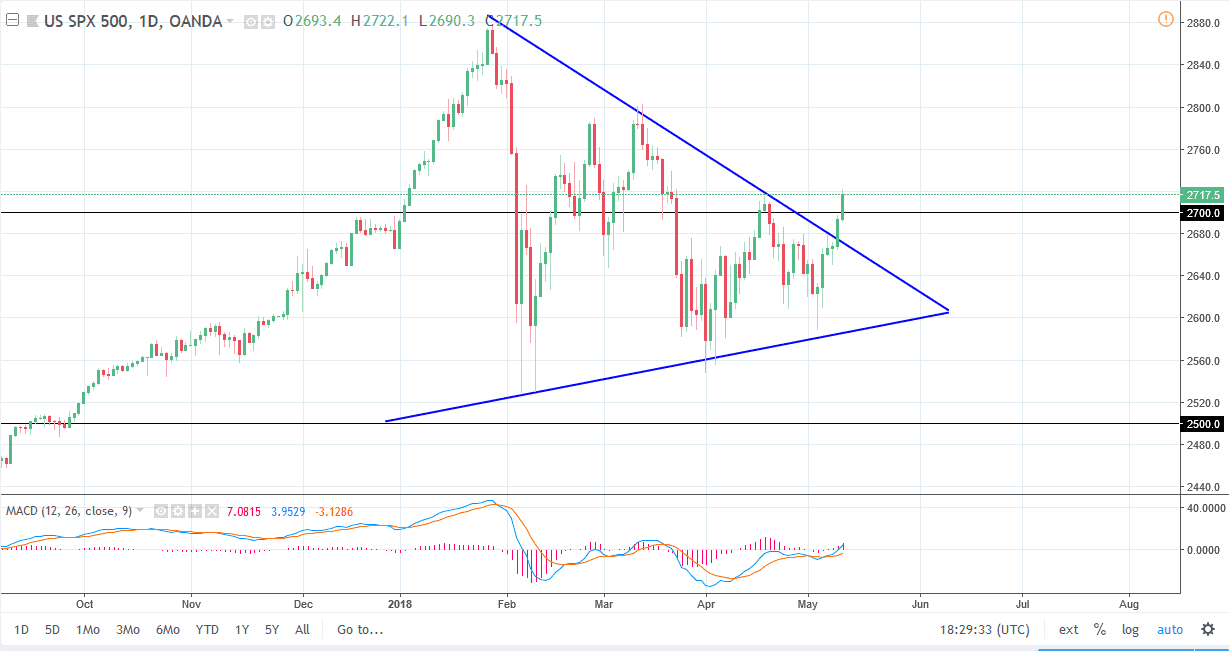

S&P 500

The S&P 500 broke higher during the trading session on Thursday, clearing the 2700 level and showing signs of strength. If we can break above the top of the range during the session from Thursday, the market should continue to go much higher and that’s what I expect to see happen. Short-term pullback should be buying opportunities, and the previous resistance line that had been the top of the wedge will now offer massive support. I believe that we will go looking towards the 2800 level, and then possibly the highs again but it will take a certain amount of time to get there as there has been so much in the way of volatility lately. I believe that the S&P 500 continues to see buyers looking to pick up a little bits of value underneath, but I believe that this market is one that you should be cautious, yet constructive with.

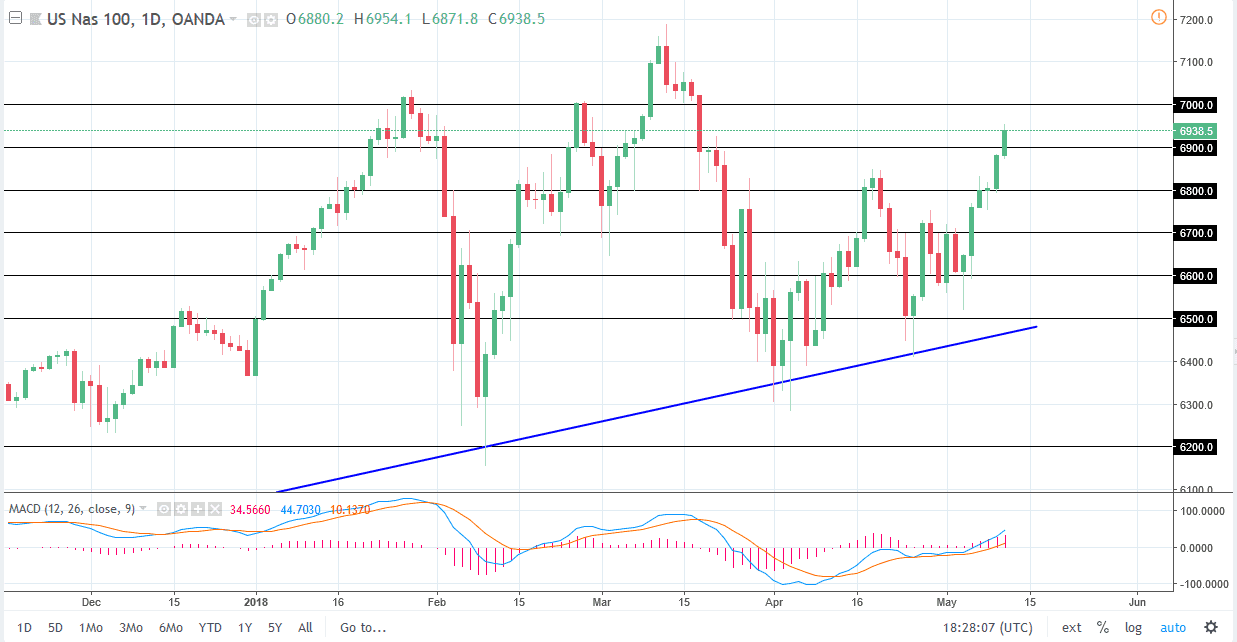

NASDAQ 100

The NASDAQ 100 broke higher during the day as well, clearing the 6900 level. The 6900 level being broken to the upside is a very strong sign, and I think that pullbacks are simple invitations to pick up value so that we can continue to go higher. The 7000 level above will be the initial target, followed by the all-time highs. I think that every 100 points there is a certain amount of support and resistance, so we are simply going back and forth between those levels. Obviously the buyers are winning though, especially after the uptrend line has offered support yet again a couple of weeks ago. The NASDAQ 100 continues to lead the other US stock indices higher, and I think that will continue to be the case.