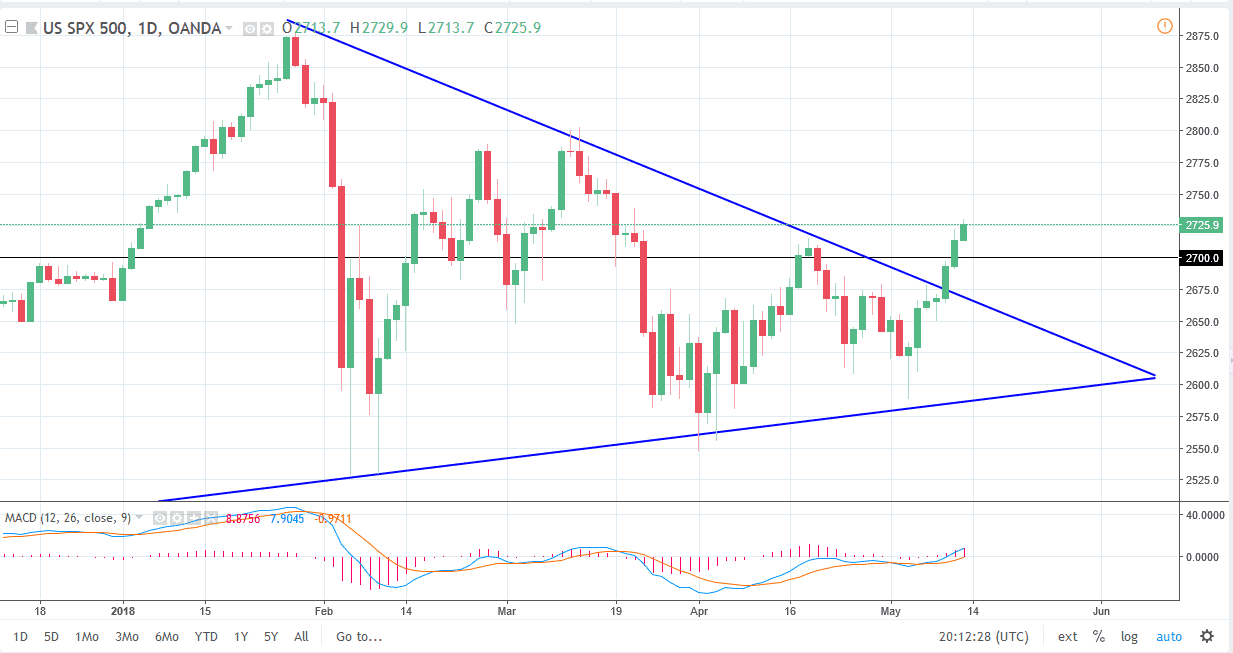

S&P 500

The S&P 500 has rallied again during the session on Friday, as we continue to see a lot of strength. I believe that the 2700 level underneath is massive support, and I believe that if we can stay above that level, we will continue to go higher. After all, we have made a fresh, new high, so it makes sense that we will continue to go towards the 2800 level, and perhaps even higher than that. I have no interest in shorting this market, least not until we break down significantly below the 2650 handle. Breaking out of the wedge of course was a bullish sign, but also making the higher high it as well. This bullish pressure continues to drive this market to the upside, and I think that the overall attitude of this market should remain bullish as the earnings in the United States have been very strong.

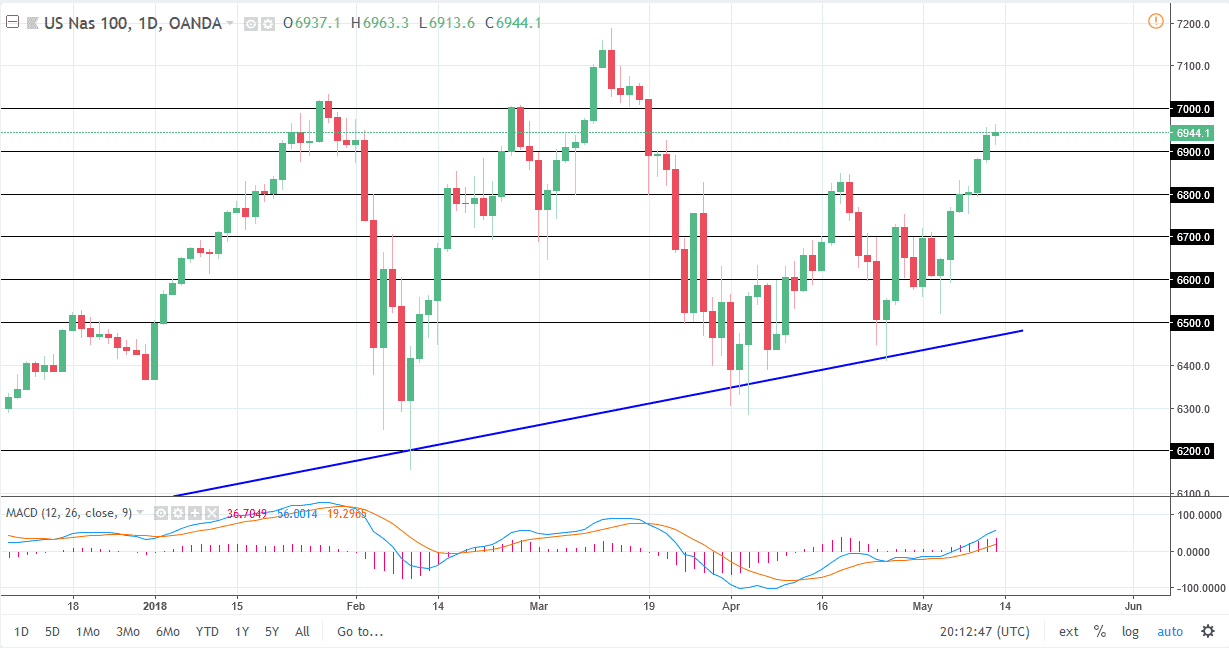

NASDAQ 100

The NASDAQ 100 did very little during the day as we continue to go back and forth. However, it looks as if the 6900 level has offered support, and the 6800-level underneath would cause support as well. I think that eventually we will go looking towards the 7000 handle above, which is a large, round, psychologically significant figure, and an area that has cause resistance more often than not.

I look at this is a potential buying opportunity on dips, and I have no interest in shorting. In fact, I believe that the NASDAQ 100 will eventually explode to the upside as the 6800 level should now offer essentially a “floor” in the market. This market continues to show strength as all stock markets do, and now I think the US dollar is ready to roll over, at least for the short term and that should help stock markets as well.