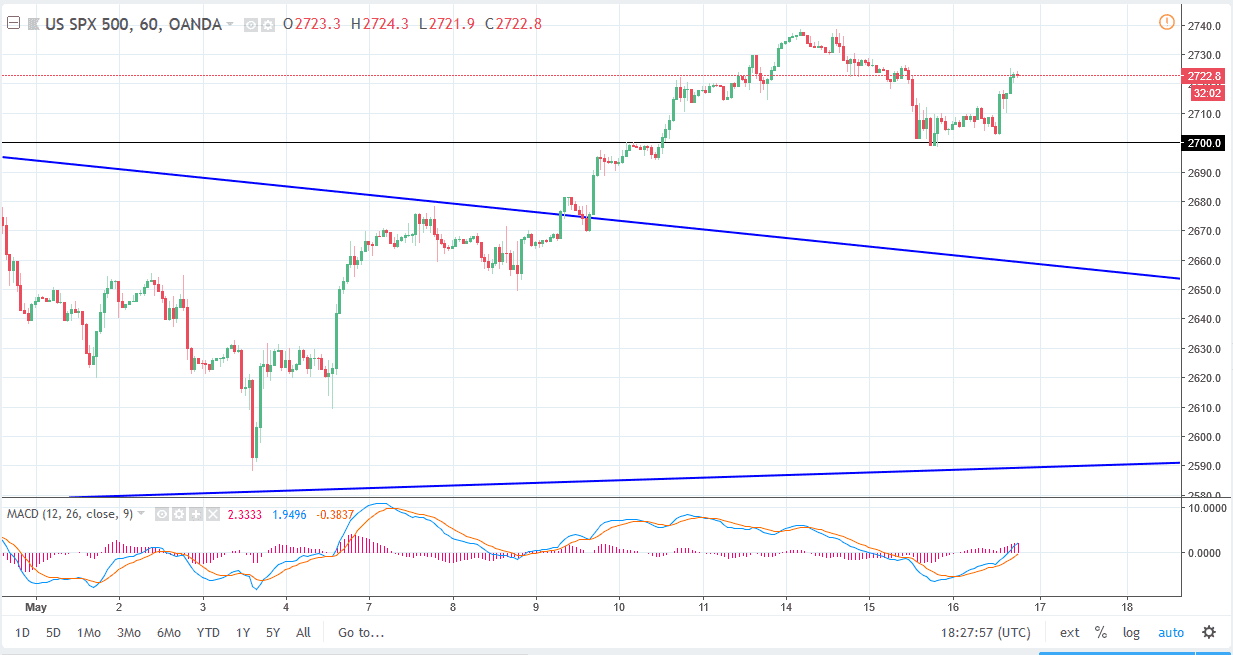

S&P 500

The S&P 500 went sideways during the trading session on Wednesday, reaching towards the 2700 level. That’s an area that has been resistance in the past, and now that we have bounce from there I think that technically speaking, that area should be supportive. Now that we have continue to go much higher, and I think that we will eventually clear the 2750 handle. If we break above the 2750 handle, then the market is likely to go to the 2800 level, and then eventually the 2900 level. Short-term pullbacks will continue to offer value, and I do believe that the stock markets have made a major bottom recently, but that’s not to say that we are done with massive volatility, quite the contrary - I believe it will continue to be a major issue for traders. Because of this, make sure that you keep your trading position acceptable.

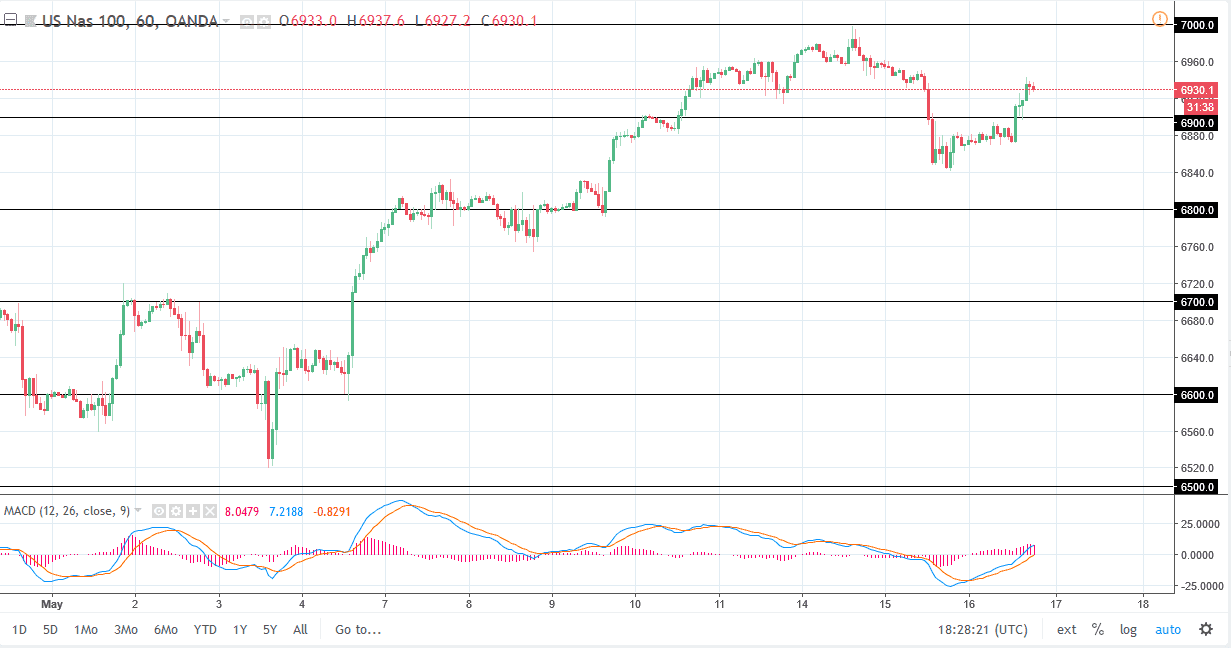

NASDAQ 100

The NASDAQ 100 initially went sideways during the trading session on Wednesday but found enough support at the 6900 level. By doing so, the market is likely to continue to try to go towards the upside, perhaps reaching towards the 7000 handle above. That’s an area that has been massive resistance in the past, and I think it’s likely to offer resistance again. However, I think that the market should continue to go higher, and I do think that we will eventually use the 7000 level as a “floor” in the market. I believe that the 6900 level will form a bit of a “floor” for the short term. I think that longer-term traders will continue to add to short-term dips, as we could eventually break out to the upside for a “buy-and-hold” situation. I have no interest in shorting.