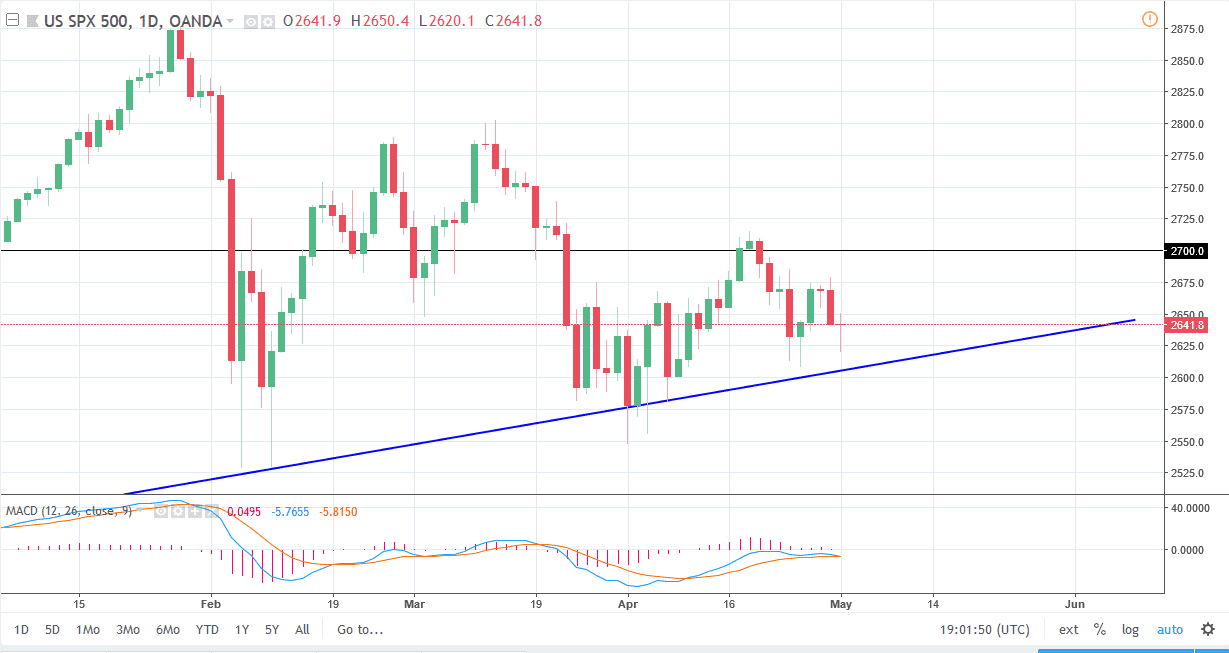

S&P 500

The S&P 500 had a rough trading session initially on Tuesday, as we reached to much lower levels, but found the area just above the daily trendline to be supportive enough to turn things around and form a hammer. The hammer of course is a bullish sign and I think that the attitude of traitor shows a certain amount of resiliency. I believe that the markets will probably be a bit choppy between now and Friday, as it is Nonfarm Payroll Friday, which of course causes a lot of noise. I think that we are trying to turn around and go to the 2675 level, but it’s going to be very difficult. Short-term pullbacks are probably buying opportunities, but if we were to break down below the 2600 level, the market probably unwinds rather drastically.

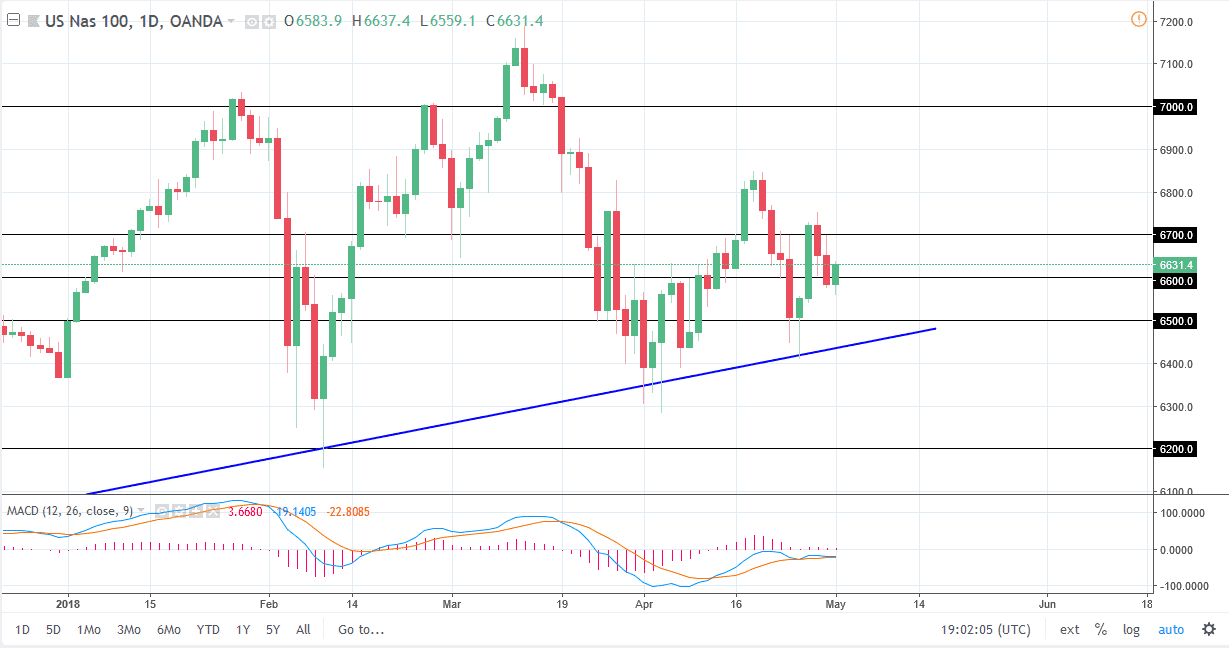

NASDAQ 100

The NASDAQ 100 initially fell during the day but then rallied quite nicely to break above the 6600 level, showing signs of life as we reached towards the 6650 level. If we can break above the top of the candle for the day, we should then go to the 6700 level, which is the next major figure. I think at that point, we would see a certain amount of resistance, but between now and the jobs number would not surprise me at all to see a little bit of positivity. Part of this has been driven by Intel beating estimates, but at the end of the day I think that a lot of traders are hesitant to be short of the market ahead of the jobs number. If we were to break down below the 6450 handle, extensively the uptrend line, then I think the market unwinds quite drastically. As things stand now though, I think it’s a buy on the dips market still.