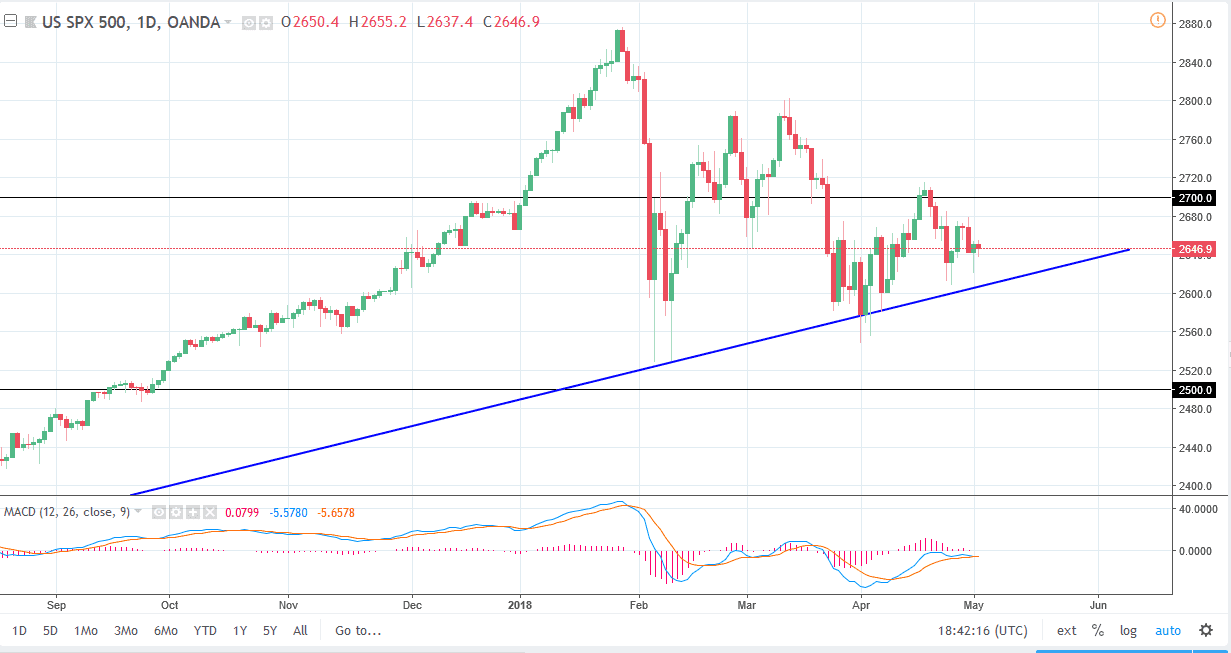

S&P 500

The S&P 500 rallied after initially falling during the trading session on Wednesday. When it up relatively unchanged, showing the 2040 level as support. The hammer from the previous session of course offering support as well, and the uptrend line that you can see I have on the chart. I think that the market is going to be very quiet today though, because tomorrow is the jobs number. I believe that we do have an upward proclivity longer-term, if we can stay above the uptrend line underneath. If we were to break down below the 2600 level, that could unwind this market to the 2500 level, which could be very negative. A breakdown below that level would unwind this entire attitude and wipe out the bullish trend that we have enjoyed for quite some time. Today though, I would expect much one way or the other.

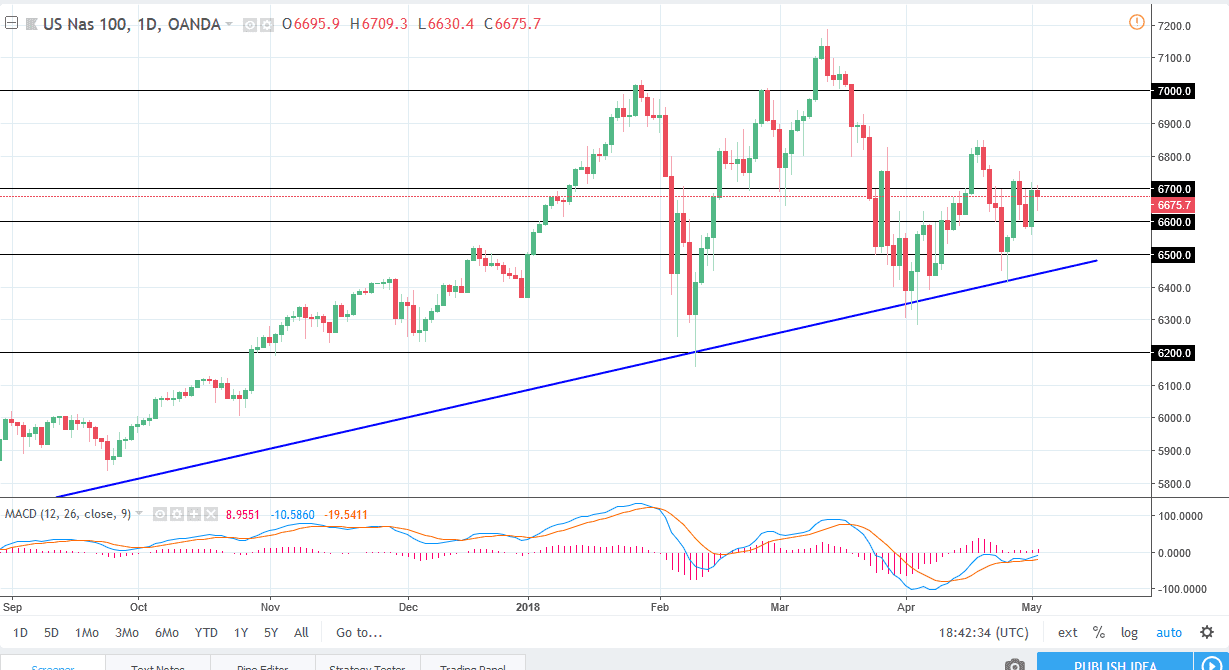

NASDAQ 100

The NASDAQ 100 initially fell on Wednesday as well, but turned around to form a hammer. We are pressing up against the 6700 level, an area that has been resistance more than once. If we can break above the top of the candle for the day, I think we could continue to grind towards the 6800 level. However, I think most of the momentum won’t appear until after we get the jobs number tomorrow, which of course is a major driver of where things go in general. I like the idea of buying dips in this market, as we are still very much in an uptrend longer-term, although things have gotten very rough as of late. A breakdown below the uptrend line with course be a massive sell signal, but right now nothing has changed other than volatility.