S&P 500

The S&P 500 has broken down rather significantly during the trading session on Tuesday as traders came back to work from the Memorial Day holiday. By breaking through the 2700 level, it looks as if we are going to continue to reach lower, but quite frankly I think this is an opportunity to take advantage of cheap pricing. Ultimately, when you look at this chart you can see that there is a significant uptrend line underneath, and we have recently made a “higher high.” Obviously there is a lot of volatility in the markets, but that is something that isn’t that out of the ordinary. I like buying these dips, but I would be very cautious about jumping in right away. I suspect that we will have opportunities to buy this market at lower levels. I’m not willing to short this market, although I do recognize that we will more than likely sell off initially. I’m looking for stability and a bounce from lower levels.

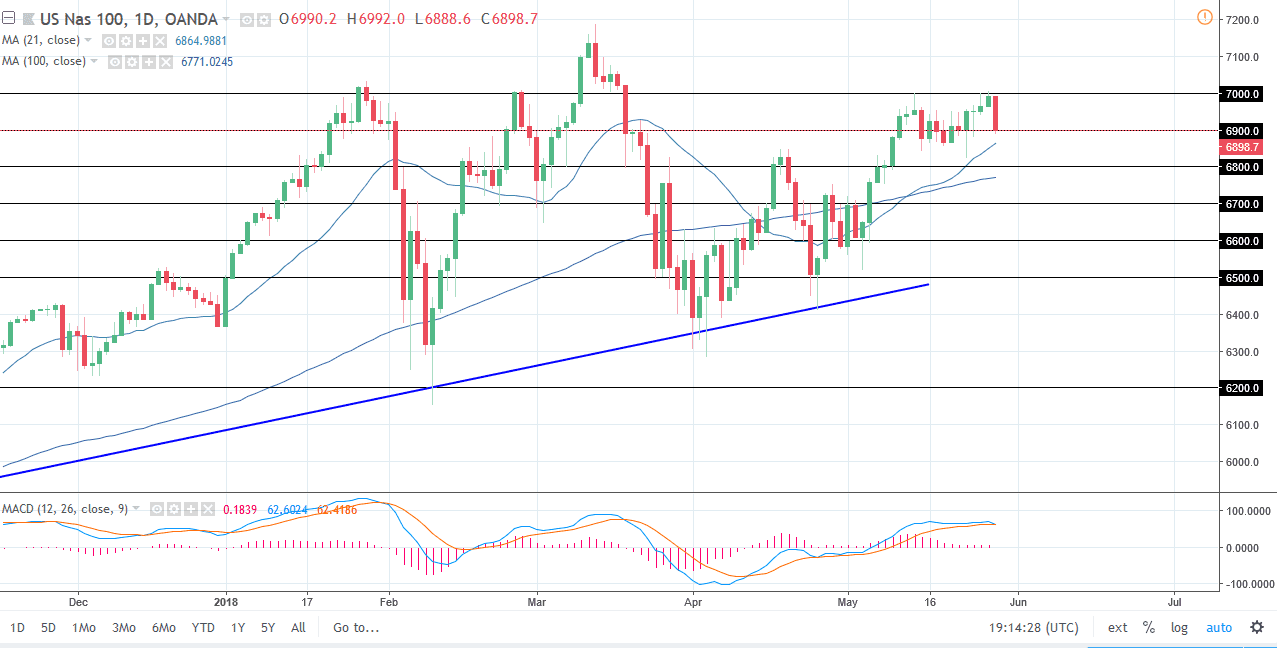

NASDAQ 100

The NASDAQ 100 has fallen during the day as well, reaching towards the 6900 level before finding some stability. Because of this, I think it’s only a matter time before the buyers come back and we start going higher, as there are plenty of support of levels just below. The 100-day moving average is closer to the 6800 level, so we could drop down to that level, but I suspect that the buyers are more than likely going to continue to run the show either way. I like the idea of going long and aiming for the 7000 handle, which has been recent resistance. Ultimately, I think that the market needs to pullback to build the necessary momentum, and that’s essentially what we are seeing.

When it comes to these markets, I think a lot of this is concerns about Italy showing up. Quite frankly, if money starts getting afraid of the European Union, it’s likely that it will end up here eventually anyway. I’m looking for value propositions.