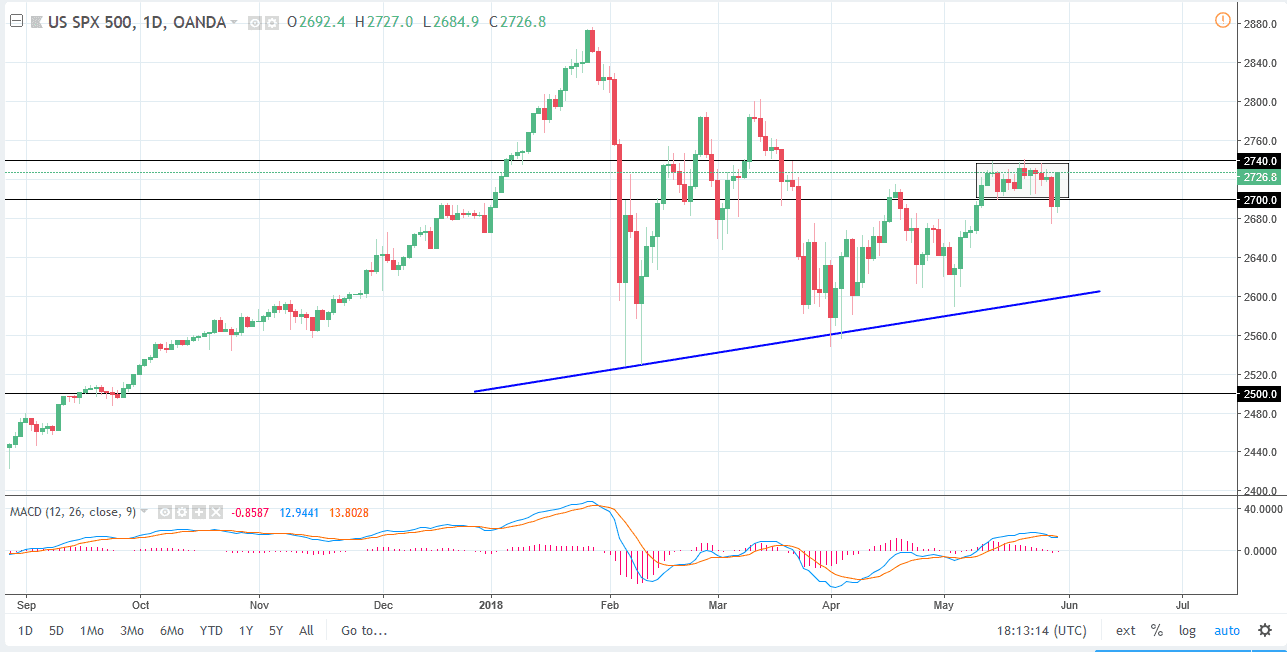

S&P 500

The S&P 500 has rallied significantly during the trading session on Wednesday, in response to the idea that the Italians might not need new elections. If we can break above the 2740 handle, the market should continue to go higher, perhaps reaching towards the 2800 level again. I think short-term pullbacks continue to be buying opportunities as we have seen, and I like the idea of going long at this market. I have no interest in shorting this market, and I do believe that since we have made a “higher high”, it signifies that the buyers are still in control of this market, regardless of the extreme amount of volatility that we have seen. With that being the case, I’m looking for opportunities to get involved to the upside.

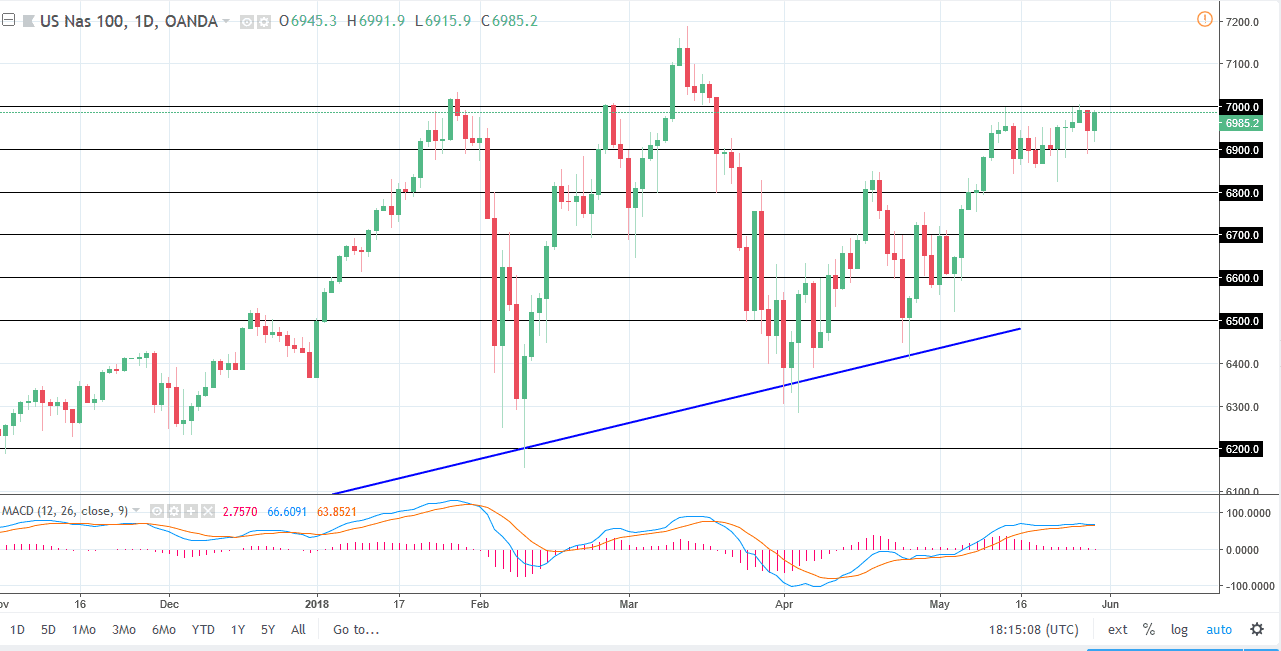

NASDAQ 100

The NASDAQ 100 initially fell during the trading session on Wednesday but found enough support above the 6900 level to rally and reach towards the 6990 level. If we can break above the 7000 handle, the market is likely to continue going higher, perhaps reaching to the 7200 level which is my initial target. I like buying short-term pullbacks, because quite frankly even if there are problems in Italy, it’s only a matter of time before money flows to the United States anyways. Because of this, I remain bullish of this market, but I also recognize that you should not put too much of your money into it in one shot. Once we break above the 7000 level, I would add to a bullish position, and then again add after we break above the 7200 level. A break down below the 6900 level almost certainly go looking for support at the 6800 level after that.