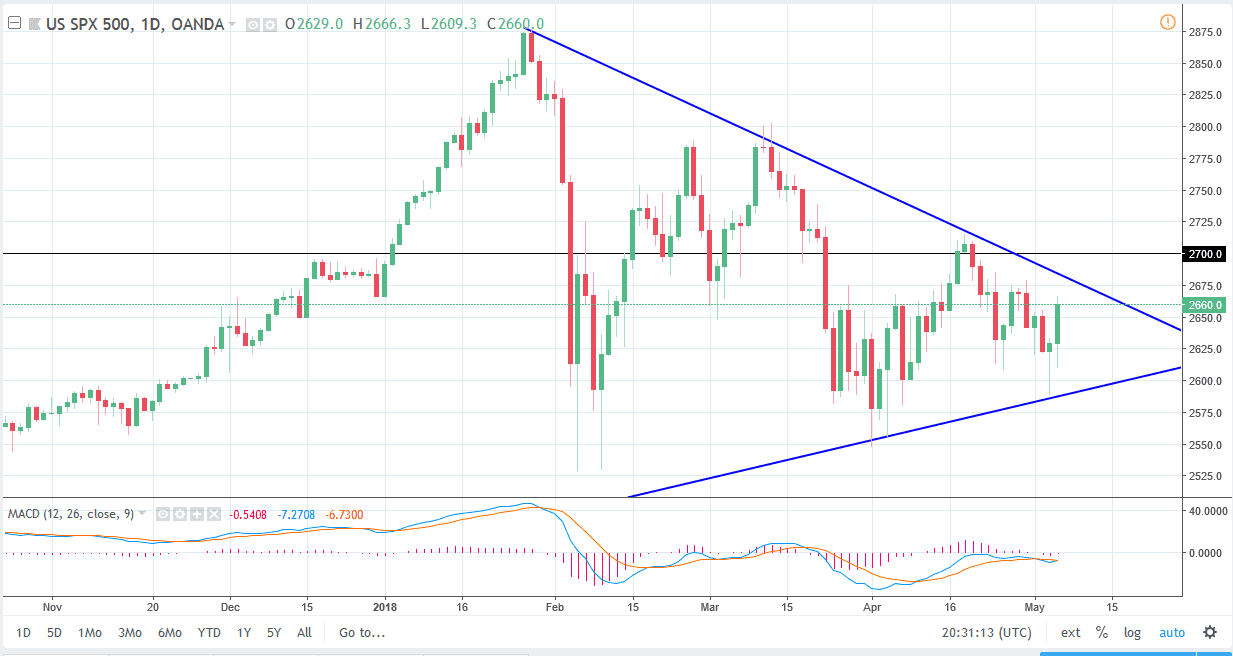

S&P 500

The S&P 500 initially fell during the trading session on Friday but turned around to reach to the upside. The market breaking above the downtrend line and more importantly the 2700 level, could send this market much higher. By breaking above the top of the hammer from the Thursday session, that shows bullish pressure, and I think that ultimately we will break out. However, if we get some type of short-term pullback, that could be a nice buying opportunity. If we break down below the 2600 level, then the market could go lower, but right now it looks as if the buyers are trying to make some type of statement. Longer-term, if we can break above the 2700 level, the market probably goes to the 2800 level, followed by the 2900 level. That’s my best case currently.

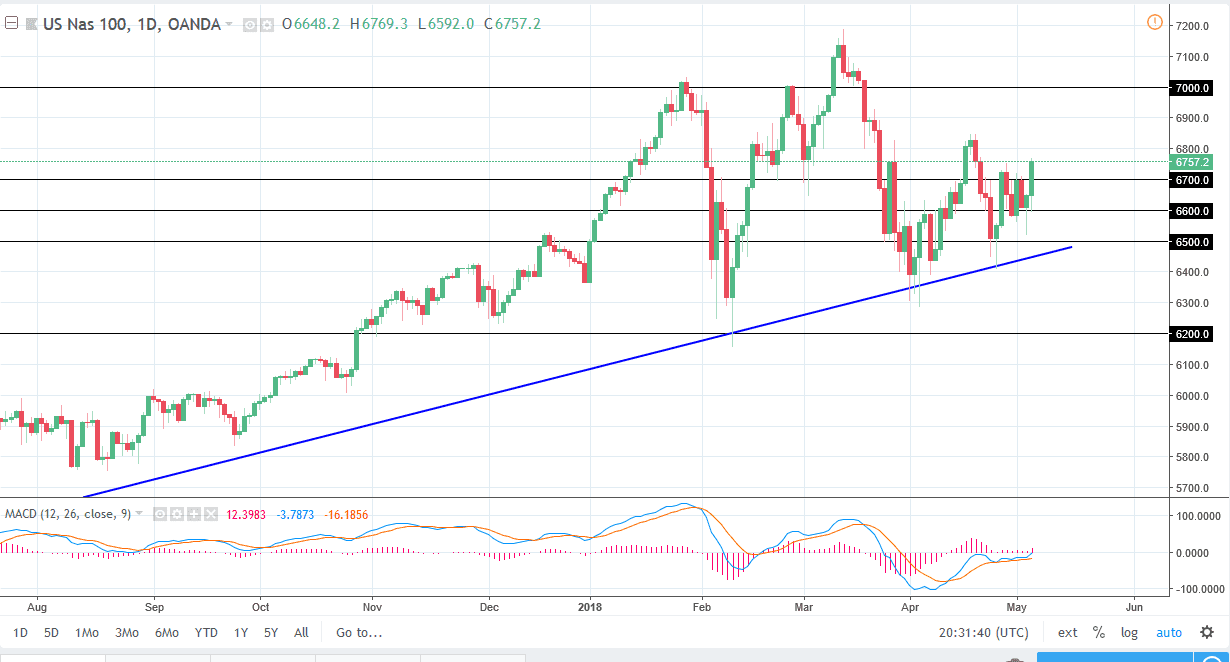

NASDAQ 100

The NASDAQ 100 initially pulled back, but then found enough support at the 6600 level to turn things to the upside and break above the 6700 level. By sending this type of significant signal, I think that the buyers are going to jump in as we have gotten past the Nonfarm Payroll announcement, and now it looks likely that we are going to go higher, perhaps reaching towards the 7000 handle. I believe that short-term pullbacks will continue to see plenty of support at the uptrend line and of course the 6500 level. Remember, US stock indices all tend to move in the same direction of the longer term, so while I believe that the NASDAQ 100 may lag behind the S&P 500, and even the Dow Jones 30, it looks very likely that we will find buyers jumping in to pick up value every time we dip.