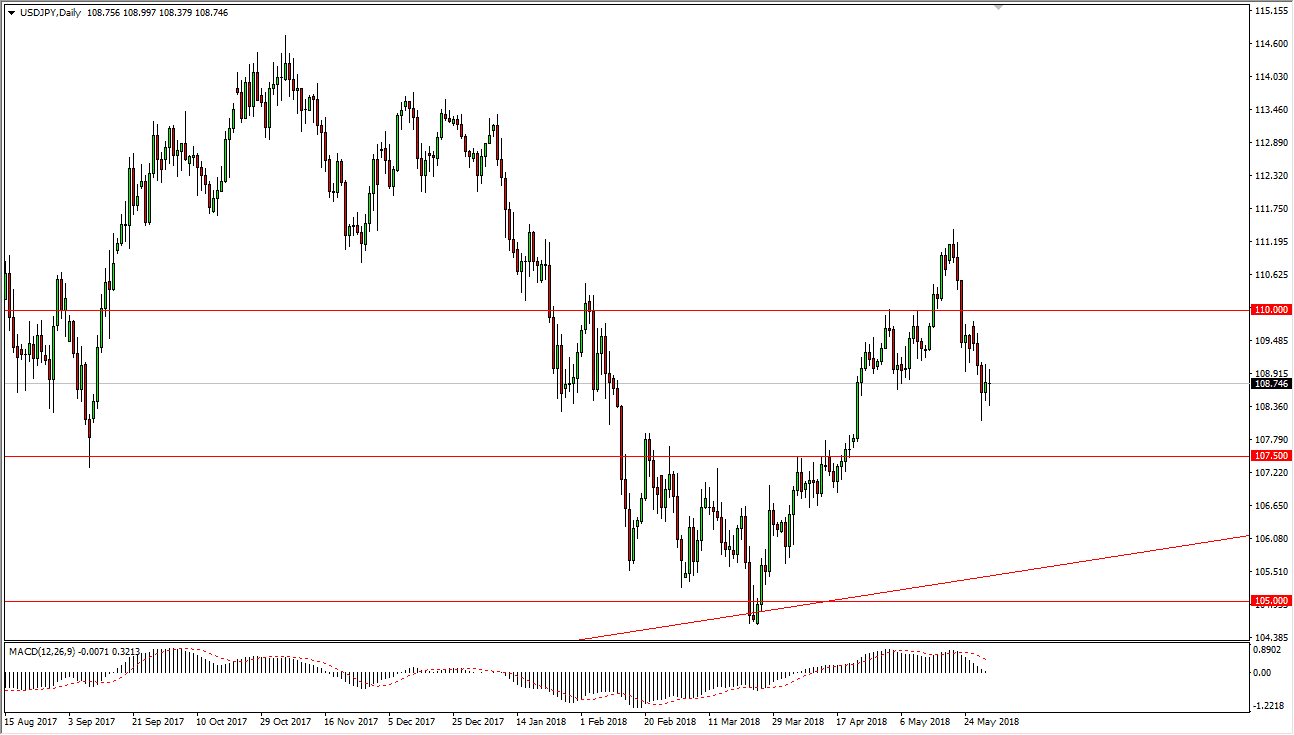

USD/JPY

The last day of May was a bit noisy in the USD/JPY pair as we continue to bounce around just below the ¥109 level. This was exacerbated by the Americans placing tariffs on Canada, Mexico, and perhaps most importantly: the European Union. There is a 25% steel tariff, and a 10% aluminum tariff placed upon those economies. The European Union has already suggested that it was going to retaliate, so I think that the market is essentially catching its breath and trying to figure out what to do next. Remember, this pair tends to fall in times of financial uncertainty, and rally in times of extreme risk appetite. I think that this pair is going to be a bit difficult to deal with, especially considering we are right in the middle of what I look at as a potential consolidation phase. The 107.50 level underneath should be massive support.

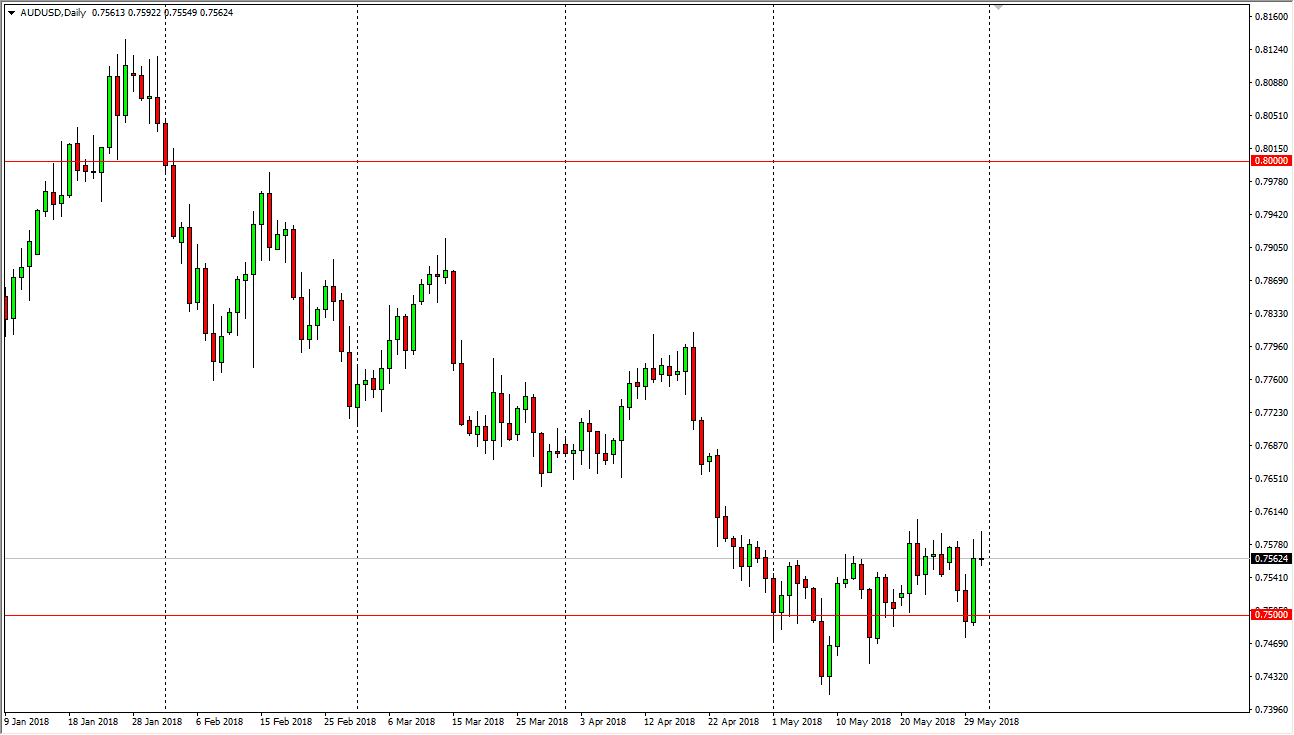

AUD/USD

The Australian dollar try to rally initially on Thursday but turned around. By doing so, we have formed a shooting star at the 0.76 level, and it looks like we are ready to roll over and perhaps go looking towards the 0.75 level underneath. This would be simple consolidation, and it makes sense as the world awaits the results of the tariffs to be in place, whether we are going to see some type of trade war. The 0.75 level underneath of course is supportive, but it’s essentially the fulcrum for the price as far as I can tell. In other words, we could very well drop to the 0.7450 level without much fanfare. If we break higher and above the 0.76 level, that would be a bullish sign but at this point I think it’s only a matter time before the sellers get involved on those attempts.