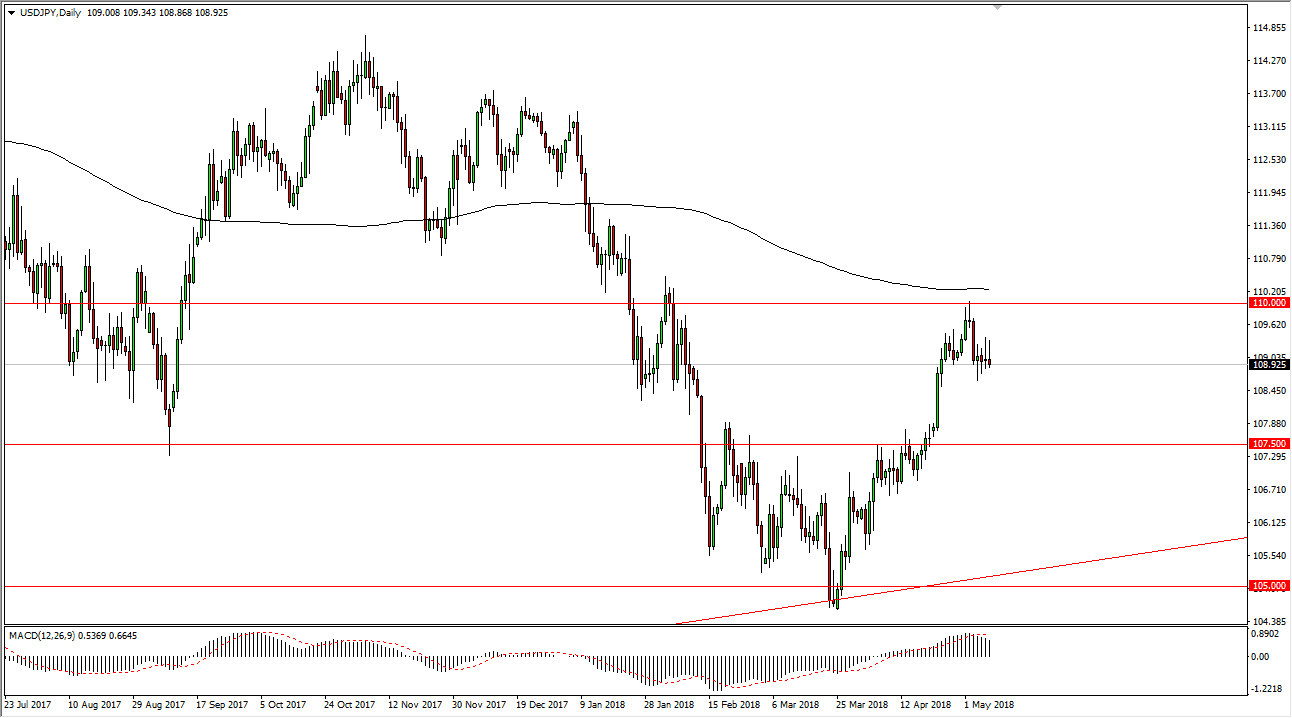

USD/JPY

The US dollar initially tried to rally against the Japanese yen during trading on Tuesday, but we have seen selling pressure before, and we sought again during the day on Tuesday. The shooting star being formed for a second consecutive session of course is a negative sign, but we also have a hammer from the Friday session that is causing a bit of conflict. The market is continuing to bounce around the ¥109 level, but the thing that I would bring up more than anything else would be the shooting star from the weekly chart. I think this means we need to pull back a bit, to build up the necessary momentum to finally break above the ¥110 level. The 200-day moving average is just above the ¥110 level, so I think that it’s going to take a lot of momentum to break out to the upside. Pulling back should give us that opportunity.

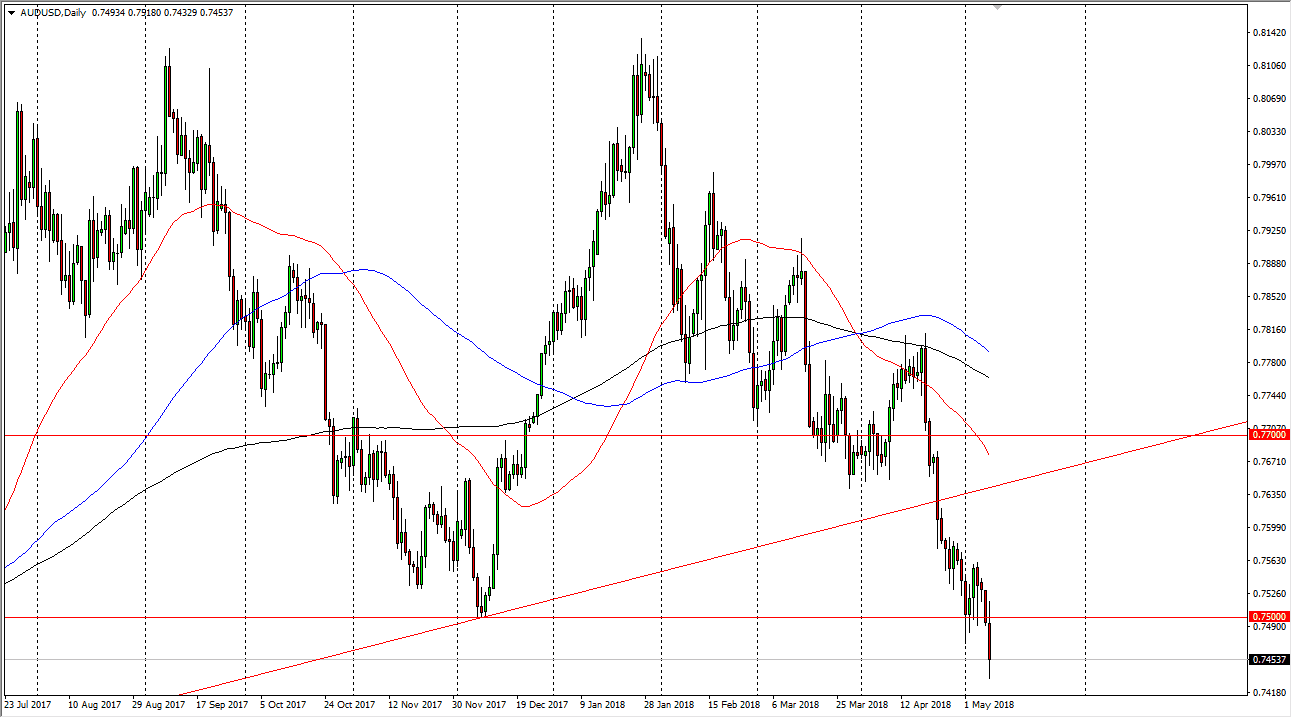

AUD/USD

The Australian dollar has initially tried to rally during the session on Tuesday but found enough resistance above the 0.75 level to turn around and fall rather hard. Part of this was due to the retail sales figures in the Australian economy being so soft. The US dollar has been strengthening anyway, so this only exacerbates the negativity in this pair. Now that we have broken below the 0.75 level, and essentially made a fresh, new, significant low, I think that the market probably goes down to the 0.74 handle, and then possibly the 0.73 level. I have no interest in buying this pair right now, because there is so much in the way of bearish pressure. Gold has since rallied either, so that does not help the Aussie dollar either.