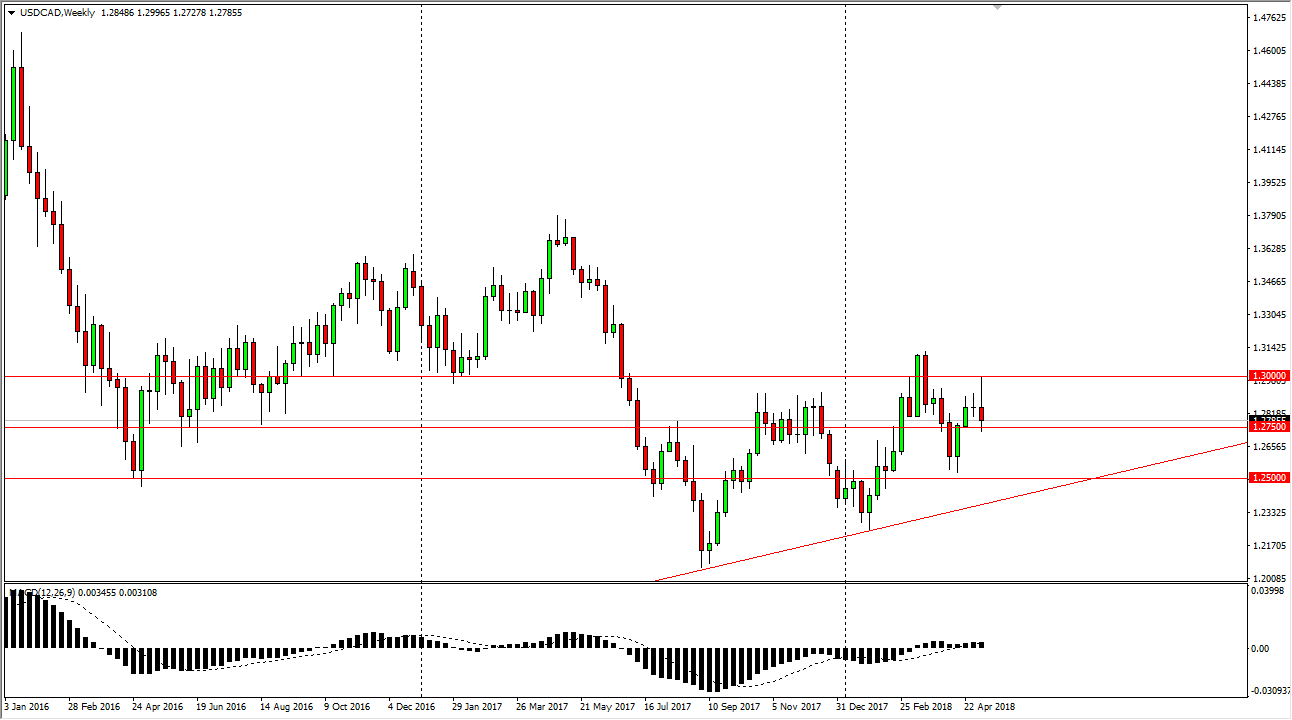

USD/CAD

The US dollar initially tried to rally against the Canadian dollar during the week but found enough resistance at the 1.30 level to turn around and form a shooting star. If we can break down below the bottom of the shooting star, that should send this market down to the 1.25 handle, especially considering that the oil markets look very strong. I believe that the market will then find buyers somewhere in that region, perhaps even a little bit lower at the uptrend line. Otherwise, if we can break above the top of the shooting star that would be a very bullish sign.

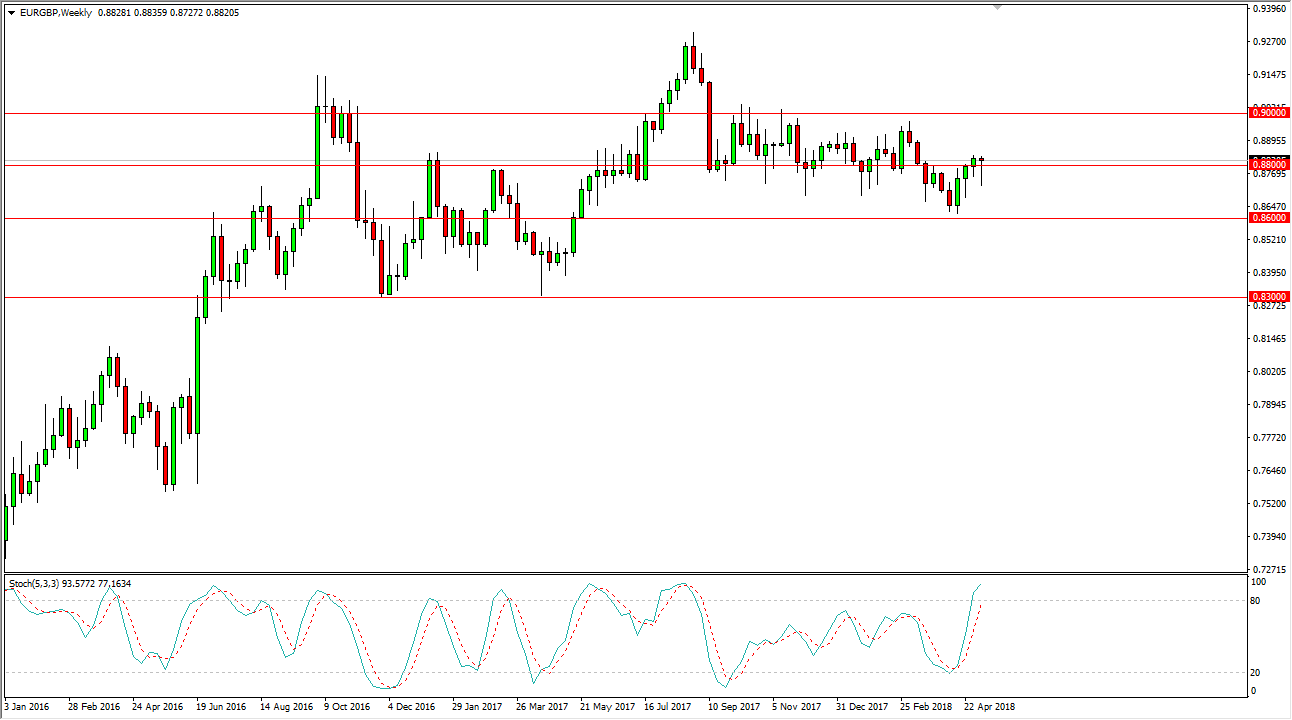

EUR/GBP

The EUR/GBP pair has fallen during the week but turned around to form a hammer again. We’ve done this over the last 3 weeks, and that tells me that there is plenty of buying pressure underneath, and that we should continue to find plenty of buyers on dips. Ultimately, I think we will go looking towards the 0.90 level, but it’s not necessarily going to be the easiest moved to take. I think that we are starting to see euro strength in general, so this move makes sense.

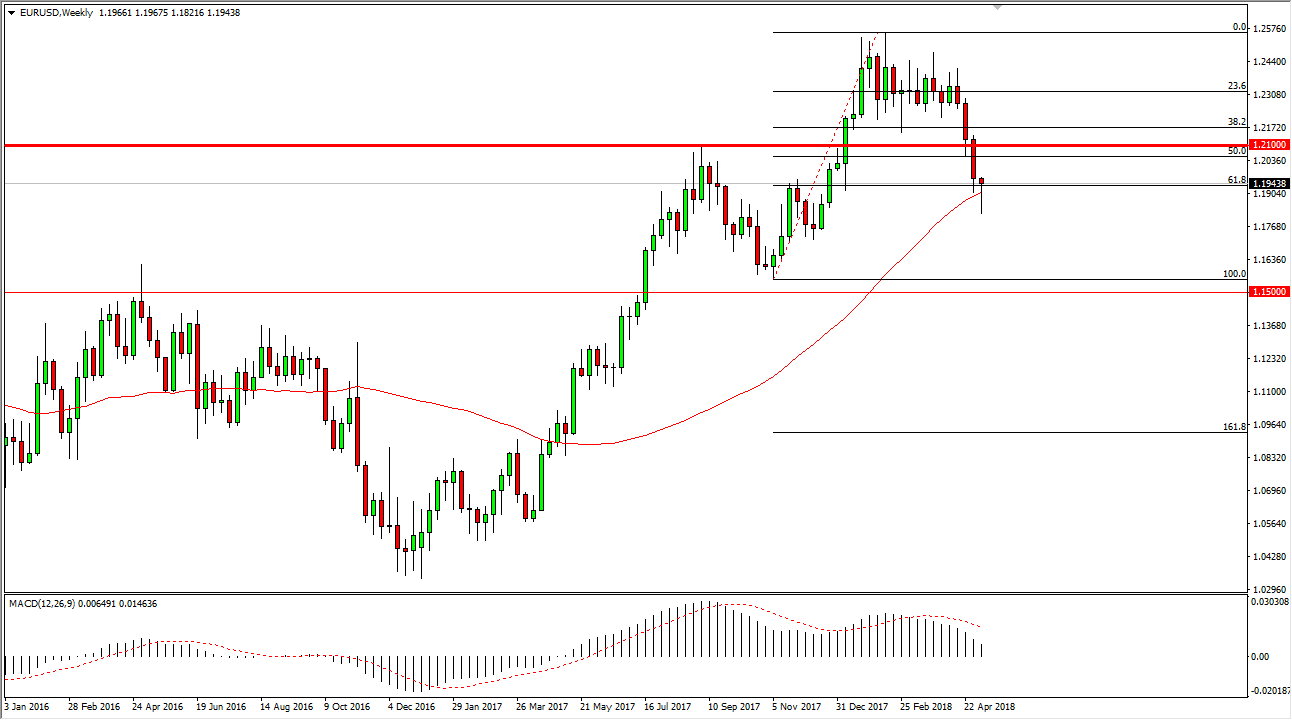

EUR/USD

The EUR fell rather hard during the week but turned around to show signs of support at a crucial level. The 52-week moving average and of course the 61.8% Fibonacci retracement level has held. Beyond that, this is the top of the bullish flag that had formed previously, so I think now we may be looking at a longer-term opportunity setting itself. If we can clear the 1.21 handle, then the market goes even further higher, perhaps even 1.32 based upon the measurement of the bullish flag.

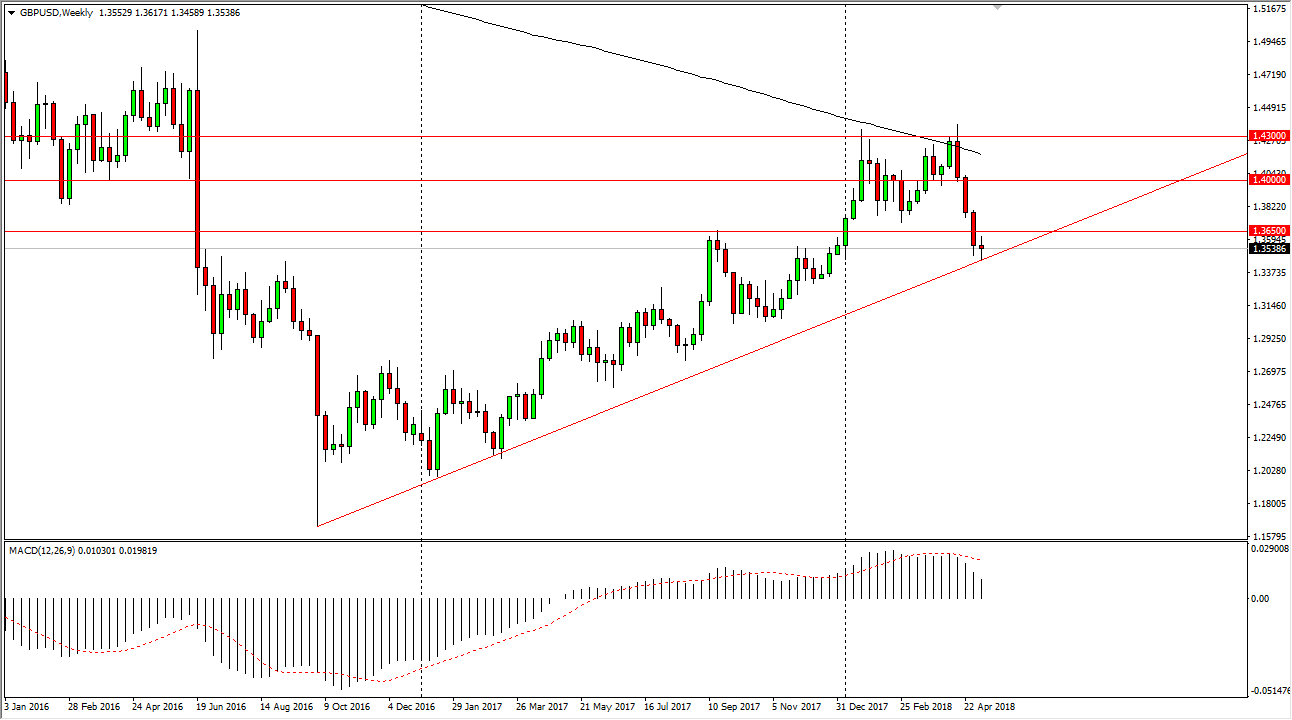

GBP/USD

The British pound has gone back and forth during the course of the week, forming a neutral candle. This neutral candle sits right on top of an uptrend line, so if we can turn around and break above the 1.3650 level, the market should continue to go higher, perhaps reaching to the 1.40 level. Otherwise, if we break down below the uptrend line just below, then the market unwinds. Either way, this is an interesting market to pay attention to.