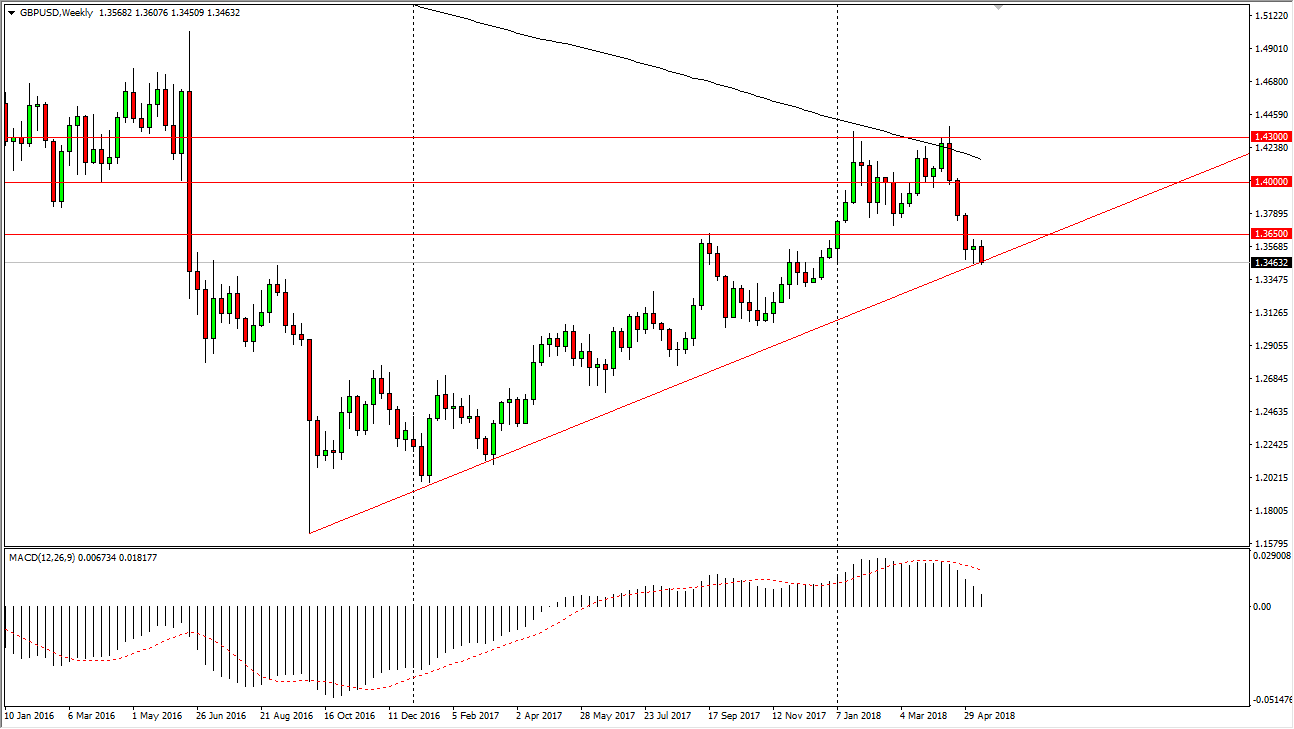

GBP/USD

The British pound fell during the week, after initially trying to rally. The 1.3650 level looks to be offering resistance, just as the uptrend line should offer support. I believe that the 1.3450 level underneath should offer support as well. If we break down below that level, I would be aggressively short of the British pound. Otherwise, if we bounce around in this area, I think that we could get range bound trading from short-term time perspectives.

EUR/USD

The Euro fell hard during the week, breaking the back of a massive hammer from the previous week. That’s a very negative sign, and should continue to send this market lower, perhaps wiping out the entirety of the move higher. Because of this, I anticipate that any rally will be sold, and the momentum is most certainly to the downside as I think we go looking towards 1.15 level.

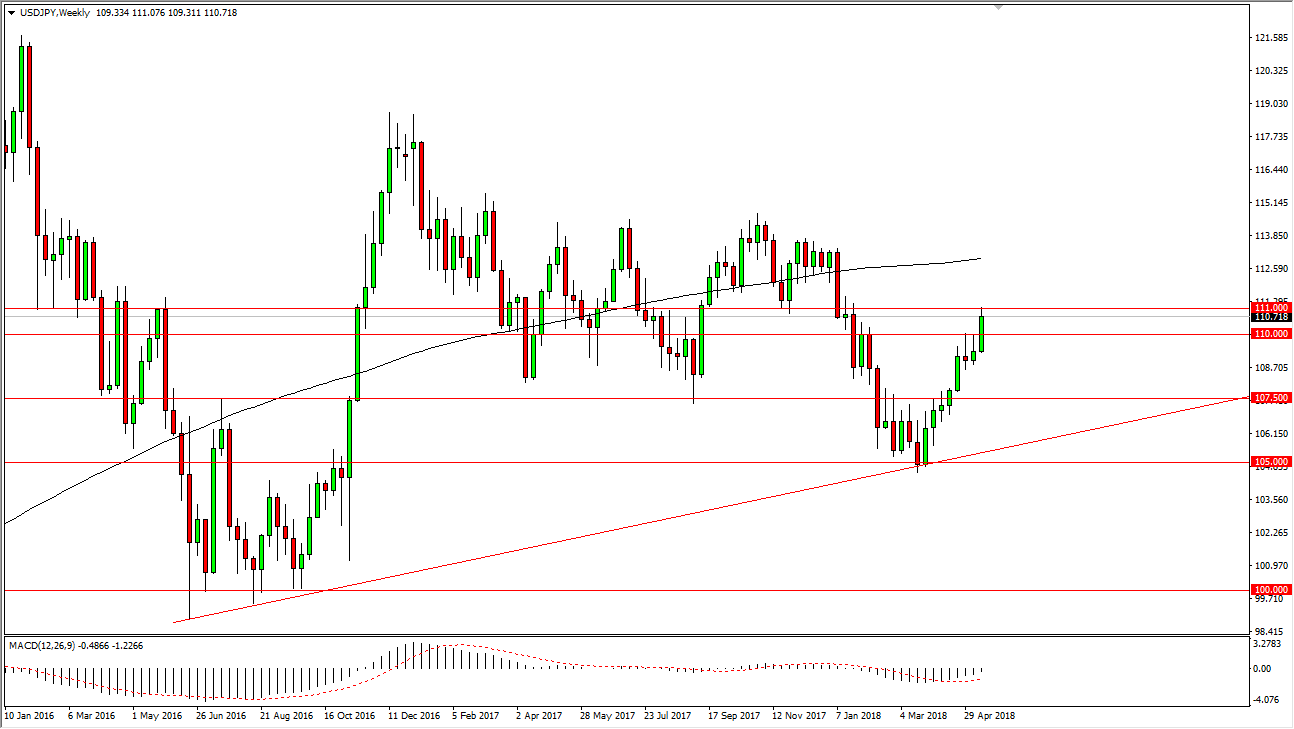

USD/JPY

Continuing with the theme of US dollar strength, we break above the ¥110 level during the week, slicing all the way to the ¥111 level. We have pulled back just a little bit, and it looks like short-term traders may be willing to step on the sidelines and pick up value on a bit. I’m a buyer at the ¥110 level, and also on a breakout above the ¥111 level, as I anticipate that this market will go looking towards ¥112.50 level longer-term.

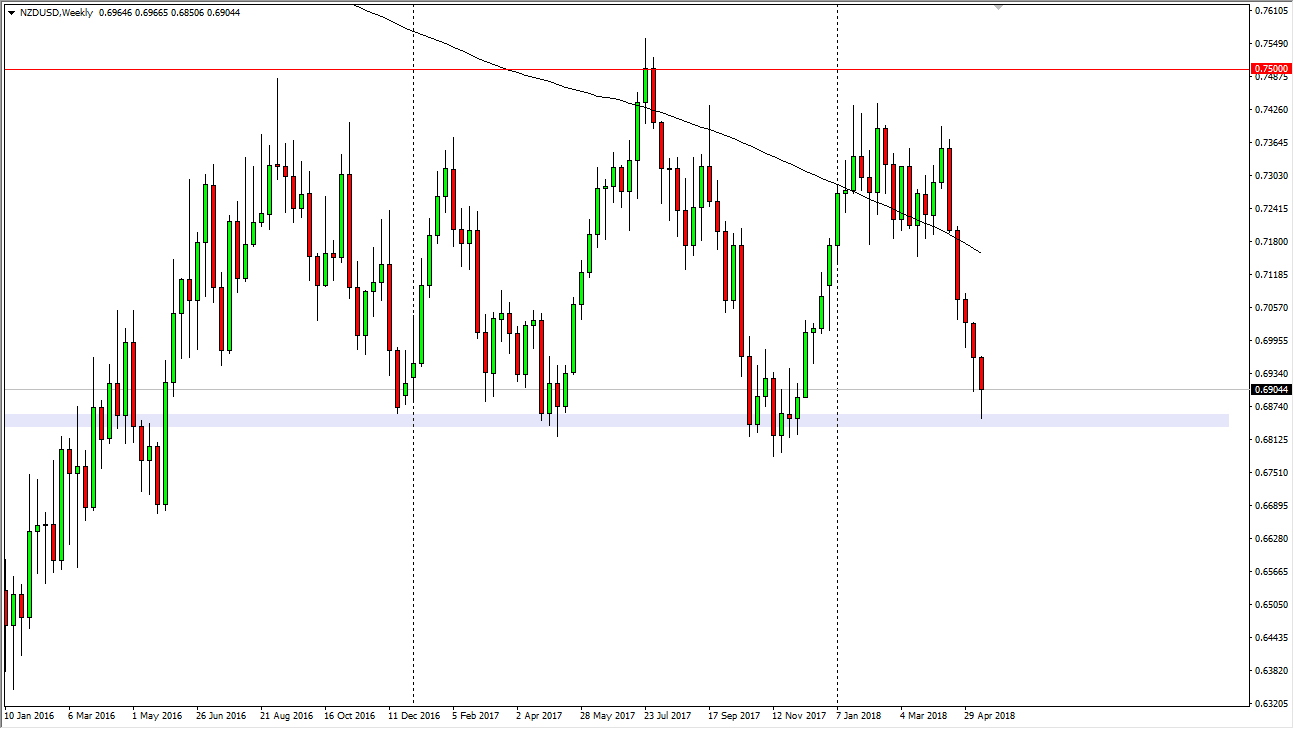

NZD/USD

The New Zealand dollar fell during most of the week, bouncing back above the 0.69 level by the time the markets closed on Friday. It looks as if we are forming a bit of a hammer for the third week in a row, so I think we may get a bit of a bounce. However, if we were to turn around and break down below the 0.68 level, this market would collapse and go much lower.