Gold ended the week up $2.95 at $1317.93 an ounce, snapping a three-week losing streak, as a downside correction in the U.S. dollar index triggered some short-side profit taking. The dollar retreated after a tame U.S. inflation report bolstered views that the Federal Reserve may not have to be so aggressive on raising interest rates. The latest data from the Commodity Futures Trading Commission (CFTC) showed that speculative traders on the Chicago Mercantile Exchange increased their net-long positions in gold to 107440 contracts, from 106779 a week earlier. Investors demonstrate limited interest in gold while stock markets remain more attractive.

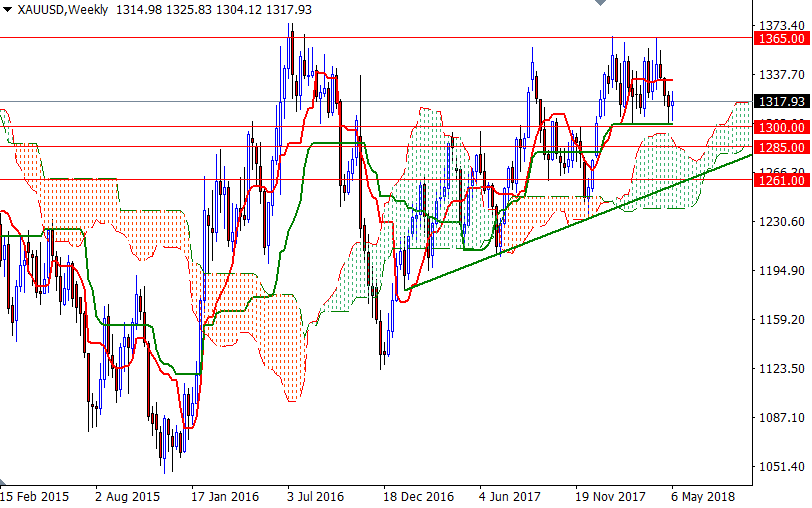

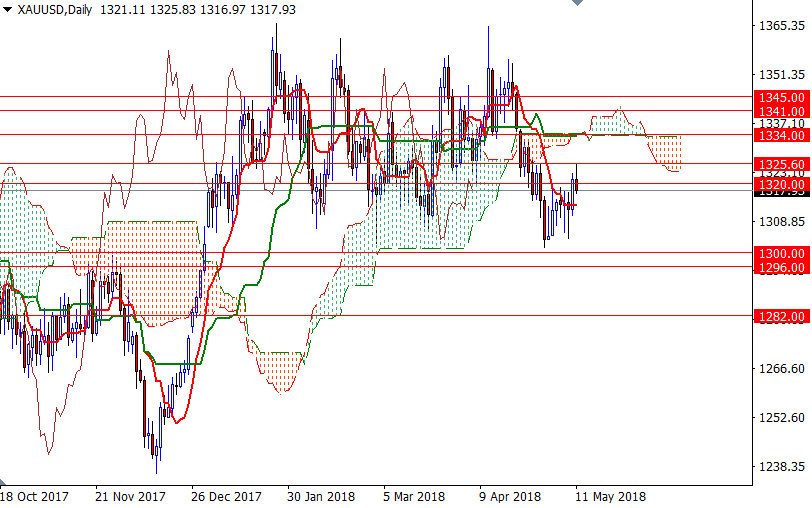

XAU/USD is trading above the weekly and the 4-hourly Ichimoku clouds, but prices are still below the daily cloud. We also have negatively aligned Tenkan-sen (nine-period moving average, red line) and Kijun-sen (twenty six-period moving average, green line) on the daily chart. The shorter-term charts suggest that the bears may have lost their momentum. However, there won’t be much room to the upside unless prices convincingly get back above 1336/4, the bottom of the daily cloud. If XAU/USD pushes through 1336/4, look for further upside with 1341 and 1346 as targets. A break up above 1346 implies that the 1352/0 area will be the next port of call.

To the downside, the initial support stands in 1313/0, followed by 1306. The bears have to drag prices below 1306 to test 1303.50 and 1300-1296. Closing below the key support in the 1300-1296 zone on a daily basis makes me think that gold will likely have another $30-$35 on the downside before encountering more serious support.