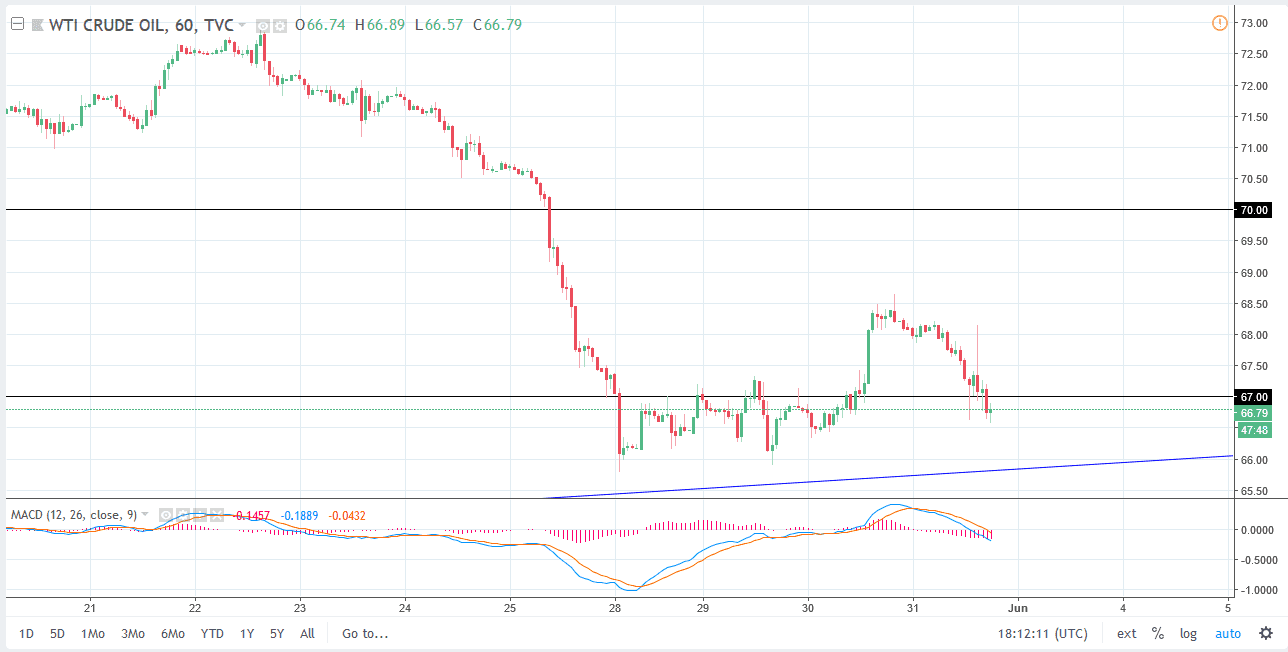

WTI Crude Oil

The WTI Crude Oil market fell rather hard during the trading session on Thursday, especially once we started talking about tariffs coming from the United States and applied towards the Canadians, Mexicans, and Europeans. This has people worried about global trade, and I think that the market testing this uptrend line again made a lot of sense from a technical standpoint as well. However, we did see a bit of a spike later in the day as inventories were much more bullish than anticipated. We have lost money since then, as we continue to test support. I think this is a market that is a bit concerned and is waiting to see what the rest of the world dollars as far as financial markets are concerned before putting risk on. However, I would suggest that perhaps the uptrend line is the real tell when it comes to this market, and if we can stay above there it’s a buy the dip mentality you should be taking advantage of.

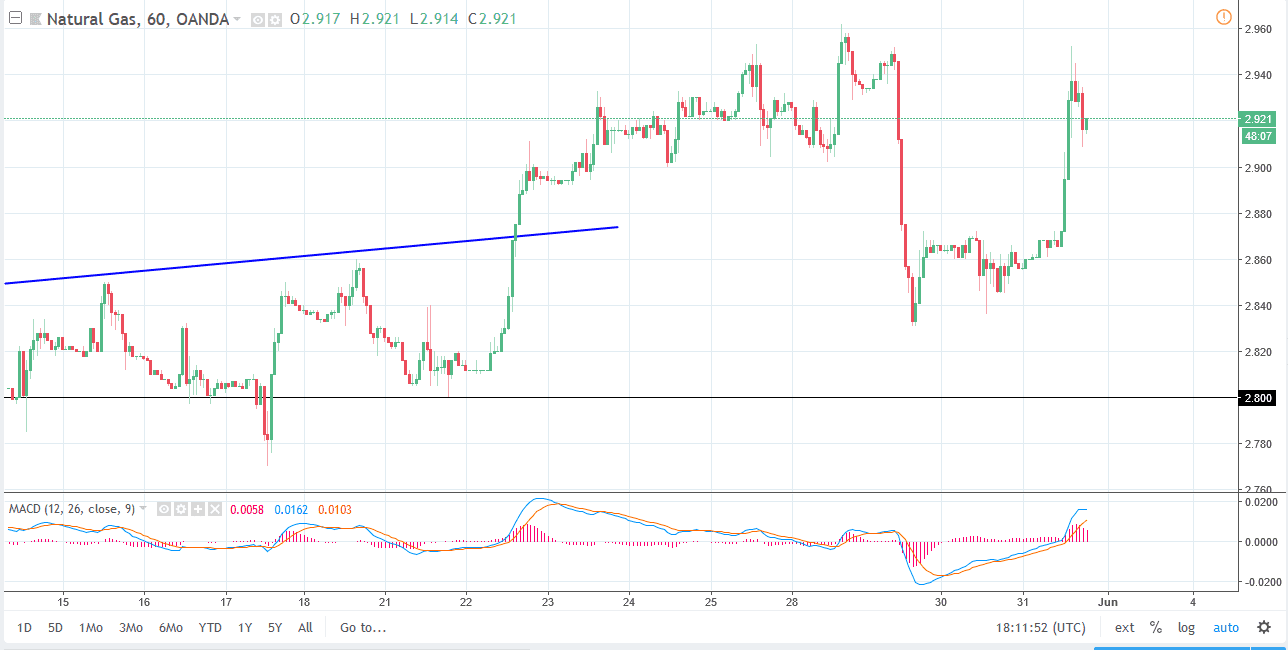

Natural Gas

Natural gas markets exploded to the upside again during the day on Thursday as the economic numbers were a bit more bullish. Beyond that, we reach towards the $2.95 level which has been resistance in the past, and then pulled back a bit. I think there is a massive amount of resistance between $2.95 and three dollars, so don’t be surprised if it takes several attempts to try to break through there. I believe that if we break down below the $2.90 level, we will probably extend the move lower. Ultimately, a break above the three dollars level would be very bullish, but even then I think it would be difficult to go beyond $3.10 anytime soon. I anticipate that the sellers will make their presence known rather soon, as we are testing such major important levels.