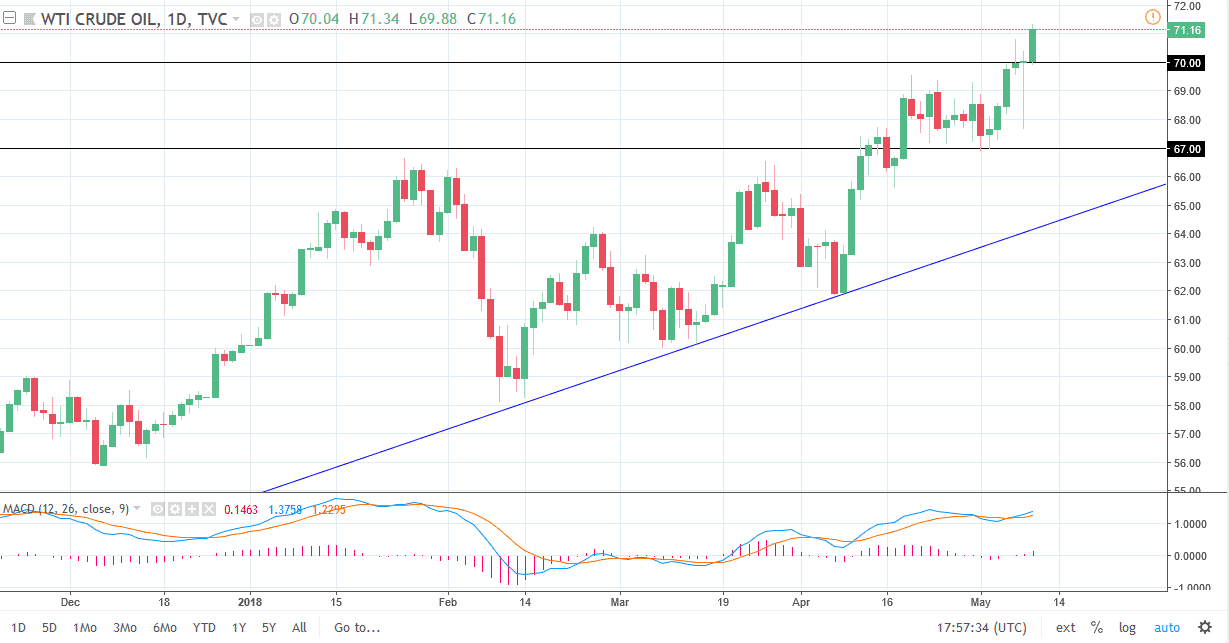

WTI Crude Oil

The WTI Crude Oil market rallied during the session on Wednesday, breaking clearly above the $70 level. I believe that breaking above the $71 level also shows that we are ready to go much higher. I think the $72.50 level above is a target. Short-term pullbacks should be buying opportunities, as we clearly have a lot of bullish pressure. We initially pulled back after false reports of Donald Trump staying in a deal with the Iranians on Tuesday, but we turned around and show strength again as that proved not to be true, and that the Americans are not only leaving the nuclear agreement, but putting more sanctions on the Iranians, perhaps hurting oil output. At the very least, this puts a lot of concern into this market to say the least. The market is very strong, and I believe the pullbacks offer value the people are willing to take advantage of.

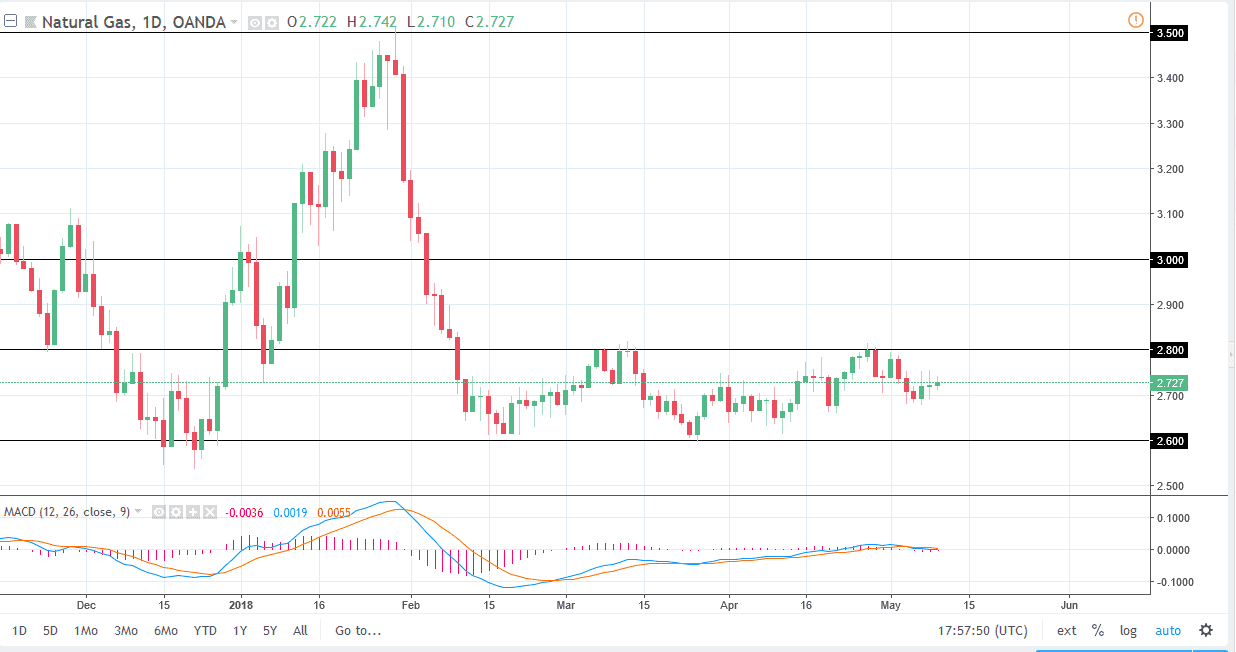

Natural Gas

The natural gas market has gone back and forth during the session on Wednesday, as we continue to dance around the $2.72 level. I see a major resistance barrier at the $2.80 level, and I think that any rally towards that level should continue to offer selling opportunities. I think that the market should continue to look at natural gas has been oversupplied in the long term, but most traders in this market focus on the weather conditions over the next week or 2. Because of this, it’s likely that the market will eventually rally, but I’m willing to squash that rally right away. If we break above the $2.82 level, I think that the market could get a bit of momentum to the upside and the short-term, but ultimately the $3.00 level is the “ceiling.” I look at the $2.60 level underneath as the “floor.”