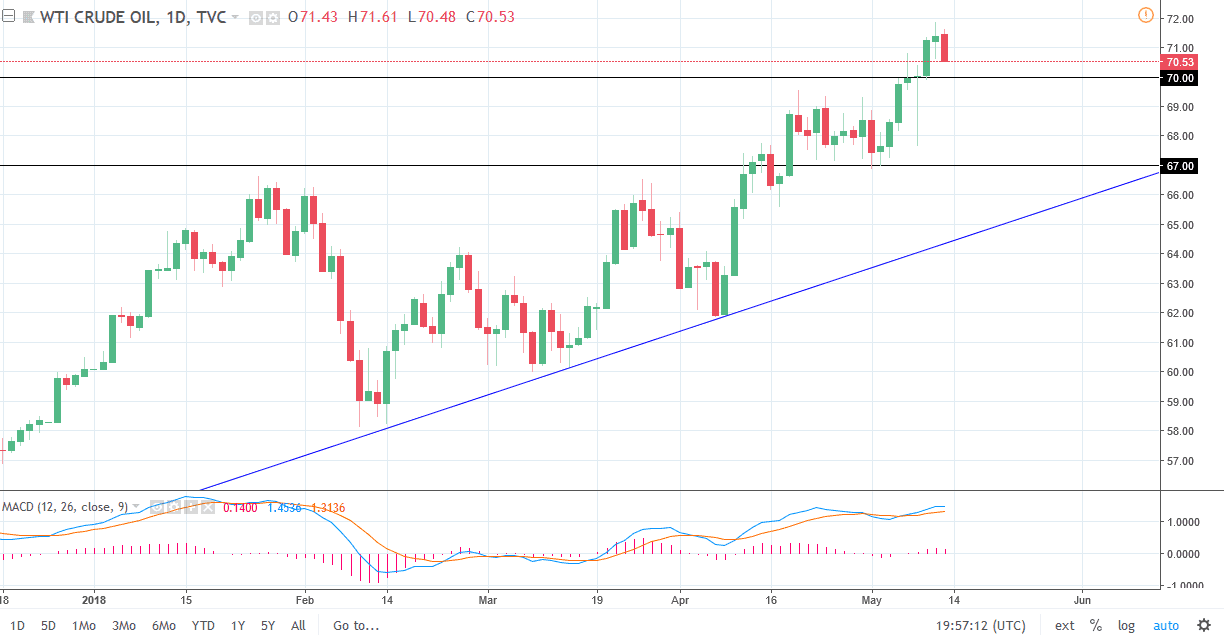

WTI Crude Oil

The WTI Crude Oil market fell significantly on Friday. The $70 level underneath should end up being support, as it was previous resistance. There’s also a hammer there that has formed previously. I think that ultimately, market should continue to go much higher. I think that the $67 level is essentially the short-term “floor”, followed very quickly by an uptrend line. Because of this, I think that this pullback will more than likely be a buying opportunity, as we continue to grind towards the $72.50 level. Ultimately, this is a market that has been rallying for some time, and we have gotten a bit ahead of ourselves. However, it does not a selling the should be shorting this market, least not yet. I think that the market will give us an opportunity to pick up value.

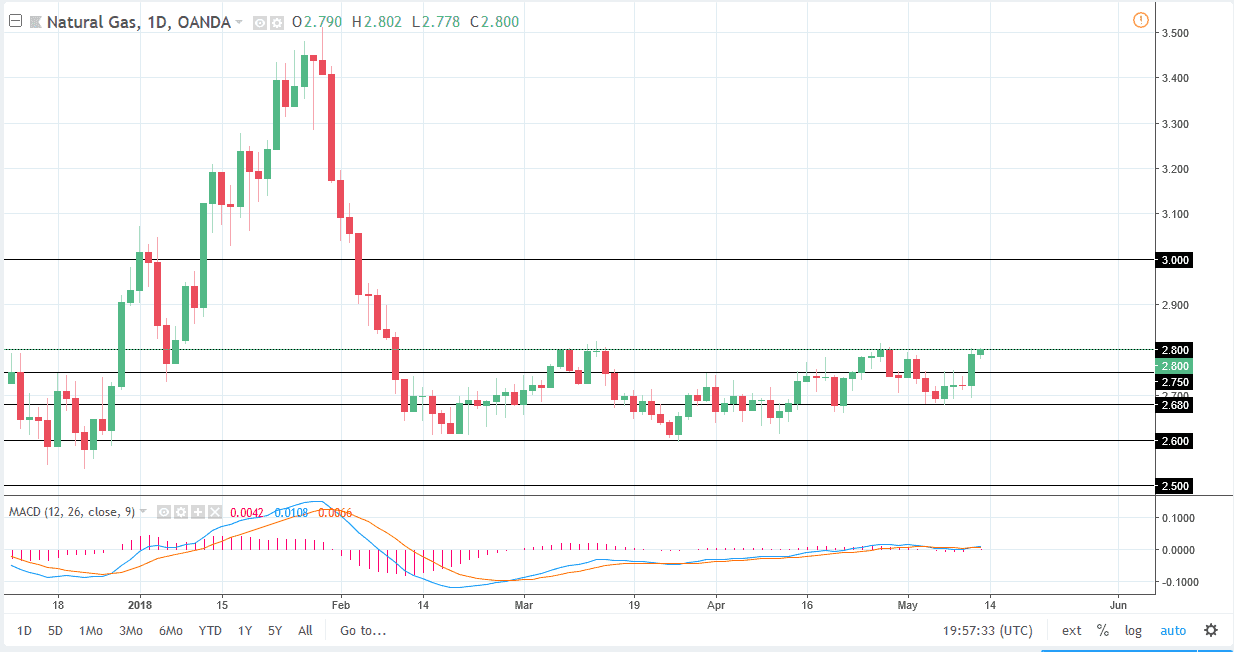

Natural Gas

The natural gas markets have rallied a bit during the trading session on Friday, reaching towards the $2.80 level. The market looks likely to continue to try to break to the upside, but it needs to clear the $2.82 level before can go higher. Short-term pullbacks could offer buying opportunities but if we end up breaking down below the $2.78 level, then the market could go lower, perhaps reaching towards the $2.75 level. Natural gas markets are definitely looking more bullish in the short term and could go as high as $3.00 level before breaking out to the upside. Regardless, I believe that it’s easier to short this market, and at the first signs of exhaustion I will more than likely be willing to sell off rather drastically. If we do break down, I believe that the $2.60 level will be a “floor.”