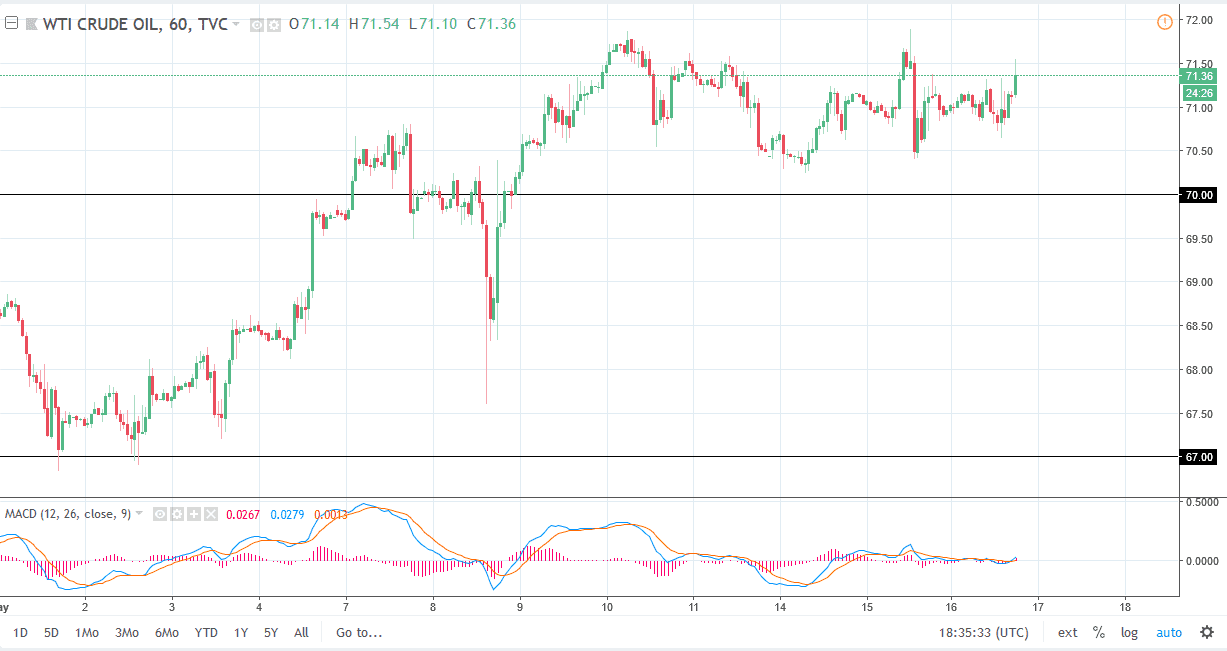

WTI Crude Oil

The WTI Crude Oil market has gone back and forth during the session on Wednesday, but eventually found buyers. I believe that the market is going to continue to find buyers underneath, as the $70 level should be a bit of a “floor” in the market. I believe that the $72 level above is massive resistance, and if we can break above the $72 level, the market could continue to go higher. I think that this consolidation is simply a function of the market trying to catch his breath after moving much higher. If we break down below the $70 level, the market is likely to go down to the $68.50 level. This is a market that is influenced by tensions in the Middle East, and I believe that the market should continue to focus on the probability of Iranian oil leaving the markets.

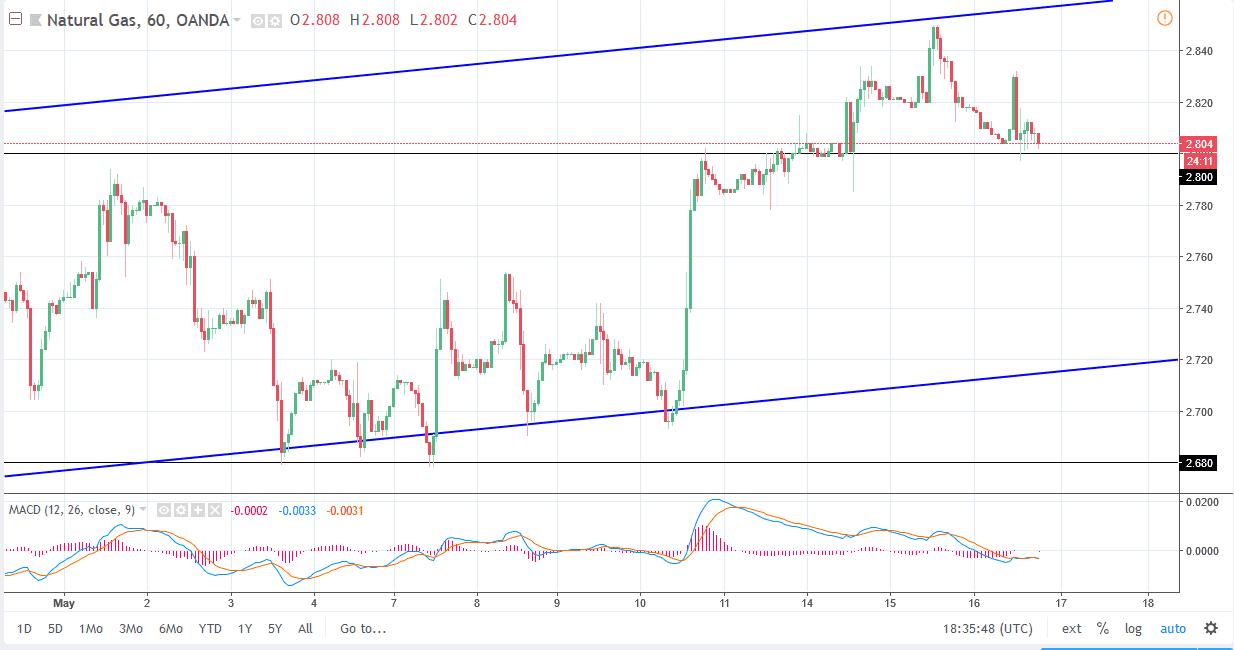

Natural Gas

The natural gas markets initially tried to rally during the day on Wednesday but found enough resistance at the $2.83 level to turn around and fall. The $2.80 level looks to be very supportive though, and I think it’s only a matter of time before we rally. Ultimately, I think that the market should continue to go to the $2.85 level, an area that could be thought of as the top of an up-trending channel, and I think that if we were to break above there, the market could enter more of a “blow off” phase. In general, I think that short-term pullbacks should continue to show plenty of support at the $2.78 level underneath. Ultimately, this is a market that I think if we can stay above the $2.78 level, the only thing you can do is buy this market.