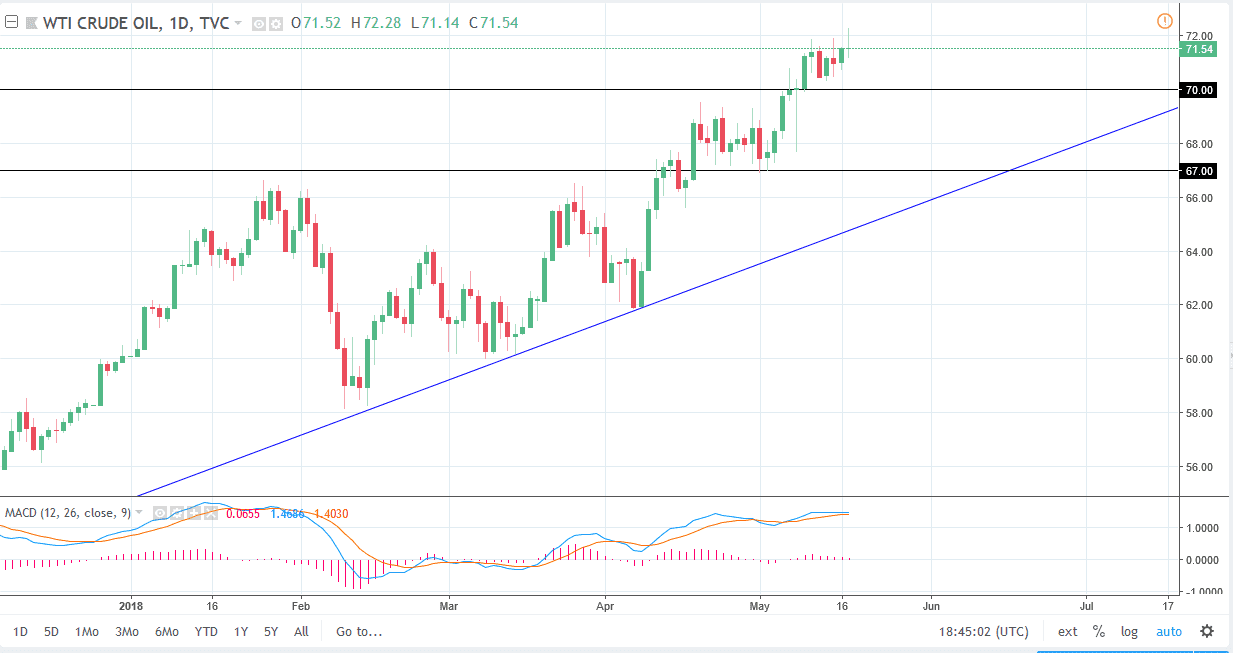

WTI Crude Oil

The WTI Crude Oil market has been very volatile during trading on Thursday, initially breaking above the $72 level only to turn around and form a shooting star. That of course is a negative candle, and it looks likely to signify that we are going to reach towards the $70 level underneath. If we can break down below the $70 level, it’s likely that we go much lower, perhaps as low as $67. The alternate scenario is that we break above the top the shooting star, which is of course a very bullish sign. I think that we will find buyers on a pullback though, as there are a lot of concerns around the world when it comes to Iranian oil, and of course the massive amount of turmoil in the Middle East right now. Even after dollar strength, crude oil continues to find buyers.

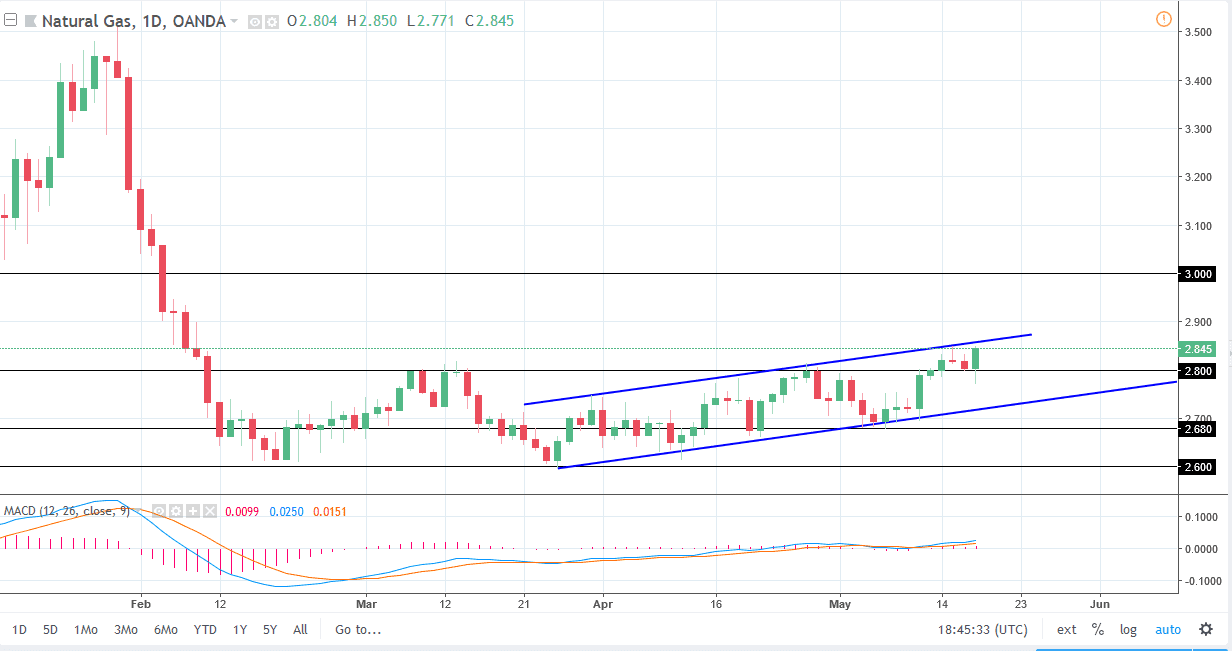

Natural Gas

Natural gas markets initially fell during the trading session on Thursday but found enough support underneath the $2.80 level to spike higher and reach towards the top of the daily timeframe uptrend channel, and if we can break above the top of the general, the market will probably accelerate to the upside, reaching towards the $2.90 level and then eventually the $3.00 level. I think it’s only a matter of time before the sellers come back in on signs of exhaustion though, so I think this could be a short-term buying opportunity, and then a longer-term opportunity to start shorting. I believe that the $3.00 level is going to continue to be massive resistance and a “ceiling” in the market overall. If we break down below the bottom of the range for the day on Thursday, then the market will break down to the uptrend line.