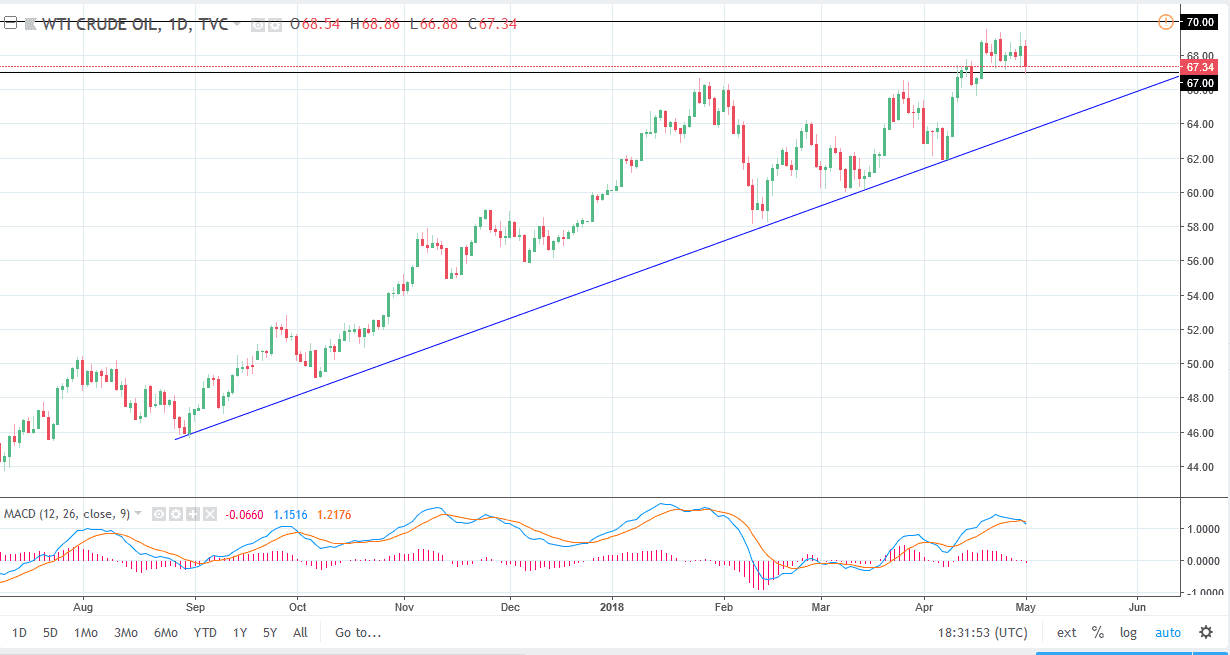

WTI Crude Oil

The WTI Crude Oil market fell during trading on Tuesday, testing the $67 level for support. It looks as if there is a zone of support down to the $66 level, and of course there is a massive uptrend line that we are paying attention to. I think that any pullback at this point should be a nice buying opportunity, and that buying these dips will continue to offer value. I also recognize that the $70 level above is massive in its resistance. The potential sanctions against Iran of course will continue to put pressure on the crude oil markets, even while the US dollar has been very strong, which should in theory at least be negative. It’s not until we break down below the uptrend line that I’m considering selling this market, but I do recognize is going to take a bit of momentum building to finally break the $70 level to the upside.

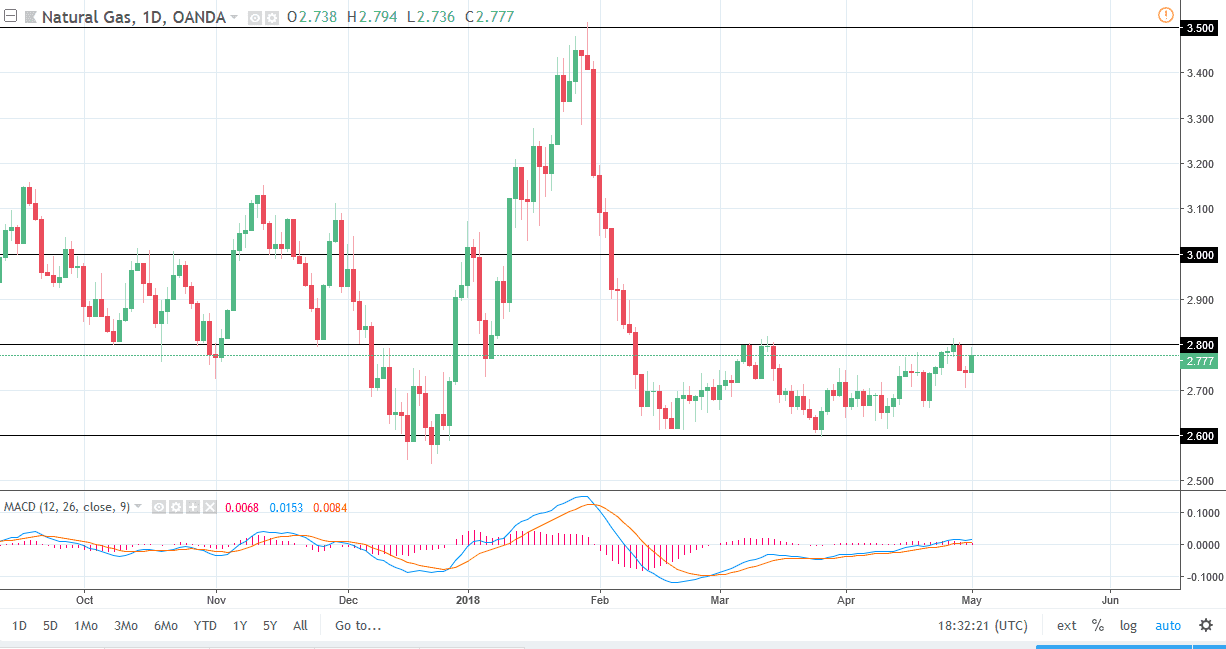

Natural Gas

Natural gas markets rallied quite significantly during the session on Tuesday, reaching towards the vital $2.80 level. This is an area that has been resistive in the past, but it looks like we are trying to break above it. If we could break above the $2.82 level, I think that the market probably goes to about the $3 level above, which is even more resistive in my estimation. I think that short-term traders will probably look for short positions, but a move above the $2.82 level might bring in momentum traders trying to push the market much higher. The $2.70 level has been shown as support based upon the hammer for the day, so obviously it’s something to be paid attention to. Longer-term though, I anticipate we will go looking towards the $2.60 level.