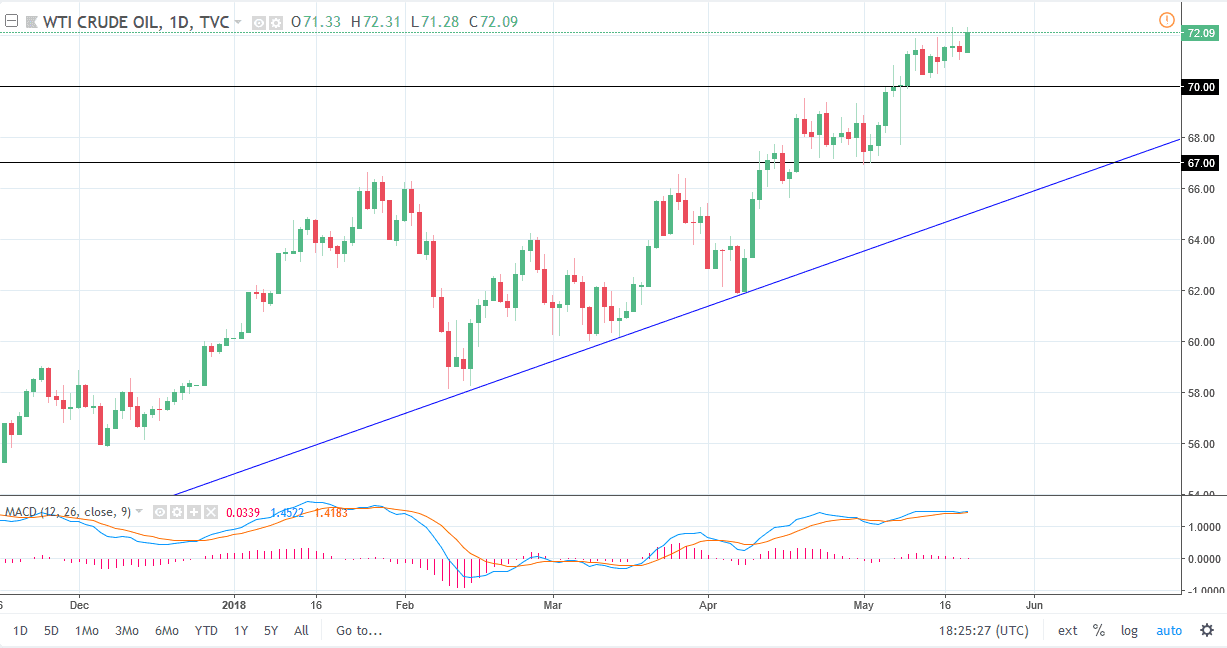

WTI Crude Oil

The WTI Crude Oil market continues to show signs of strength, making a fresh, new high again. The $72.25 level has previously offered resistance, but as the Americans close the markets at the very highest of the range for the day, it’s likely that we will continue to go much higher, perhaps reaching towards the $75 level after that. I recognize short-term pullbacks as potential buying opportunities, especially near the significant support level at the $70 level. That’s an area that was previous resistance, and it should now be supported. I believe that the market should continue to be very bullish in general, but I think that the noise will continue. I think that adding slowly to your position is probably the best way to go, but I think it’s only a matter time before we reach towards $75, possibly over the next couple of weeks.

Natural Gas

Natural gas markets have been very noisy during trading on Monday, drifting down towards the $2.80 level before bouncing to the $2.84 level, only to break back down again to reach towards that level. I think that the support level down to the $2.78 level should be paid attention to, so if we can break down below there is likely that the market could go down to the uptrend line underneath, the bottom of the up-trending channel. Otherwise, we could bounce from here and go looking towards the $2.86 level again, and beyond. I believe that overall the market is somewhat bullish, but we need to stay above the $2.78 level to keep the momentum going. Longer-term, I’m still bearish but it’s obvious that the buyers have been running the show as of late.