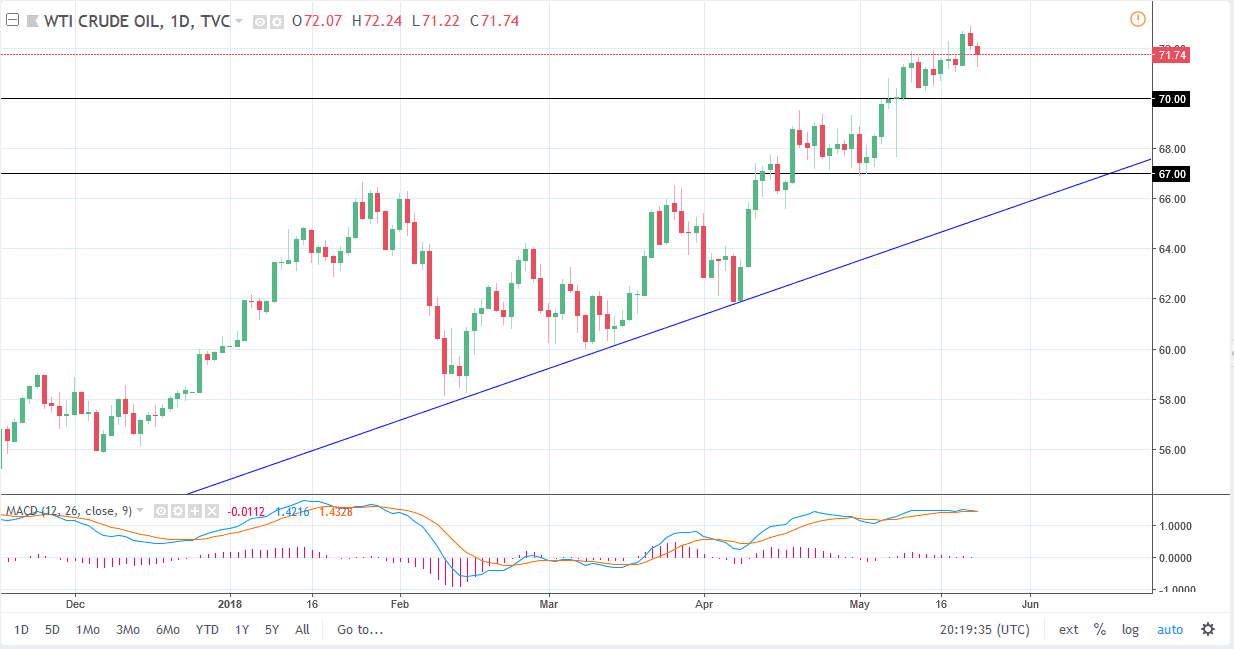

WTI Crude Oil

The WTI Crude Oil market fell during the trading session on Wednesday, reaching as low as $71.25 after we got a surprise addition to inventory numbers in the United States. We have turned around since then to form a hammer though, which of course is a very bullish sign. For me, this shows just how much underline pressure there is to the upside, and I think that it’s only a matter time before we rally again. This is based upon troubles in the Middle East, and of course the situation between the United States and Iran. Until we get some type of resolution to that situation, this market will continue to be very difficult to sell. I believe ultimately buyers will return every time we did, and that the $70 level underneath would be a bit of a “floor” in the market.

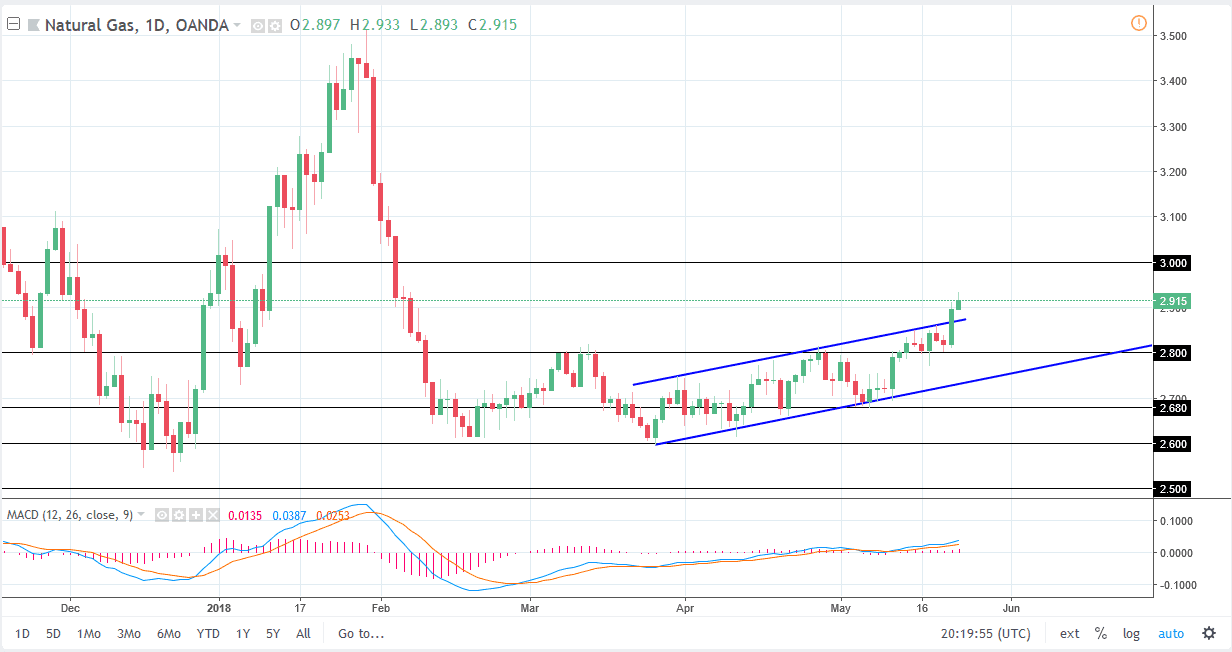

Natural Gas

Natural gas markets broke to the upside during the trading session on Wednesday, reaching towards the $2.93 level above. The markets continue to be very bullish, and I think that breaking above the top of the up trending daily channel should continue to push this market higher, perhaps reaching to the $3.00 level. I believe that every time we rally, there will eventually be sellers coming back in, but in the short term it looks as if the market is going to continue to reach the higher levels. I think that the $2.87 level underneath should be support, as the uptrend line should offer support now. Longer-term though, I do believe that the sellers come back as we will be oversupplied eventually, but the hotter temperatures in the United States has driven short-term use higher.