WTI Crude Oil

The WTI Crude Oil market broke down significantly during the trading session on Thursday, reaching down towards the $70.50 level, which is testing a major support level that extends down to the $70 level. If we were to break down below the $70 level, I think the market will unwind a bit from there. The US dollar has been strengthening, and of course there is talk that perhaps the OPEC cuts may end sooner rather than later, so that should bring more supply into the market. If we did break down, I think that the $67 level underneath is massive support, so I think we would find buyers in that area and a bit of a “reset.” I believe that the market should continue to be bullish if we get more noise coming out of the Iranian situation as well.

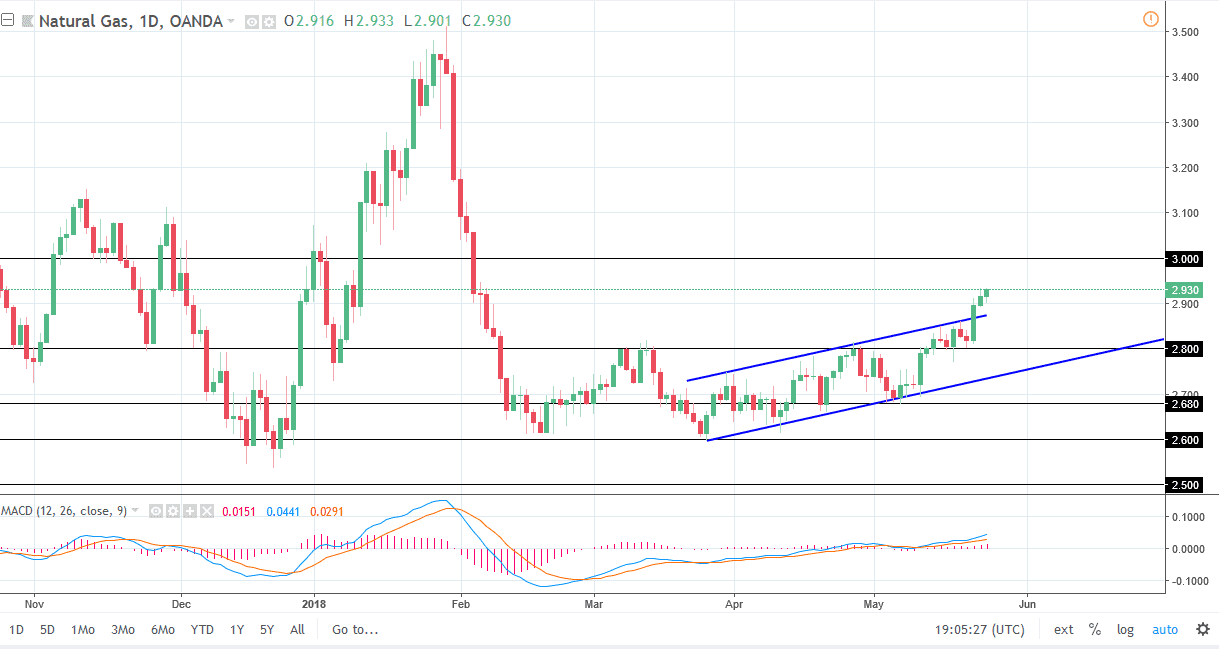

Natural Gas

Natural gas markets initially fell during the day on Thursday but found enough buying pressure near the $2.90 level to turn around and rally. It looks as if the market is ready to go higher, reaching towards the $3.00 level above. I think that the market above has more than enough resistance in that $3.00 region, so I think that the first signs of exhaustion will probably bring sellers back into the market, and I think that we will probably reach down to the $2.90 level. I think that the market will eventually find sellers as we are oversupplied in general, but right now it looks as if short-term traders are focusing on hotter temperatures in the United States, which should drive up demand over the next several weeks. Breaking above the up trending daily channel course was a good sign.