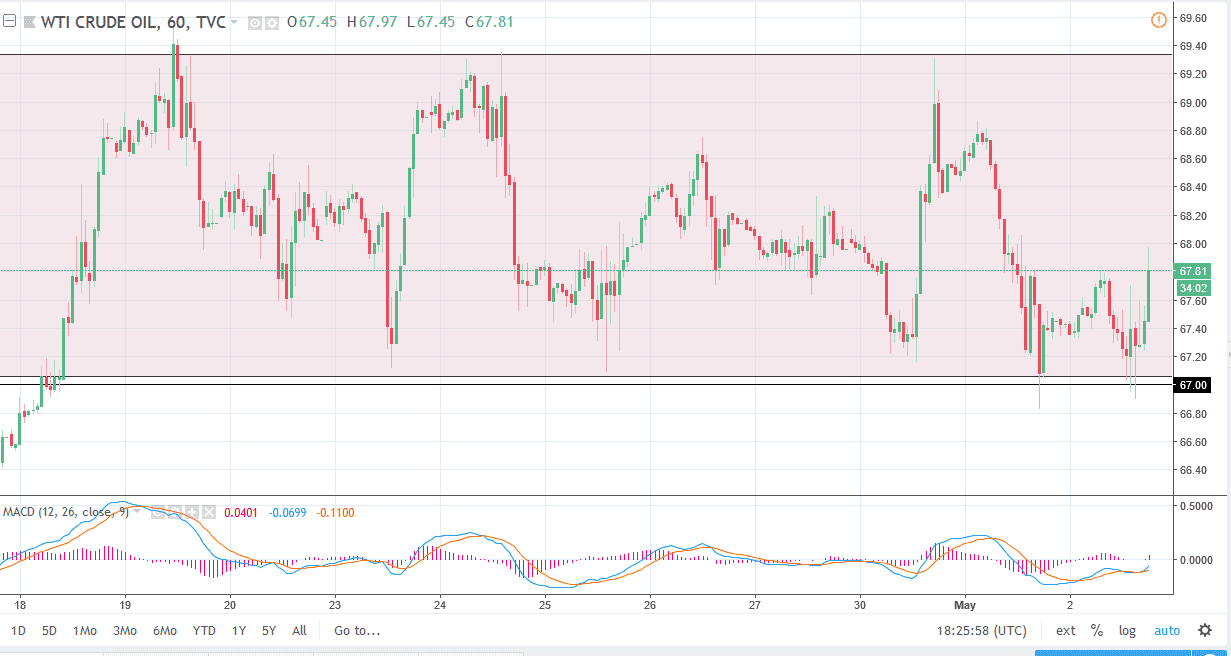

WTI Crude Oil

The WTI Crude Oil market initially fell during the day on Wednesday, as we got a higher-than-expected inventory build. However, a less than exciting statement from the FOMC sent the US dollar a bit lower. This put bullish pressure on the oil markets, and we of course when higher as a result. All things being equal, we are still very much in consolidation, so I don’t think much is changed. As we head into the Thursday session, most eyes will be on the jobs number coming out of America, so I don’t expect much for the session. I believe that the $67 level underneath continues to offer a floor, while the $69 level would offer a resistance barrier. Short-term pullbacks should continue to be opportunities to pick up little bits and pieces as far as positions are concerned, but I’m not looking for a major move between now and the jobs figure.

Natural Gas

Natural gas markets fell heavily during the session on Wednesday, losing over 1.5% during the day. The market continues to respect to the $2.80 level as resistance, and I think that we are going to continue to struggle to break above there. I anticipate that today will probably see a short-term bounce, but it should be and I selling opportunity. Ultimately, I believe that the market breaking above the $2.82 level could send this market much higher in a shorter-term momentum type of trade, but beyond that I think most rallies are going to end up being selling opportunities. I believe that the $2.60 level underneath is massive support that extends down to the $2.50 level, and it will be visited again based upon the oversupply of natural gas.